Pi Coin Price Prediction 2025: Binance Listing Rumors Fuel Speculation – Is $10 Just the Beginning?

Rumors of a Pi Network listing on Binance are reaching fever pitch—again. The crypto community's favorite speculative asset could be gearing up for a major breakout if the exchange finally gives it the green light.

Will PI defy the skeptics?

With zero official confirmation from Binance, PI's price action hinges entirely on hopium and trader FOMO. The token’s underground following insists this is the year it goes mainstream—while traditional finance snickers into its spreadsheet.

Key factors at play:

- Binance Effect: Past exchange listings have sent obscure tokens parabolic. PI’s army of mobile miners bets history repeats.

- $10 or Bust: The magic number floating through PI forums. No technical analysis, just vibes.

- The Regulatory Wildcard: SEC scrutiny could turn this party into a pumpkin overnight.

One thing’s certain: PI’s price will move violently—the only question is which direction. Either way, hedge funds won’t lose sleep over it.

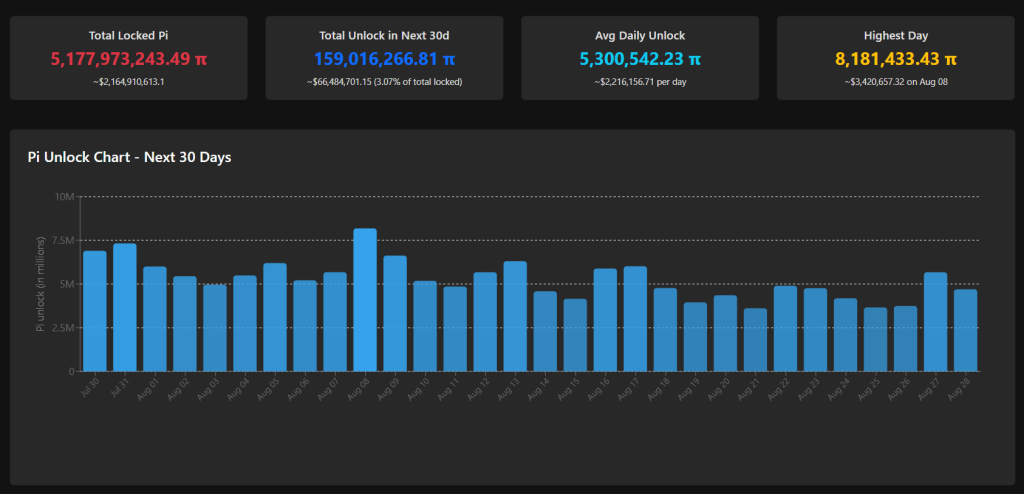

Pi Network token unlocks over the next 30 days. Source: Piscan.

Pi Network token unlocks over the next 30 days. Source: Piscan.

Could Binance List Pi Network on August 15?

While skepticism on the source’s credibility remains high within the community, Pi Barter Mall argues that past “unusual activity” in Binance hot wallets could indicate behind-the-scenes preparations.

![]() A message is circulating widely in the Pi community:#PiNetwork is said to be preparing for a Binance listing on August 15

A message is circulating widely in the Pi community:#PiNetwork is said to be preparing for a Binance listing on August 15![]()

Unusual $PI activity detected in Binance hot wallets…

Community buzz is growing — is the silent giant about to awaken?

Brace yourself for potential… pic.twitter.com/GxU0HZaMBt

In early May, two Binance-linked wallets became active on the Pi Mainnet, sending 1 PI for what appeared to be Know Your Customer (KYC) and Know Your Business (KYB) verification.

While neither Binance nor the Pi Network Core team has issued an official statement, traders have been interpreting these moves as a potential prelude to a listing.

Despite growing optimism, analyst Kim H Wong has cast doubt on the likelihood of a listing in a recent x thread, citing key fundamental barriers.

According to Wong, Pi Network is not fully open-source, lacks a third-party security audit, and may not have established direct collaboration with Binance, all of which block listing approval.

PI Coin Price Prediction: Could a Binance Listing Push PI to $10

Binance listing rumors could be what the PI coin price needs to avoid a breakdown from the falling wedge pattern forming since late June, as early reversal signs begin to flash.

Early reversal signs are starting to emerge.

The RSI has plunged to an oversold 24 as holders rush to cut losses, often a sign of seller exhaustion and a possible entry point for buyers.

However, the MACD continues to widen below the signal line, pointing to sustained bearish pressure and limited buy-side momentum.

This puts heavy focus on the current retest of the 1.168 Fibonacci extension at $0.41, the final major support before a deeper breakdown.

If renewed listing speculation sparks a sentiment shift,could rebound toward the 0.5 Fibonacci level, a key accumulation zone where stronger demand typically surfaces.

A breakout from there could target the late June high of $0.665, representing a potential 62% upside, though that MOVE may depend heavily on ato fuel volume.

While the long-term $10 target remains a hot topic among holders, reaching it WOULD require a major leap in adoption, continued development, and broader exchange support to evolve Pi beyond its current speculative phase.

If $0.41 fails to hold, PI could fall into a low-liquidity zone with little historical buying interest, increasing the risk of accelerated downside.

How Traders Are Profiting from Bearish Coins Like PI — Without Holding the Bag

Pi Network spot traders are stuck with a tough choice: sell at a loss or keep holding while the price drifts lower with no clear reversal in sight.

But leverage traders don’t wait — they capitalize on both ups and downs.

With, the new Leveraged trading platform from the team behind, anyone can take advantage of market moves without owning the token.

It’s simple: you choose whether the price will go up or down, decide your stake, and apply leverage, with options up to.

Whether the market pumps or dumps, CoinFutures puts you in control.

This leverage is what multiplies your potential profits — and yes, potential losses too.

But with built-in stop-loss tools and the ability to cash out at any time,of your risk and exposure.

For spot traders, hitting 1000x returns takes a perfect bull market and a lot of patience.

For leverage traders on, it’s a calculated move you can make today.

You can try out CoinFutures by visiting the official website, with no KYC or exchange accounts required to sign up.