BitGo Charges Toward IPO as Crypto Surges Under Trump’s Pro-Digital Asset Policies

Wall Street's latest crypto darling is gearing up for its close-up. BitGo—the institutional custody heavyweight—is reportedly prepping a public debut, riding the regulatory tailwinds of the Trump administration's crypto-friendly pivot.

The timing couldn't be more strategic. With the SEC's enforcement crusade losing steam and lawmakers drafting pro-innovation frameworks, institutional capital is flooding back into digital assets. BitGo's rumored IPO plans signal that crypto's institutional infrastructure players are ready for their mainstream moment.

Of course, no finance story is complete without irony: The same Wall Street banks that once called crypto a 'fraud' are now quietly building custody solutions—while BitGo, which survived three bear markets, might beat them all to the public markets. Talk about poetic justice.

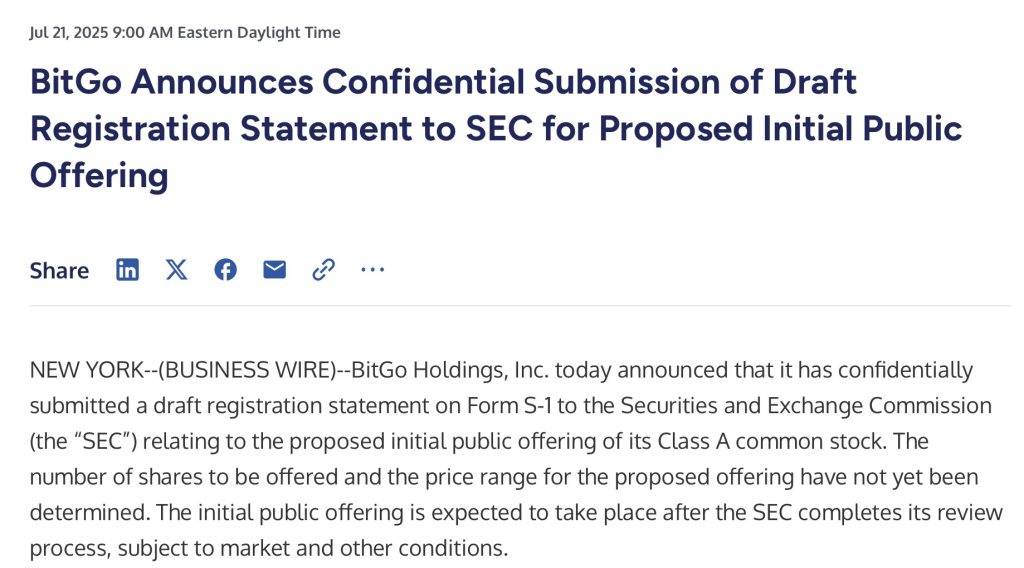

Image Source: BitGo statement

Crypto Listings Heat Up as BitGo Files Amid $4T Market Boom

While details on the IPO remain under wraps, BitGo noted that the number of shares and price range are yet to be determined. The firm’s decision to go public follows a broader trend in the sector, where regulatory clarity and institutional inflows have revived momentum for crypto listings.

The crypto industry’s total market value recently surged past $4 trillion for the first time, fueled by a record-breaking rally in Bitcoin, which climbed above US$120,000.

At the same time, political support has grown more visible. Last week, US President Donald TRUMP signed the first federal legislation to regulate stablecoins, calling it a “giant step to cement American dominance of global finance and crypto technology.”

BitGo Expands Trading Services, Taps Institutional Demand Ahead of IPO

His crypto-friendly moves have emboldened several companies in the space. Exchange operator Bullish recently disclosed its IPO plans, while Grayscale and Gemini, founded by the Winklevoss twins, have also filed confidentially for listings. Circle, the issuer of USDC, debuted publicly in June with a strong market reception.

BitGo is now looking to ride this wave. Earlier this year, it launched an over-the-counter trading desk for digital assets to meet rising demand from hedge funds and other institutional players. The desk offers spot and options trading as well as lending for margin trades.

The firm has also been expanding internationally. It recently secured regulatory approval under the European Union’s Markets in Crypto-Assets (MiCA) framework, allowing it to extend its services across the bloc. That approval marks a key step in its plan to grow beyond the US market.

Bank Charter Bid Signals Broader Ambitions Beyond Crypto Custody

Further, BitGo is exploring a deeper foothold in traditional finance. In May, the company was reported to be among a handful of crypto firms seeking a US bank charter, pending regulatory clarity. If granted, the move WOULD allow BitGo to broaden its financial offerings within the existing banking system.

In 2023, BitGo raised $100m at a valuation of $1.75b. Since then, it has quietly built a presence as a key infrastructure player in the crypto ecosystem.

With market conditions turning more favorable and political support growing, BitGo’s IPO could mark a pivotal moment for the company, and for the broader push to bring digital asset firms into the financial mainstream.