🚀 Ethereum ($ETH) Smashes $3K Barrier with 19% Weekly Rally – Are ETFs the Rocket Fuel for $5K?

Ethereum isn't just climbing—it's moonwalking past resistance levels like they're made of tissue paper. The $3K breakout marks a psychological win for bulls, but the real question lingers: can ETF hype turn this surge into a full-blown price revolution?

The ETF wildcard: Wall Street's stamp of approval could flood the zone with institutional cash—or become another overhyped 'narrative' for bagholders. Remember when 'institutional adoption' was going to save Bitcoin from volatility? Good times.

Technicals screaming bullish: That 19% weekly pump wasn't retail FOMO alone. Options markets are pricing in explosive upside, while staking yields quietly print money for diamond hands. Even the SEC's foot-dragging on approvals can't kill the momentum.

Reality check: ETH's outperformance smells like a liquidity rally—the kind where traders cheer until they realize everyone's leveraged to the tits. But hey, when the music's playing, you dance... just know where the exit doors are.

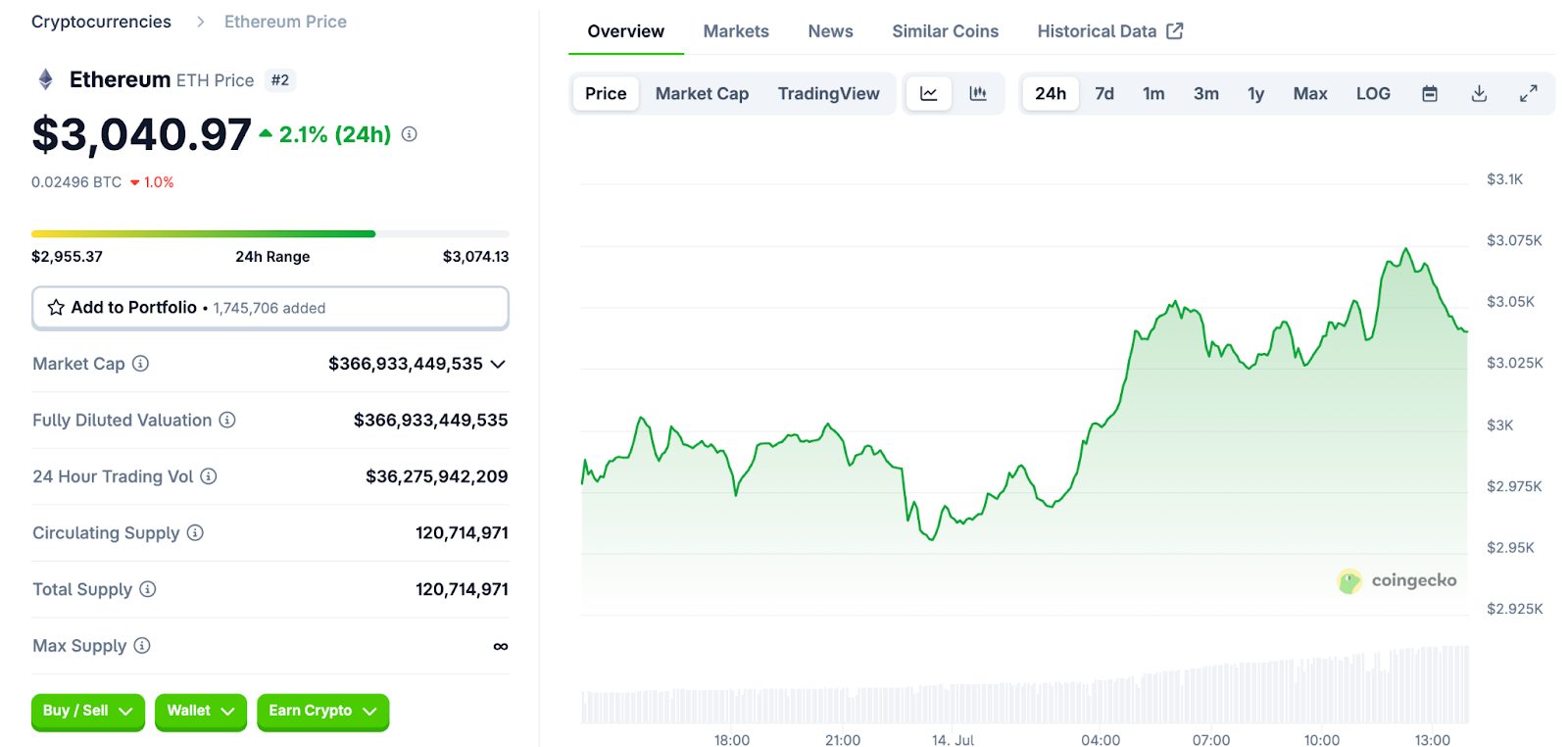

Source: CoinGecko

Source: CoinGecko

Soaring Institutional Demand and Record Network Growth on the Ethereum Network

Ethereum ($ETH) continues to solidify its dominance in the decentralized finance space with $74.4 billion in total value locked (TVL) on DeFiLlama. This demonstrates sustained demand for on-chain lending, staking, and trading activities on the premier smart contract network.

Meanwhile, daily active ERC-20 addresses are at 414,706, reflecting strong user engagement across Layer-1 and Layer-2 solutions.

As of July 12, 2025, Ethereum’s 327.97 million unique wallets marked a 20% year-over-year increase. The creation of new wallets is seen as a sign of growing interest by traders and developers alike.

![]() As ethereum trades right at the $2,500 level, the utility and growth of the network continues looking healthier than ever. The amount of new weekly $ETH addresses created is ranging around 800K-1M per week, compared to about one third less at this point last year. pic.twitter.com/K1nxFBVlqL

As ethereum trades right at the $2,500 level, the utility and growth of the network continues looking healthier than ever. The amount of new weekly $ETH addresses created is ranging around 800K-1M per week, compared to about one third less at this point last year. pic.twitter.com/K1nxFBVlqL

Decentralized exchanges also processed $1.71 billion in 24-hour volume, while protocol revenues topped $2.11 million, showing strong market participation.

Additionally, institutional interest in $ETH is on the rise. U.S. spot Ethereum ETFs have seen the second-largest inflows in recent months, reflecting steady institutional demand.

#Ethereum Spot ETF flows have remained positive for the 8th consecutive week, with net inflows topping 61,000 $ETH pic.twitter.com/aTANkr4RCy

— glassnode (@glassnode) July 7, 2025Following the SEC approving options trading on spot ETFs in April to enhance trading flexibility, corporate balance sheets are now bulking up on $ETH.

Nasdaq-listed SharpLink Gaming has overtaken the Ethereum Foundation by amassing 270,000 $ETH, driving $81.8 million in unrealized gains

SharpLink Gaming Acquires 176,271 ETH for $463 Million, Officially Becoming Largest Publicly-Traded ETH Holder

— zerohedge (@zerohedge) June 13, 2025Market sentiment remains bullish, with the recent hold above $3,000 echoing expectations of further inflows and balance sheet additions from corporate bodies.

Ethereum Pauses After Bullish Breakout as Market Gauges Next Move

Ethereum ($ETH) is trading around $3,028 following a breakout from a bullish pennant structure earlier in the week.

The pattern had formed over several days of consolidation, with price coiling between converging trendlines before making a clean MOVE above $3,030. The breakout, however, has not yet accelerated into a sustained rally. Instead, $ETH is consolidating just below the breakout zone.

The recent pullback is relatively shallow. RSI sits NEAR 54, indicating a neutral stance with no immediate signs of overbought or oversold conditions. MACD remains above the signal line, although momentum is beginning to flatten. These indicators collectively point to a market in wait-and-see mode.

Volume footprint data on the $ETH futures contract reveals a shift in order flow. Initially, buy imbalances were dominant, particularly at $3,085 and $3,092.

Later on, especially in the most recent candles, sell-side aggression returned. Large negative deltas, especially near $3,076, suggest some traders are using the post-breakout range to offload risk or establish new short positions.

Additionally, Ethereum has seen a sharp uptick in speculative activity. CoinGlass data shows volume is up 112% to $99.6 billion, with open interest climbing modestly to $44.6 billion.

Options activity is also elevated, rising 238% to over $2 billion. The 24-hour long/short ratio is balanced at 0.9956, pointing to a lack of directional conviction. However, the positioning of top traders at Binance and OKX still favors longs, with ratios above 2.4.

ETH now sits at a key level. A clean move above $3,100 could reinvigorate bullish momentum and validate the pennant breakout, opening the way to the measured target near $3,250. A drop below the ascending base, on the other hand, may indicate a failed pattern and shift market focus back to $2,880–2,900.