Crypto Strategy Snags 4,225 BTC in $472.5M Mega-Buy—2025 YTD Yield Now 20.2%

Bitcoin just got a half-billion-dollar vote of confidence.

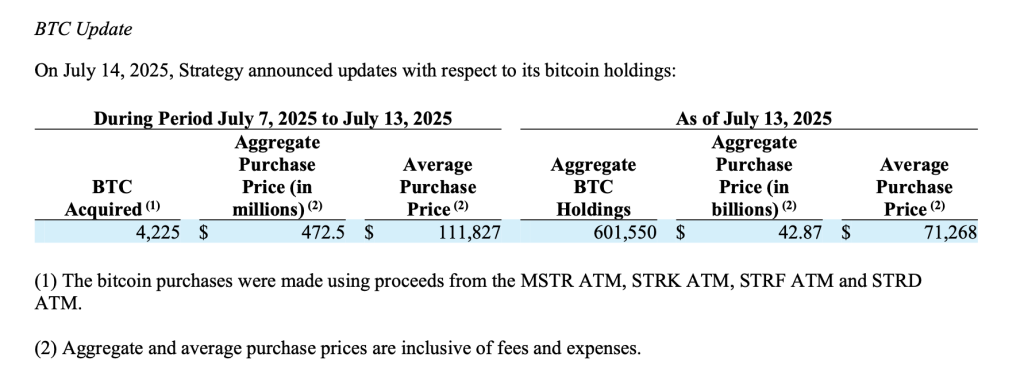

The whale move: An undisclosed strategy dropped $472.5 million to grab 4,225 BTC this week—proving institutional FOMO didn't die with the 2024 bull run.

By the numbers: The purchase pushes the strategy's year-to-date Bitcoin yield to 20.2%, outperforming traditional assets like gold (and most hedge funds' fee-laden 'alpha').

Why it matters: While Wall Street still debates crypto's merit, cold hard math keeps stacking sats. The playbook? Buy when others are distracted by shiny AI stocks and Fed rate chatter.

The kicker: At this rate, the strategy might actually beat your financial advisor's 2%-with-a-side-of-condescension portfolio.

Funding Strategy: Preferred Stock Offerings Fuel Growth

To fund its latest Bitcoin accumulation, Strategy tapped into multiple at-the-market (ATM) offering programs, including its common stock (MSTR) and three distinct preferred share offerings: STRK (Strike), STRF (Strife), and STRD (Stride).

Between July 7 and July 13, 2025, Strategy sold nearly 2 million shares across these instruments, raising a combined $472.3 million in net proceeds. The largest tranche came from the common stock ATM, which generated $330.9 million.

The STRK preferred shares contributed $57.4 million, STRF added $44.4 million, and STRD rounded out the raise with $15.8 million. Each preferred share class offers annual dividends ranging from 8.00% to 10.00%, giving investors exposure to income-generating equity tied to Strategy’s long-term Bitcoin vision.

These instruments also reflect Strategy’s financial creativity, offering scalable fundraising mechanisms without diluting common shareholders excessively.

Transparent Reporting and Long-Term Positioning

As part of its commitment to transparency, Strategy says it continues to maintain a publicly accessible dashboard at www.strategy.com, where it discloses real-time Bitcoin purchases, aggregate holdings, security market data, and key financial metrics.

By integrating Bitcoin acquisition updates with structured equity offerings, Strategy has positioned itself as both a technology firm and a de facto Bitcoin ETF.

Bitcoin Breaks $123K ATH

Earlier today, Bitcoin has shattered all previous records by reaching a new all-time high (ATH) of $123,091, prompting former Binance CEO Changpeng Zhao (CZ) to put the milestone in historical perspective by calling it “just a fraction” of what’s to come.

CZ reminded followers that after buying Bitcoin in 2014, it took three years to reach $1,000 again in January 2017, noting that today’s excitement over current highs will seem minimal in future years.

Bitcoin ATH Wipes Out $1.3B Short Positions

The latest surge liquidated $1.3 billion in short positions in less than 60 seconds as Bitcoin skipped past $120,000 and went directly to $121,000.

At $2.39 trillion market capitalization, Bitcoin has now officially become larger than Amazon and ranks as the world’s fifth-largest asset by market value.

Crypto markets have added $1.2 trillion in market cap since President TRUMP paused “reciprocal tariffs” on April 9th, with Bitcoin gaining $15,000 since the House passed Trump’s “Big Beautiful Bill” on July 3rd