Wall Street Goes All-In on Ethereum: ETH Primed to Smash $4K in Coming Rally

Institutional money is flooding into Ethereum like never before—and the charts are screaming bullish. With Wall Street piling into ETH, the $4K resistance looks more like a speed bump than a barrier.

Here’s why the smart money is betting big.

The Institutional Stampede

Hedge funds, family offices, and even stodgy pension funds are quietly loading up on ETH. Forget ‘digital gold’—Ethereum’s becoming the backbone of decentralized finance, and Wall Street finally gets it (or at least, wants a cut).

Technical Breakout Imminent

The price action tells the story: ETH’s coiled tighter than a spring, trading above key moving averages with volume ticking up. Traders whisper about a replay of 2021’s parabolic run—but this time, with actual revenue-generating dApps fueling the fire.

The Cynic’s Corner

Of course, the same suits now hyping ETH were calling it a ‘scam’ three years ago. Funny how a 10,000% ROI changes minds—and how quickly ‘innovative asset class’ replaces ‘dangerous speculation’ on bank research reports.

Buckle up. When Wall Street’s late to the party, they always overcompensate on the way in.

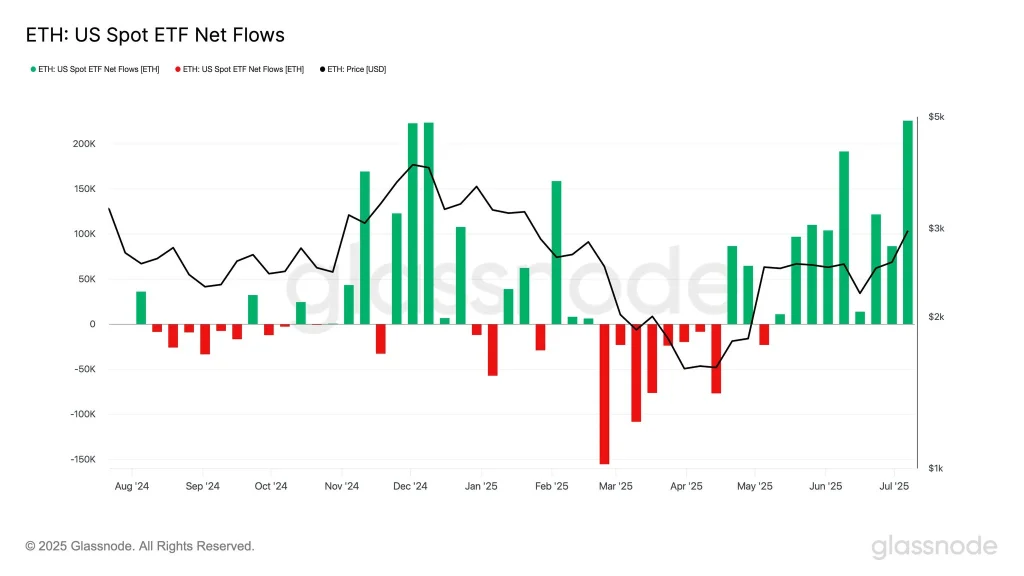

The demand for ethereum (ETH) has gone up through the roof in recent times, led by Wall Street corporations. After more than a year trailing Bitcoin (BTC) in net cash inflows, on-chain data analysis shows that long-term investors have favored Ether.

Ethereum Records Renewed Demand for Long-term Investors

For instance, the U.S. spot Ether ETFs, led by BlackRock’s ETHA, recorded the highest weekly cash inflow, of about $908 million, since their inception. As a result, the U.S. spot Ether ETFs extended their multi-week streak of cash inflows, whereby the cohorts have recorded over $2.7 billion in net cash inflows for the past four months.

The demand for Ether by corporations has also skyrocketed in the recent past. For instance, BitMine, a publicly traded company, announced on Monday that its Ether holding has surpassed $500 million. After closing a $250 million private placement, BitMine increased its ETH bath to 163,142 coins.

”We are pleased that we added significantly to our ETH treasury just 3 days after closing our private placement,” Jonathan Bates, CEO of BitMine, noted. “Clearly Wall Street is getting ‘ETH-pilled.”

Midterm Targets for ETH Price

After consolidating in a choppy mode for the past two months, ETH price recently broke out beyond $3k for the first time since January 2025. The large-cap altcoin, with a fully diluted valuation of about $363 billion, has since signaled bullish sentiment.

$ETH – Consolidate, FORM a new support, then higher. This is the most bullish way to go higher even though impatient people just want one giant candle. pic.twitter.com/qdr59RHXJV

— IncomeSharks (@IncomeSharks) July 14, 2025From a technical analysis standpoint, Ether price is aiming for $3,400 next with the pathway towards $4k more clear. Furthermore, the weekly MACD indicator has flashed bullish sentiment after the MACD line recently crossed above the zero line amid increasing bullish histograms.