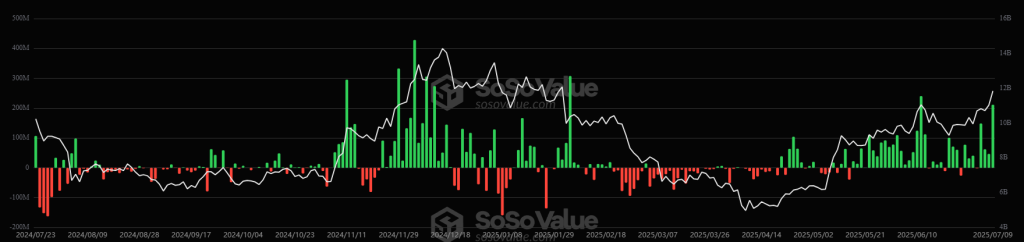

US Ethereum Spot ETFs Hit 5-Month Inflow High – Second Only to Crypto Mania Peaks

Wall Street's ETH gamblers are back—and they're throwing cash at Ethereum ETFs like it's 2021 again.

The surge no one saw coming

After months of sideways action, US spot Ethereum ETFs just posted their second-largest inflow streak since February. Traders are piling in despite regulators still treating crypto like a back-alley poker game.

Institutional FOMO wins (again)

The numbers don't lie: five months of tepid demand just got bulldozed by a sudden wave of 'smart money' chasing yield. Funny how Wall Street's risk aversion disappears when ETH starts pumping.

The cynical take

Nothing brings out finance bros like the scent of easy money—especially when they can pretend it's 'exposure to blockchain innovation' rather than pure speculation. Watch the outflows start the second ETH dips 10%.

Source: SoSoValue

Source: SoSoValue

Moreover, the cumulative total net inflow climbed to $4.72 billion as of 9 July. Total valued traded stood at $1.26 billion, while total net assets were at $11.84 billion, or 3.58% of Ethereum market cap.

Of the $211.32 million in inflows,took in $158.62 million.

Four more Ethereum spot ETFs saw positive flows, and none saw negative flows.share is $29.53 million, followed by$17.96 million and$5.21 million.

In comparison, the US BTC spot ETFs recorded inflows of $218.04 million on 9 July. Its ATH is $1.38 billion on 7 November 2024.

BlackRock saw the highest inflows of this amount, standing at $125.58 million. This is followed by$56.96 million. Fidelity, Grayscale,,, andalso saw positive flows between $2 million and $16 million.

You may also like: Spot bitcoin ETFs Attract Another $218M, Total Net Inflows Top $50B Since Launch Spot Bitcoin exchange-traded funds (ETFs) have now surpassed $50 billion in cumulative net inflows, less than two years since their debut in January 2024. On July 9 alone, the market saw $218 million in net inflows, marking the fifth consecutive day of positive momentum, according to SoSoValue data. Over the past five trading days, U.S. spot Bitcoin ETFs have pulled in nearly $1.52 billion. Bitcoin ETF Inflows Accelerate in July After Brief Setback Inflows into spot Bitcoin...Ethereum ETFs: ‘Inflows Surpass 61,000 ETH’

Analysts are highlighting an increased interest in Ethereum spot ETFs in particular. This factor, they argue, is likely to benefit the coin’s price as well as it pushes higher.

Onchain data and intelligence platformnoted on Monday that spot ETF flows remained positive for the 8th consecutive week. Inflows surpassed 61,000 ETH, it said.

#Ethereum Spot ETF flows have remained positive for the 8th consecutive week, with net inflows topping 61,000 $ETH pic.twitter.com/aTANkr4RCy

— glassnode (@glassnode) July 7, 2025The crypto market overall has seen a notable increase over the past 24 hours. One of the positive factors is the regulatory support for the industry in the US, as the country works towards forming a crypto market structure regulation.

“Make no mistake: blockchain technology and digital assets are not going away – they are here to stay,” saidChairman Tim Scott during the first full committee hearing on digital assets on 9 July.

Moreover, thedecided to keep the federal funds rate steady, per the June minutes released on 9 July, as “tariffs pose a persistent risk for driving up prices.” However, many believe that a rate cut will happen this year if inflationary pressures ease. And interest rate cuts are typically favorable for crypto assets.

Meanwhile, Ethereum is currently trading at $2,776. It’s up 5.5% in a day and 7% in a week. It’s unchanged in a month and down 10.5% in a year.

It started the day with the intraday high of $2,869 and then plunged to $2,182, before gradually climbing back to the current level. You can read more below.

You may also like: Why Is Crypto Up Today? – July 10, 2025 The crypto market is up today. The majority of the top 100 coins per market cap have appreciated over the past 24 hours. At the same time, the cryptocurrency market capitalization has decreased by 0.9% to $3.45 trillion. The total crypto trading volume is at $128 billion, significantly up from $82.5 billion seen yesterday. Crypto Winners & Losers The crypto market has continued the green streak, with all top 10 coins per market cap rising today. Bitcoin (BTC) is up 2.2%, currently...