Remixpoint Bets Big: Japanese Firm Drops $215M on 3,000 Bitcoins in Bold Crypto Play

Tokyo-based Remixpoint just made a power move—securing a staggering $215 million war chest to snap up 3,000 BTC. Talk about doubling down on digital gold.

Why this matters: While traditional finance scrambles to regulate, corporations keep treating Bitcoin like a corporate treasury asset. Guess someone didn’t get the ‘volatility’ memo.

The big picture: This isn’t just another institutional buy—it’s a Japanese firm going all-in during what many call crypto’s ‘prove it’ phase. No hedges, no ETFs, just cold hard satoshis.

Cynic’s corner: Nothing says ‘conviction’ like spending nine figures on an asset that could swing 20% before lunch. But hey—when the yen’s weak, maybe digital scarcity beats fidget spinners as a store of value.

Japanese Remixpoint Building on Existing Bitcoin Strategy

Remixpoint has been accumulating Bitcoin since September 2024, establishing itself as a significant corporate holder in the cryptocurrency space.

According to bitcoin treasuries data, Remixpoint ranks as the 30th publicly listed company by Bitcoin holdings with 1,051 BTC, surpassing firms like Nano Labs and The Smarter Web Company at the time of writing.

The company’s commitment to Bitcoin was demonstrated earlier this year when it approved a ¥1 billion ($7 million) Bitcoin purchase following a board resolution in May.

![]() Japan’s Remixpoint approves another $7M Bitcoin purchase, raising total crypto holdings to $84M.#Japan #Remixpoint #Bitcoinhttps://t.co/ozpqS3v3QL

Japan’s Remixpoint approves another $7M Bitcoin purchase, raising total crypto holdings to $84M.#Japan #Remixpoint #Bitcoinhttps://t.co/ozpqS3v3QL

Beyond Bitcoin, Remixpoint has expanded its digital asset holdings to include Ethereum (), Solana (), and Avalanche ().

In September 2024, the firm invested approximately $351,700 to acquire 130.1 ETH, 2,260.5 SOL, and 12,269.9 AVAX tokens.

The Japanese firm’s crypto commitment extends to executive compensation, with the company becoming the first Tokyo Stock Exchange-listed entity to pay its CEO and President entirely in Bitcoin.

According to the report, CEO Yoshihiko Takahashi characterized this decision as a “” of his commitment to corporate value and shareholder-focused governance.

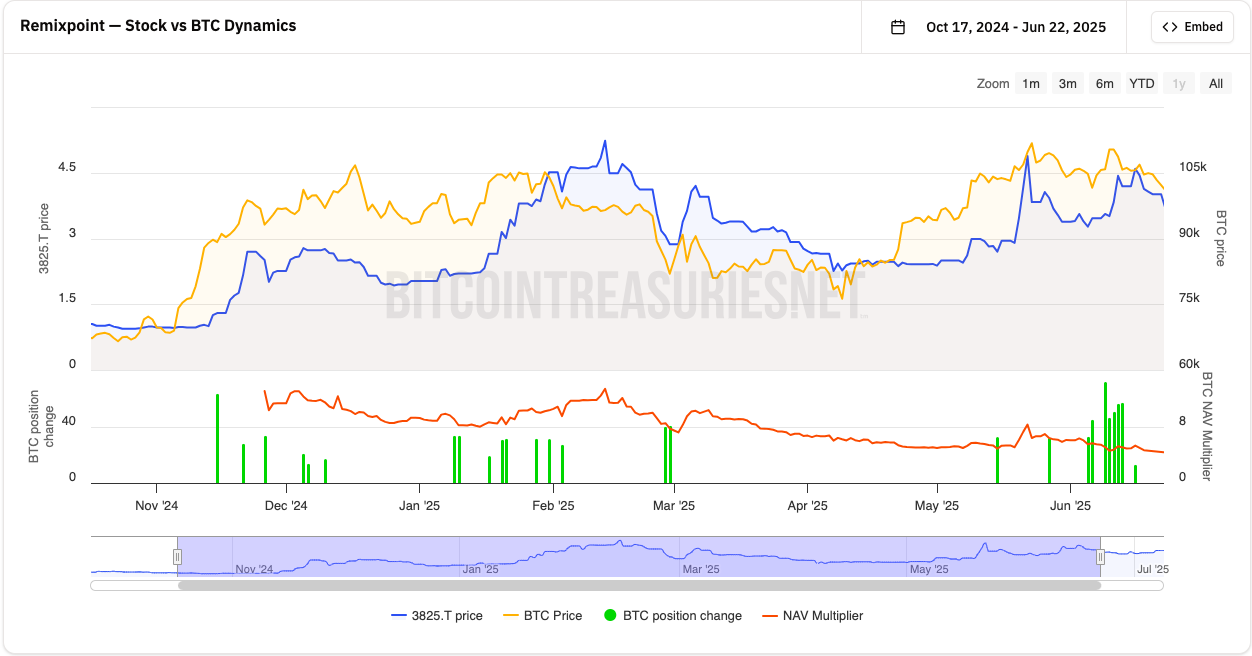

Moreover, Remixpoint’s stock price has demonstrated a strong correlation with Bitcoin’s performance, benefiting from the cryptocurrency’s success.

When Bitcoin reached its lows of $77,000 in April, 3825.T shares traded at ¥328 ($2.26). As Bitcoin climbed above $109,000 in May, the stock price more than doubled to ¥701 ($4.88).

At press time, Remixpoint shares trade at 592 yen, reflecting a 3.86% increase in the last 24 hours and over 64% year-to-date gains, according to Google Finance.

Growing Japanese Corporate Bitcoin Adoption

Remixpoint’s strategy aligns with an emerging trend among publicly listed companies that incorporate Bitcoin into their balance sheets.

While U.S.-based companies like MicroStrategy have popularized this approach, Remixpoint joins a growing list of Japanese firms adopting similar models.

Metaplanet, another Bitcoin-focused Japanese company, has consistently expanded its holdings of BTC.

![]() Japanese investment firm @Metaplanet_JP has unveiled an ambitious new target to amass 210,000 BTC by the end of 2027.#Metaplanet #Bitcoinhttps://t.co/jCQ3G0uzPC

Japanese investment firm @Metaplanet_JP has unveiled an ambitious new target to amass 210,000 BTC by the end of 2027.#Metaplanet #Bitcoinhttps://t.co/jCQ3G0uzPC

On Monday, Metaplanet purchased an additional 2,205 BTC, bringing its total Bitcoin holdings to 15,555 BTC, valued at approximately 225.8 billion yen ($1.7 billion).

In April, NASDAQ-listed Japanese beauty and cosmetic surgery clinic operator SBC Medical Group Holdings completed a Bitcoin purchase worth over $418,000.

Moreover, Japan’s evolving regulatory landscape is supporting the increased adoption of cryptocurrencies.

The country is preparing to formally recognize crypto assets as financial products under its Financial Instruments and Exchange Act and is moving toward approving Bitcoin ETFs.

These developments are expected to encourage more Japanese companies and citizens to embrace Bitcoin and cryptocurrency investments.

Government officials are also considering Bitcoin as a reserve asset.

Satoshi Hamada, a member of parliament from the Party to Protect the People from NHK, has called for the establishment of a national Bitcoin reserve, similar to recent proposals from lawmakers in Argentina, Russia, and other countries.