Bitcoin Accumulation Surge: Short & Long-Term Holders Defy Market Patterns in 2025

Market norms shatter as Bitcoin sees unprecedented accumulation from both tactical traders and diamond-handed HODLers.

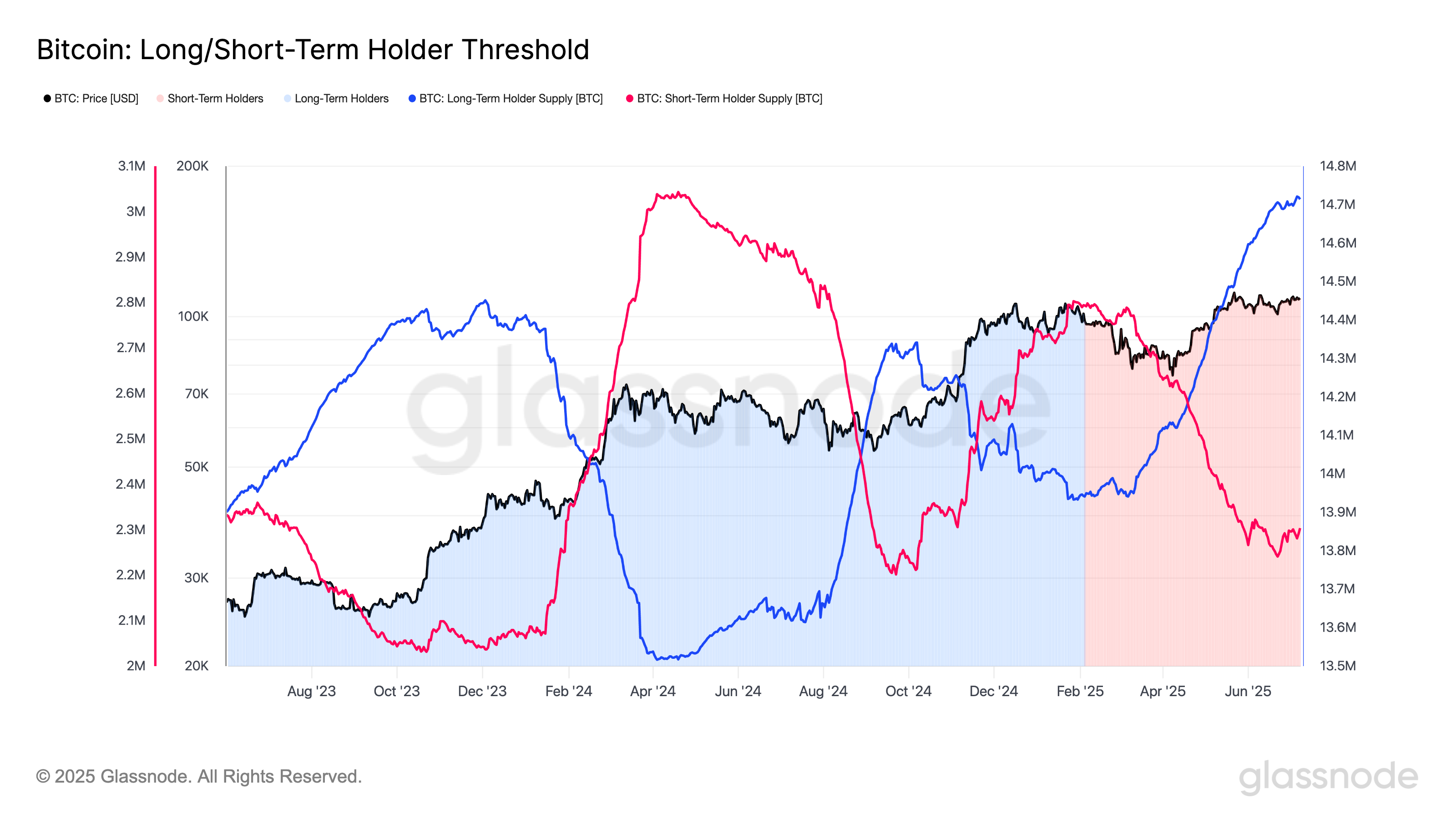

The Two-Way Accumulation Play

For the first time since the 2021 cycle, short-term speculators and long-term holders are simultaneously stacking sats—a divergence from typical market behavior where these cohorts historically move in opposition.

Liquidity Squeeze Incoming?

The coordinated accumulation comes as Bitcoin's circulating supply continues tightening, with over 70% of coins untouched for 6+ months. Market makers whisper about potential violent upside moves when this much liquidity gets locked away.

Wall Street Still Doesn't Get It

Meanwhile, traditional finance analysts keep drawing Fibonacci retracements on their Bloomberg terminals while missing the fundamental shift: Bitcoin isn't just an asset class anymore—it's becoming the benchmark. (But don't expect them to update their PowerPoint decks until after the next ATH.)