DOGE at Make-or-Break $0.155 Support as ChatGPT’s 42-Signal Analysis Collides With Musk Chaos

Dogecoin's fate hangs on a razor's edge—ChatGPT's algorithmic crystal ball flashes 42 bullish and bearish signals as the meme coin battles Elon-fueled volatility.

The $0.155 Litmus Test

DOGE either bounces hard or faceplants harder. Traders are glued to charts as the self-proclaimed 'people's crypto' dances on critical support—proving once again that in crypto, 'fundamentals' are just Elon's tweet drafts.

Musk Drama: The Ultimate Beta Test

Every Doge hodler's PTSD flares up as Tesla's CEO resumes his favorite hobby: turning crypto markets into his personal meme playground. ChatGPT's analysis? A chaotic 42-signal soup of 'maybe buy' and 'abandon ship.'

Bottom Line

Whether DOGE moons or craters depends on which way the algorithmic winds blow—and whether billionaire whims count as 'technical analysis' now. (Spoiler: They always did.)

Source: Cryptonews

Source: Cryptonews

The market cap stands at, with an explosivevolume surge to, validating institutional repositioning during periods of uncertainty.

The following analysis synthesizes ChatGPT’sreal-time technical indicators, political developments, sentiment metrics, and technical patterns to assess DOGE’strajectory amid escalating political tensions and chart pattern formations.

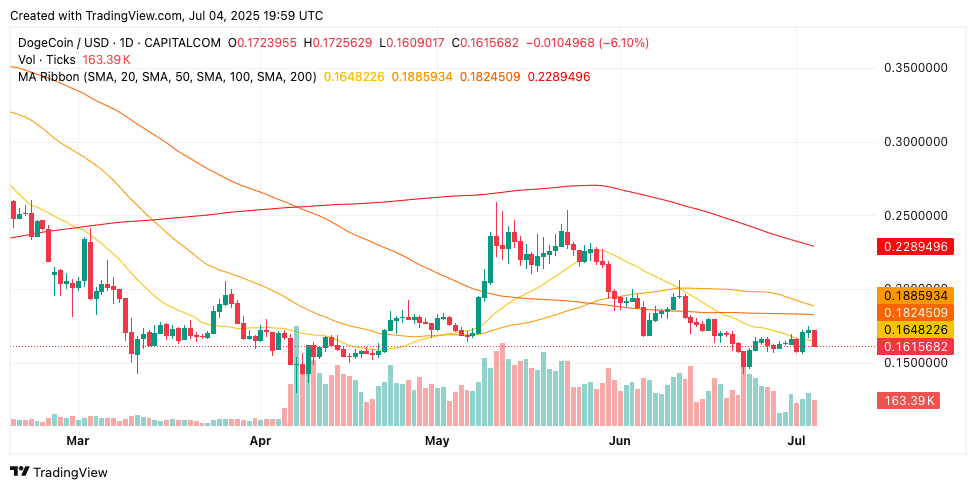

Technical Breakdown: Bearish Structure Dominates All Timeframes

Dogecoin’s current price ofreflects a majordaily decline from its opening price of $0.17201, establishing a concerning trading range between(high) and(low).

Thisintraday spread indicates high volatility during periods of political uncertainty.

RSI atapproaches oversold territory without reaching extreme levels, indicating balanced momentum despite intense selling pressure. This positioning suggests Doge remains vulnerable to further declines without immediate reversal signals from technical indicators.

MACD indicators display conflicting readings with the MACD line at, trading slightly above zero, which suggests underlying bullish momentum. However, the negative histogram atindicates strong bearish momentum divergence requiring careful monitoring for breakdown cues.

Political Drama Impact: Musk-Trump Tensions Drive Volatility

The political feud between Elon Musk and Donald TRUMP has introduced volatility to DOGE, with speculation surrounding the DOGE agency creating uncertainty among investors.

This political drama represents a departure from traditional meme-driven rallies, introducing systematic risk to DOGE’s price action.

Donald Trump on whether or not he’ll deport Elon Musk amid their feud:

“I don’t know. We’ll have to take a look. We may have to put DOGE on Elon, You know what DOGE is? DOGE is the monster that might have to go back and eat Elon.” pic.twitter.com/eO4FB0QTTh

Elon Musk’s speculation about a new American party has generated increased attention for potential meme coin boom scenarios, although current political tensions have overshadowed these bullish narratives.

It is obvious with the insane spending of this bill, which increases the debt ceiling by a record FIVE TRILLION DOLLARS that we live in a one-party country – the PORKY PIG PARTY!!

Time for a new political party that actually cares about the people.

The timing of political developments coincides with technical breakdown patterns, amplifying downward pressure.

Ascending Triangle Formation: Bulls Maintain Hope Despite Breakdown

Technical analysts identify a large ascending triangle pattern on weekly charts, representing a classic bullish structure despite current price weakness.

The pattern shows DOGE holding trendline support around, though the recent breakdown challenges this bullish thesis.

$DOGE Weekly Chart Update$DOGE is forming a large ascending triangle pattern on the weekly — a classic bullish structure!![]()

![]() Holding trendline support around $0.17

Holding trendline support around $0.17![]() Bounced twice off key support zone

Bounced twice off key support zone![]() Eyes on breakout above $0.25–$0.29 resistance

Eyes on breakout above $0.25–$0.29 resistance![]() Targets ahead:… pic.twitter.com/ZeeiVdY9mL

Targets ahead:… pic.twitter.com/ZeeiVdY9mL

The ascending triangle formation suggests accumulation at higher lows while facing consistent resistance aroundlevels.

This pattern typically resolves with upward breakouts, though current political tensions complicate traditional technical analysis assumptions.

Multiple bounces off key support zones indicate institutional interest in DOGE accumulation during periods of weakness, although the recent breakdown below triangle support raises questions about the pattern’s validity.

The next few weeks will be key in determining whether bulls can reclaim triangle support or bears continue driving prices lower.

Historical Context: Sharp Correction from January Highs

DOGE’sperformance exhibits extreme volatility following January’s strong close at, representing the local high for the year.

The subsequent correction to February’sand stabilization aroundin March and April established the current trading ranges.

May’s modest recovery tofollowed by June’s decline todemonstrates DOGE’s inability to sustain momentum without major catalysts. Current price action represents the continuation of the correction cycle that began after January’s peak performance.

Thedecline from January highs to current levels reflects DOGE’s high-beta nature and sensitivity to sentiment shifts.

This historical context provides perspective on current weaknesses while highlighting DOGE’s potential for dramatic reversals during periods of positive catalysts.

Support & Resistance: Key Levels Define Next Direction

Immediate support emerges at today’s low of around, reinforced by the key support zone at.

This confluence represents the most significant technical level for determining DOGE’s near-term direction and potential for deeper correction.

Major support zones extend fromtorepresenting historical accumulation levels, followed by strong support fromcorresponding to previous cycle lows. These levels provide multiple safety nets during extended correction scenarios.

#Dogecoin is at the third touchpoint of an ascending channel, making it the ideal buy level before a huge surge![]() $Doge/M1 pic.twitter.com/ZiYlzKPAaG

$Doge/M1 pic.twitter.com/ZiYlzKPAaG

Resistance begins immediately at theEMA, located at, representing the first hurdle for any potential recovery attempts.

The key resistance cluster lies between theEMA () and theEMA (), creating a challenging overhead supply.

Market Metrics: High Volume Confirms Selling Pressure

DOGE maintains amarket capitalization with an exceptionaltrading volume of, representing a massivesurge. The volume-to-market cap ratio ofsuggests intense selling pressure during periods of political uncertainty.

The high volume surge toDOGE confirms institutional repositioning during breakdown attempts, validating technical analysis rather than suggesting accumulation.

This volume pattern supports a bearish interpretation of current price action.

Current pricing represents adiscount to the all-time highs achieved in, although comparison to recent highs shows adecline from the Januarypeaks.

This positioning provides long-term value arguments while acknowledging significant technical damage.

Social Sentiment: Community Optimism Fights Technical Reality

LunarCrush data reveals resilient community engagement withpositive sentiment despite recent price weakness.

The social dominance ofwithtotal engagements demonstrates DOGE’s ability to maintain attention during correction periods.

Recent social themes have focused on ascending triangle formations, accumulation opportunities, and long-term bullish scenarios targeting thelevel.

The prophecy: $1$DOGE pic.twitter.com/SESlJ33hMT

— Chimp of the North (@cryptochimpanz) July 4, 2025Community discussions emphasize technical patterns while acknowledging the short-term political headwinds that affect price action.

The disconnect between social sentiment (positive) and technical indicators (bearish) represents typical DOGE community behavior during correction periods. This resilient sentiment provides fundamental support for eventual recovery scenarios.

90-Day DOGE Price Forecast

Political Resolution Rally (Bull Case – 30% Probability)

Resolution of Musk-Trump political tensions, combined with a breakout from an ascending triangle, could drive the recovery toward, representingupside.

This scenario requires political clarity and successful defense ofsupport zone with volume confirmation.

Technical targets include,, andbased on triangle pattern measurements and historical resistance levels. The meme coin narrative could resurface strongly if political uncertainties resolve favorably for DOGE-related speculation.

Extended Correction (Base Case – 50% Probability)

Continued political uncertainty and technical breakdown could drive DOGE toward, representing adownside.

This scenario assumes ongoing political tensions and failure to hold key support levels during summer trading periods.

Support atwould likely fail during an extended correction, with volume normalizing aroundDOGE daily. This sideways-to-downward action provides better accumulation opportunities for long-term holders seeking lower entry points.

Deep Correction (Bear Case – 20% Probability)

Severe political escalation or broader market weakness could trigger a correction toward, representing adownside.

This scenario WOULD require strong negative catalysts beyond current political tensions.

The strong community sentiment and meme coin resilience limit extreme downside scenarios, with major support atproviding key long-term trend support for future recovery cycles.

DOGE Forecast: Political Drama Meets Technical Breakdown

DOGE’s current positioning reflects the convergence of political uncertainty, technical breakdown, and community resilience.

Theanalysis reveals that the cryptocurrency is positioned at a key juncture between pattern continuation and a major correction.

Current consolidation aroundwith critical support at–creates a decision point for DOGE’s trajectory. The combination of political drama, technical weakness, and community Optimism positions DOGE for volatile price action as catalysts develop throughout Q3.