🚀 July Altcoin Surge: Hyperliquid Targets $100, Solana Soars on ETF Hype, & Stablecoins Get Volatile

Altcoins are stealing the spotlight this July—here's what's fueling the frenzy.

Hyperliquid's $100 Dream: The perpetual swaps darling isn't just climbing—it's moonwalking past resistance levels. Traders whisper triple digits by August.

Solana's ETF Tailwind: With BlackRock's paperwork in play, SOL's 30% monthly pump looks like a warm-up. Cue the 'we told you so' from degenerates who held through the FTX mess.

Stablecoin Wars 2.0: Tether's printing presses are overheating, Circle's playing regulator pet, and PayPal's PYUSD just remembered it exists. Meanwhile, crypto natives stack USDH—because why trust traditional finance at all?

Bottom line: The 'dumb money' is piling into BTC ETFs, but the real action? It's in the alts—where leverage meets lunacy and the SEC's rulebook collects dust. *Cue hedge fund managers furiously Googling 'how to short memecoins.'*

Hyperliquid Eyes $100 – Too Ambitious or Within Reach?

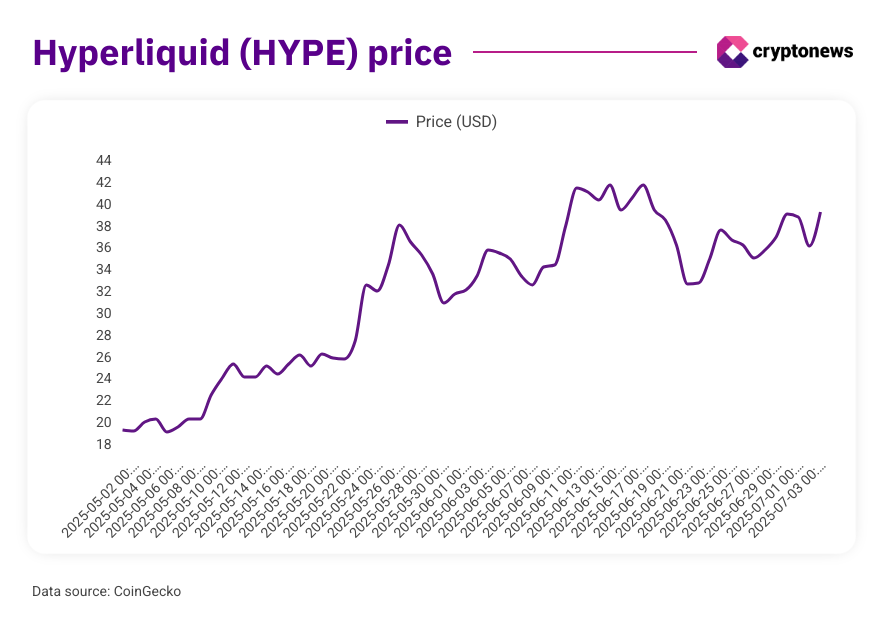

Hyperliquid (HYPE) has become one of the most talked-about new crypto projects. Its price has jumped nearly 250% over the past three months, while Bitcoin and many altcoins remain in a holding pattern.

On June 16, HYPE hit its all-time high of $45.57.,, told Cryptonews that the altcoin may keep climbing:

Hyperliquid leads with gasless perpetual trading and HyperBFT consensus. Price could reach $80 by Q3 2025.

In 2025, crypto projects with real value and utility often struggle to grow, while meme coins continue to lead the market. Hyperliquid hasn’t broken this pattern entirely, but shows that non-meme projects can also rally. Its gasless perpetual trading platform has secured a strong niche.

,, shared his view with Cryptonews:

It’s predominantly organic growth, and the numbers support this. They’ve become the undisputed leader in decentralized perpetuals in record time.

Solana’s ETF Wave – Which Projects Could Surf It?

Eneko Knörr also noted that Solana’s (SOL) ecosystem could become more attractive soon, thanks to the first solana staked exchange-traded fund (ETF) registered in the U.S.:

Riding the ETF wave and scalability gains, key Solana tokens like RAY and ORCA remain strong short-term plays.

Raydium (RAY) and Orca (ORCA) are decentralized exchanges (DEXs) on Solana with their own tokens listed across platforms. Raydium remains one of the most popular projects, especially after launching its meme coin launchpad, LaunchLab.

In June, Raydium ranked fifth among Solana’s top 15 DeFi projects by revenue, earning $6.17 million. Pump.Fun continues to lead in revenue, although a recent Cryptonews study showed its numbers have dropped significantly from peak levels.

Meme coins and their “infrastructure” remain some of the most profitable segments on Solana. For example, Axiom ranked second by revenue in June. It’s a wallet and platform mainly used for meme coin trading. However, with the Solana staked ETF, this picture could change.

Moreover, a spot Solana ETF approval is expected this year, potentially bringing even more liquidity and institutional interest. This could help shift Solana’s reputation away from being just a meme coin blockchain and attract a new class of investors. Knörr added:

Ecosystem projects drive adoption, while ETF approval odds for SOL sit at 95% in 2025. Potentially unlocking $1B+ inflows.

Stablecoin Summer – Set to Sizzle or Stay Cool?

Stablecoins remain one of crypto’s most promising markets. They serve as a bridge between traditional finance and crypto while also adding liquidity to DeFi. In 2024, they even surpassed Visa in transaction count.

Knörr highlighted Ethena (ENA) as a short-term project to watch amid regulatory shifts. Ethena issues its own stablecoin, USDe (USDE), along with its ENA token.

USDE launched in April 2024 and is already among the top five stablecoins by market cap. While it’s still far behind giants like Tether (USDT) and USDC, no project can compete with their scale for now. Ethena, however, is part of Ethereum’s (ETH) ecosystem and offers its own protocol and yield programs.

,, told Cryptonews:

More and more companies are integrating digital payment solutions into their systems, drawn by the key advantages of digital asset transactions: lowest transaction costs, near-instant processing speeds, and transparency. As a result, a growing number of market participants are engaging with blockchain projects to enhance their payment infrastructure and leverage these benefits.

Conclusion

July could bring strong momentum for Hyperliquid and select Solana projects, while stablecoins continue to cement their role as crypto’s backbone. But as always, liquidity flows and regulatory headlines will shape where altcoins go next.