ZachXBT Exposes USDC’s Role in North Korean Crime Wave as FATF Sounds Alarm on Stablecoins

Crypto sleuth ZachXBT drops a bombshell: USDC isn't just for DeFi degens—it's become Pyongyang's favorite money-laundering tool. Meanwhile, global watchdog FATF sharpens its claws on stablecoins.

The dirty little secret of 'compliant' stablecoins

While Circle touts USDC's transparency, blockchain investigators trace millions in sanctioned funds flowing through the 'regulated' stablecoin. Guess those KYC forms aren't stopping Kim Jong-un's hackers.

FATF's warning shot across crypto's bow

The financial cops aren't buying the 'but we're just tech' excuse anymore. New guidance puts stablecoin issuers on notice—play banking games, win banking regulations. Cue the industry's collective eye-roll.

Another day, another dollar-pegged scandal. At this rate, Tether's 'wild west' reputation might start looking like a selling point.

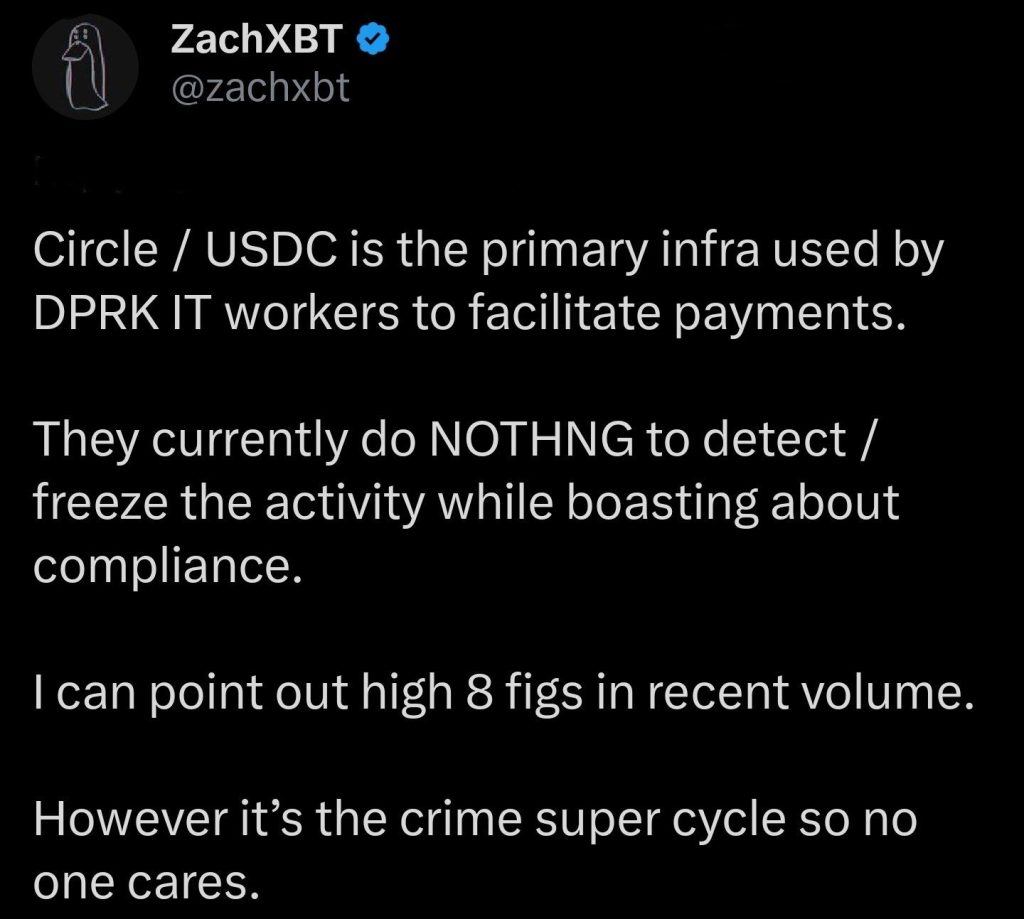

ZachXBT alleged that he could trace recent transactions worth “high eight figures” linked to North Korean IT workers using USDC.

The timing of these accusations coincides with FATF’s stark assessment that DPRK actors, terrorist financiers, and drug traffickers have increasingly turned to stablecoins as their preferred medium for cross-border money movement.

Circle’s Compliance Claims Face Scrutiny as DPRK Operations Scale

ZachXBT’s investigative credibility can be attributed to his successful exposure of major crypto fraud schemes that have led to prosecutions and hundreds of millions in asset recoveries.

His assertion that DPRK IT workers systematically exploit USDC infrastructure may suggest that their operations have achieved significant scale beyond isolated incidents to systematic revenue generation schemes funding weapons programs.

Circle’s position as a regulated stablecoin issuer makes Zach’s accusations particularly disturbing, given the company’s frequent public statements about robust compliance frameworks and cooperation with law enforcement agencies.

The FATF report specifically cited North Korea’s execution of “the largest single virtual asset theft in history” this year, with hackers stealing $1.46 billion from the ByBit exchange, of which only 3.8% has been recovered through international enforcement efforts.

Recent Department of Justice cases have also revealed how North Korean operatives embed themselves in Western companies as remote IT workers, using stolen identities to secure employment before exploiting access to steal cryptocurrency and sensitive data.

Federal prosecutors described these schemes as part of a “cyber-enabled revenue generation network” designed to fund the DPRK’s weapons programs, with one recent case involving defendants who stole over $900,000 in cryptocurrency from their unwitting employers.

![]() DPRK-linked perpetrators landed in remote IT jobs using fake and stolen identities and exploited their company’s trust to steal and launder over $900,000 in crypto.#DPRK #NorthKoreaCrypto #CryptoScamhttps://t.co/6UvXug5OZp

DPRK-linked perpetrators landed in remote IT jobs using fake and stolen identities and exploited their company’s trust to steal and launder over $900,000 in crypto.#DPRK #NorthKoreaCrypto #CryptoScamhttps://t.co/6UvXug5OZp

The FATF report further bolsters these concerns by noting that industry participants estimate approximately $51 billion in on-chain activity related to fraud and scams occurred in 2024 alone, with stablecoins playing a prominent role in these illicit flows.

Meanwhile, global enforcement agencies have struggled to keep pace with increasingly sophisticated criminal networks that exploit regulatory gaps between jurisdictions, particularly as these groups migrate operations to regions with weaker oversight frameworks.

Stablecoins Emerge as New Frontier in Global Financial Crime Wars

The growing role of stablecoins in criminal finance particularly shows the uneasy balance between their usefulness in payments and DeFi and their potential for scale abuse.

The FATF warned that widespread adoption could exacerbate the problem if regulation doesn’t keep pace quickly enough to contain cross-border risks.

Nearly 100 countries are working on Travel Rule legislation to improve transparency in crypto transactions, but enforcement remains inconsistent.

![]() The EBA extends its Travel Rule to crypto exchanges, enforcing stricter AML and CFT standards. Learn more here.#EU #TravelRulehttps://t.co/Lrl2uzrqKB

The EBA extends its Travel Rule to crypto exchanges, enforcing stricter AML and CFT standards. Learn more here.#EU #TravelRulehttps://t.co/Lrl2uzrqKB

Recent enforcement actions, including the DOJ’s seizure of $225.3 million in USDT linked to “pig butchering” scams and investigations into Cambodia-based platforms that process $24 billion in criminal flows, further show the scale of the problem.

Another recent report by the UN also detailed how transnational criminal groups have built vast underground economies using stablecoins, with platforms like Huione Guarantee supporting over 970,000 users while offering services from identity forgery to money laundering tools.

![]() UN warns of global crypto crime surge: Militias exploit stablecoins, illicit mining, and encrypted markets to launder billions and evade regulators.#UN #Stablecoinshttps://t.co/9cCaNaT4fE

UN warns of global crypto crime surge: Militias exploit stablecoins, illicit mining, and encrypted markets to launder billions and evade regulators.#UN #Stablecoinshttps://t.co/9cCaNaT4fE

However, the disconnect between the borderless nature of stablecoins and the jurisdictional limitations of traditional law enforcement creates persistent vulnerabilities that criminal networks continue to exploit with apparent impunity.

Looking forward, with the GENIUS Act nearing a positive conclusion, stablecoins may eventually be duly regulated, and enforcement measures to prevent misuse can be implemented.