Altcoin Summer Inbound? Analysts Predict July Ignition for Crypto’s Second Act

Sleeping altcoins may finally wake next month as traders rotate profits from Bitcoin’s rally. The usual suspects—Ethereum, Solana, and a handful of DeFi tokens—are primed to lead the charge.

Market cycles suggest we’re overdue for altseason. With BTC dominance hovering near 55%, capital typically floods into smaller caps once the king crypto takes a breather. Meme coins need not apply—this round could favor protocols with actual revenue.

Just don’t tell your traditional finance friends. They’re still waiting for that ’blockchain, not Bitcoin’ epiphany while missing every profitable turn.

AI + Blockchain: Next Big Bet?

Experts who spoke to Cryptonews said attention is shifting toward infrastructure-focused projects at the intersection of AI and blockchain.

Tracy Jin said:

Amid the general hype around artificial intelligence, I WOULD highlight blockchain projects related to on-chain AI infrastructure and decentralized data marketplaces, such as Fetch.ai, Bittensor, and Numerai.

Dean Chen also pointed to a steady demand for AI tokens:

I am particularly optimistic about the AI sector (FET, RNDR), due to strong correlations with mainstream AI stocks and sustained narrative momentum.

In May, performance across the sector was mixed. Tokens like Virtuals Protocol (VURTUAL), Grass (GRASS), and Artificial Superintelligence Alliance (FET) saw monthly gains, while others such as Render (RENDER) and Story (IP) corrected. The focus is shifting to infrastructure plays and new, lesser-known projects with strong speculative traction.

Other Opportunities: Layer 2 and Modular Chains

Dean Chen emphasized the role of projects that enhance the ethereum ecosystem:

Layer 2 solutions (ARB, OP), which directly benefit from Ethereum network traffic growth and have expected airdrop incentives.

According to TokenTerminal, trading volumes for Arbitrum (ARB) and Optimism (OP) jumped in May, reaching $7.4 billion (+75.2%) and $7 billion (+94.2%) respectively.

Chen also pointed to modular blockchains as a key narrative:

Modular blockchains (SUI, APT), which as next-generation base layers receive top-tier venture capital backing, highlighting their infrastructure value.

TON and Telegram: ‘Promising Ecosystem’

Tracy Jin called attention to the Toncoin (TON) ecosystem as one of the most promising outside of Solana (SOL) and Ethereum:

That said, we’re seeing growing interest in ecosystems like TON, where adoption is being driven by user behavior rather than speculation. Its integration into Telegram’s one billion user base has created a new kind of user engagement that can make TON the biggest blockchain ecosystem by 2027.

Tokenized Real Assets Are On the Rise This Summer

The tokenization of real-world assets (RWA) remains one of the most discussed and institutionally supported narratives in the market. Tracy Jin noted that this category continues to gain traction as traditional financial players explore the potential of on-chain infrastructure:

It’s become a theme that bridges crypto with mainstream finance, and it resonates well with both retail and institutional investors.

Dean Chen added that some of the top-performing assets in this category benefit from their regulatory positioning and ties to major institutions:

Real-world assets (ONDO, LINK), which benefit from regulatory compliance and institutional partnerships.

This theme supports broader adoption and helps align the crypto market with more stable, real-world use cases that appeal to professional investors and regulatory bodies alike.

What’s Losing Steam

According to Chen, some older narratives are falling out of favor:

The weakest will be pure gamified NFTs/GameFi, due to insufficient user retention and utility, and Meme coins, due to lack of long-term fundamental support and excessive volatility.

Jin echoed this sentiment:

Some older narratives are starting to fade. The Layer-1 race, where everyone once competed over speed and TPS, is no longer the center of attention. Speculative NFT projects are losing steam too, as focus shifts toward real-world utility.

Fragmented Altseason Is Underway

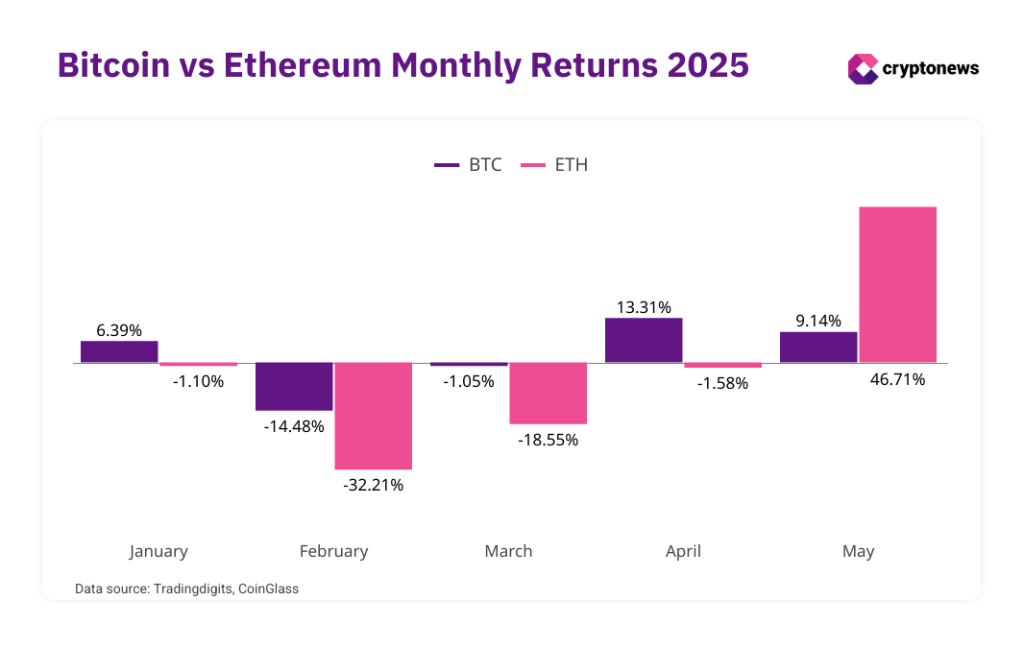

Despite BTC’s continued dominance, capital is slowly rotating into other sectors. Ethereum ends the month stronger than Bitcoin price for the second time this year, with such a wide lead for the first time. This could signal growing ETH interest amid regulatory expectations and the start of broader altcoin rotation.

Chen also outlined the conditions needed for the altseason to continue:

If BTC dominance continues to break support levels alongside a consolidation of the total market cap at new highs, a segmented altcoin rally window may emerge around June to July.

Jin noted that altseason is taking shape unevenly:

The altseason index fluctuates around neutral values, and investors are showing increased caution, especially about highly speculative assets. Meme coins and little-known tokens show bursts of activity, but are often accompanied by sharp corrections. Growth in the segment still depends on the dynamics of Bitcoin, the level of institutional interest in ETH and the macroeconomic environment.

She concluded:

The altseason has begun, but its development will occur in waves — not as a massive breakthrough, but as a gradual expansion of interest in other sectors of the crypto market.

Key Altcoin Events to Watch in June 2025

- June 1 – MANTRA (OM): End of ERC-20 Rewards

- June 2 – Jupiter (JUP): DAO Vote

- ~June 8 – Raydium (RAY) x letsBONK.fun (BONK) Event

- June 16 – Arbitrum (ARB): 92.65M Token Unlock