SEC and Binance Move to Dismiss Landmark Lawsuit—Crypto’s Regulatory War Winds Down?

The crypto industry’s most-watched legal battle may be nearing an unexpected truce. Both the SEC and Binance filed motions to dismiss their high-stakes lawsuit this week—just as Bitcoin flirts with new all-time highs.

Regulatory whiplash or calculated retreat? The sudden détente comes after 18 months of discovery that reportedly cost both sides eight figures in legal fees. ’Nothing focuses the mind like burning $20,000/hour,’ quipped one Wall Street analyst.

Behind the scenes: Insiders suggest the SEC’s shrinking war chest and Binance’s compliance overhaul created rare common ground. The exchange recently onboarded three ex-SEC regulators—because nothing says ’regulatory compliance’ like hiring the cops who used to chase you.

Market impact: BNB surged 12% on the news, though skeptics note the token still trades 60% below its 2021 peak. Meanwhile in Washington, lawmakers continue debating whether crypto is a security, a commodity, or just a very expensive game of regulatory hot potato.

Bottom line: This could mark a turning point for crypto’s fraught relationship with regulators—or just the calm before the next enforcement storm. Either way, the lawyers win.

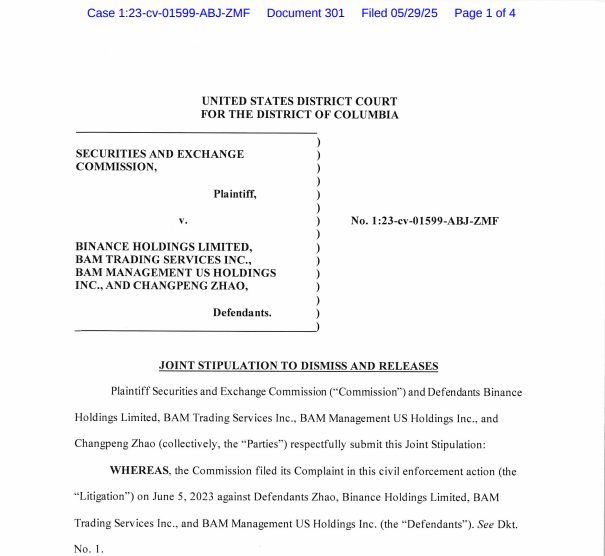

SEC Dismisses Civil Case Against Binance and Changpeng Zhao

The SEC voluntary dismissal, filed jointly with Binance with prejudice in Washington, D.C., means the regulator cannot revive these charges, marking a major shift in U.S. crypto policy and enforcement.

According to the court document, the SEC stated, “in the exercise of its discretion and as a policy matter, the Commission believes the dismissal of this Litigation is appropriate.”

While the regulator provided no further explanation, it did clarify in its litigation release that the MOVE does not necessarily reflect its stance on other cases.

Over the past several months, the case had remained in limbo. In April 2025, the SEC and Binance requested a stay, followed by extension requests, suggesting shifting priorities and behind-the-scenes negotiations.

The dismissal follows a turbulent 2023 for Binance, which included a $4.3 billion settlement with the U.S. Department of Justice over Bank Secrecy Act violations.

Zhao and Binance admitted to criminal wrongdoing as part of that settlement and agreed to overhaul compliance protocols.

In a tweet celebrating the SEC’s decision, Binance called it “a huge win,” adding, “Thank you to Chairman Atkins and the TRUMP team for pushing back against regulation by enforcement.”

Huge win for crypto today. The SEC’s case against us is dismissed.

Thank you to Chairman Atkins & the Trump team for pushing back against regulation by enforcement. U.S. innovation is back on track – and it’s just the beginning.

Thursday’s court filing also referenced the SEC’s newly formed crypto task force, which has recently engaged with industry stakeholders.

The task force indicates a potential shift in the agency’s regulatory strategy under evolving political and administrative leadership, particularly in contrast to the aggressive enforcement style seen during former SEC Chair Gary Gensler’s tenure.

While the SEC may be recalibrating its crypto policy direction, it remains unclear how this dismissal might influence other ongoing or future enforcement actions.

For Binance and Zhao, however, the end of this legal chapter marks a significant win as they explore continued global regulatory challenges.

Policy Reset: SEC Retreats from Enforcement-Led Crypto Regulation

The SEC’s dismissal of its lawsuit against Binance is part of the shift in regulatory posture under the Trump administration, marked by a move away from aggressive enforcement and toward more structured policymaking in the crypto space.

In recent months, the SEC has either settled or dropped multiple high-profile cases involving other major industry players.

Coinbase, ConsenSys, and Kraken all reached settlements earlier this year. Investigations into Circle, Immutable, and others were quietly closed without further action.

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.#CryptoRegulation #CryptoPolicy #SEChttps://t.co/pn7Utn0XLL

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.#CryptoRegulation #CryptoPolicy #SEChttps://t.co/pn7Utn0XLL

Lawsuits against Uniswap and OpenSea have also been withdrawn, significantly softening the agency’s stance.