Crypto Bloodbath: Why Digital Assets Are Tanking on May 29, 2025

Crypto markets got sucker-punched today—here’s why.

### The Usual Suspects: Macro Jitters & Whale Dumps

Bitcoin’s flirting with $60K again as Fed chatter about rate hikes spooks traders. Meanwhile, a 12K BTC dump hit Binance at 3 AM UTC—classic ‘buy the rumor, sell the news’ after last week’s ETF hype.

### Altcoins Follow BTC Off the Cliff

Ethereum got dragged below $3.5K as DeFi TVL shrinks for the third straight week. Even Solana’s ‘unstoppable’ meme coins bled out—some degenerate bets lost 80% in 24 hours.

### The Silver Lining (Because We’re Required to Mention It)

OGs know this is just another Tuesday in crypto. Volatility cuts both ways—just ask the hedge fund guys now over-leveraged on ‘safe’ stablecoin yields. Remember: the market always punishes impatience faster than incompetence.

Crypto Winners & Losers

At the time of writing, four of the top 10 coins per market capitalization are down and four are up over the past day (not taking stablecoins into account).

has decreased by 0.9% to the price of $107,940. This is also down from the intraday high of $109.037.

saw the highest increase in this category by far. While others are up less than 1% per coin, ETH appreciated 3.6% to $2,729.

As for ten coins, they are all down by less than 1%. BTC’s and0.9% falls are the highest. SOL now trades at $172.

Of the top 100 coins, nearly half are green, more than double seen yesterday. The highest decrease is4.8% to $1.29.

The highest gainer is, followed by. They’re up 14.3% and 11% to $1.13 and $3.31, respectively. Over the past 24, TON perpetual futures open interest jumped to $190 million, its highest level since February.

Over the past 24h, $TON perpetual futures OI surged +33% from $143M to $190M – its highest level since Feb 18. Interestingly, OI stayed elevated even after the price pullback. Past spikes like this have often preceded corrections – worth watching closely: https://t.co/wXpcaQoKul pic.twitter.com/IwbflHdkwZ

— glassnode (@glassnode) May 29, 2025The current market dip doesn’t seem alarming. Per various analysts, it’s following the previously established patterns, whereby rallies are followed by short-term downwards corrections and sell-offs. Overall, it’s currently consolidating.

‘The Broader Outlook Remarkably Uncertain’

“Strength in the Bitcoin market remains firm,” says the latest report by blockchain and market data intelligence platform.

The report notes that price discovery phases are historically often followed by brief sell-offs. Early profit-takers are exiting and de-risking at new highs.

As the market re-enters a period of price discovery, the unrealized profit has surged. However, with the rise in profitability comes an increase in sell-side pressure. At the same time, when the price rises, “larger volumes of buy-side demand are required to absorb the distributed coins in order for the market to sustain upwards momentum,” Glassnode explains.

Overall, BTC bitcoin has followed the pattern so far. It hit an ATH, profit-takers seized the opportunity to exit, the price pulled back to $107,000 shortly after the initial breakout, then recovered and consolidated around the $108,000 level.

“Bitcoin is outperforming most asset classes amidst an environment of challenging macroeconomic conditions and geopolitical tensions, making the broader outlook remarkably uncertain. This robust performance is a truly fascinating signal amidst relatively challenging market conditions,” the report highlights.

Is $BTC strength waning – or just heating up? In the latest Week On-Chain, we explore rising investor spending, #BTC volume flowing through exchanges, and surging derivatives activity. We also highlight $120K as the next key zone of interest. Learn why: https://t.co/S4doFto7uL pic.twitter.com/Qd86YbmVtC

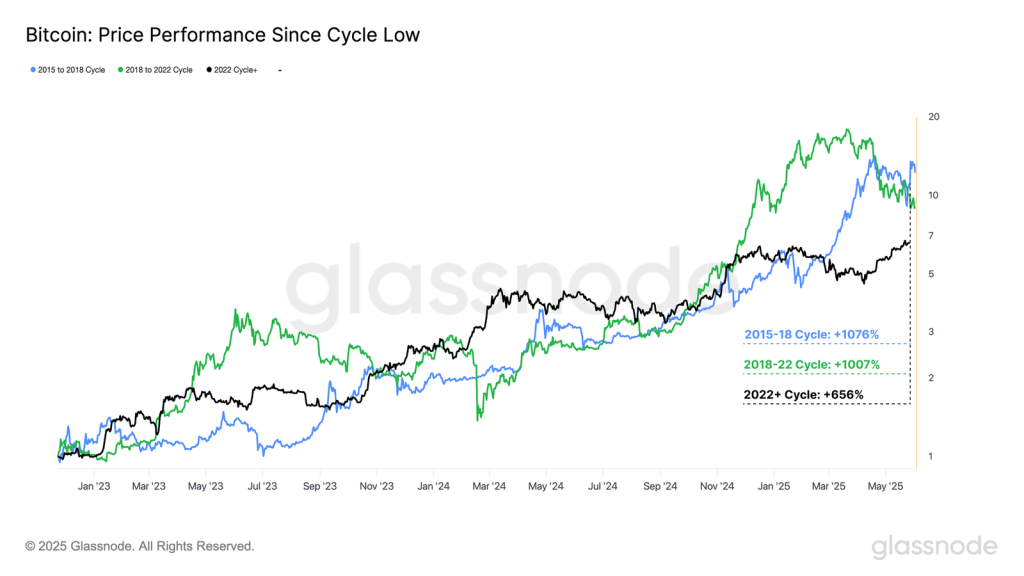

— glassnode (@glassnode) May 28, 2025When the analysts compared the price performances of the current cycle to previous ones, they found “a surprising similarity in structure.” Glassnode argues that it’s “a remarkable feat” for BTC to track earlier cycles so closely when accounting for the significantly larger market capitalization today.

“This suggests that the scale of demand for Bitcoin is keeping pace with the growth rate of the asset,” the report concludes.

Levels & Events to Watch Next

As noted, BTC currently trades at $107,940. This is 3.5% lower than the all-time high of $111,814 hit a week ago. The coin has largely been trading around the $108,000 level over the last few hours.

Notably, it broke one support level of $108,731. Should it go lower, we could see it breaking supports at the $107,000 and $105,000 levels as well. On the upside, we’re also looking to see if the coin will break through $109,600 again and push towards $112,000.

Moreover, the Fear and Greed Index has decreased from 68 to 65. Notably, this is also down from 76 seen last week. This is still the green territory and indicates positive market sentiment and increased risk-taking. Nonetheless, the decrease over the week is notable.

Meanwhile, on 28 May, US BTC spot exchange-traded funds (ETFs) saw a net inflow of $432.62 million, led by$480.96 million. The total net inflow now reached $45.34 billion. US ETH spot ETFs saw $84.89 million in net inflows, significantly higher than yesterday. The cumulative inflow is now $2.88 billion.

The flows haven’t turned negative despite the market decrease. This indicates continual and strong institutional support and adoption. Consequently, this support may fuel the market’s next leg up.

Meanwhile, Japanese Bitcoin treasury firmannounced a fresh $21 million bond issuance to fund additional purchases of Bitcoin. Norwegian crypto brokeragethrough zero-interest loans and equity to fund Bitcoin purchases. Also, American video game retailer.

In Russia, the central bank allowed limited access to crypto-linked financial products for qualified investors.

In the US, NYC Mayor Eric Adams has announced plans to build a municipal Bitcoin-backed bond, dubbed ‘BitBond’, and eliminate BitLicense. There are also reports that some of Wall Street’s banking giants are discussing crypto expansion.

BREAKING: NYC MAYOR ERIC ADAMS JUST ANNOUNCED HE’S GOING "TO FIGHT TO GET A BITBOND IN NEW YORK"

BREAKING: NYC MAYOR ERIC ADAMS JUST ANNOUNCED HE’S GOING "TO FIGHT TO GET A BITBOND IN NEW YORK"

THIS IS MASSIVE pic.twitter.com/8Ix0spHEOf

pic.twitter.com/8Ix0spHEOf

Quick FAQ

The crypto market has recorded another slight decrease today, though the situation has improved since yesterday. The stock market also saw a decrease, though the two don’t seem linked. Theis down 0.56%, thefell 0.45%, and thedecreased by 0.58%. Donald Trump’s back-and-forth on trade policy has resulted in volatile trading in traditional markets over the past few months.

Analysts seem to agree that the rally may continue after a brief pause. Though the crypto market remains supported by strong capitalization and investor interest, regulatory or macroeconomic changes may negatively affect it as well, pulling the prices downward.