NFT Lending Market Implodes: 97% Crash Wipes Out Users and Loan Volumes

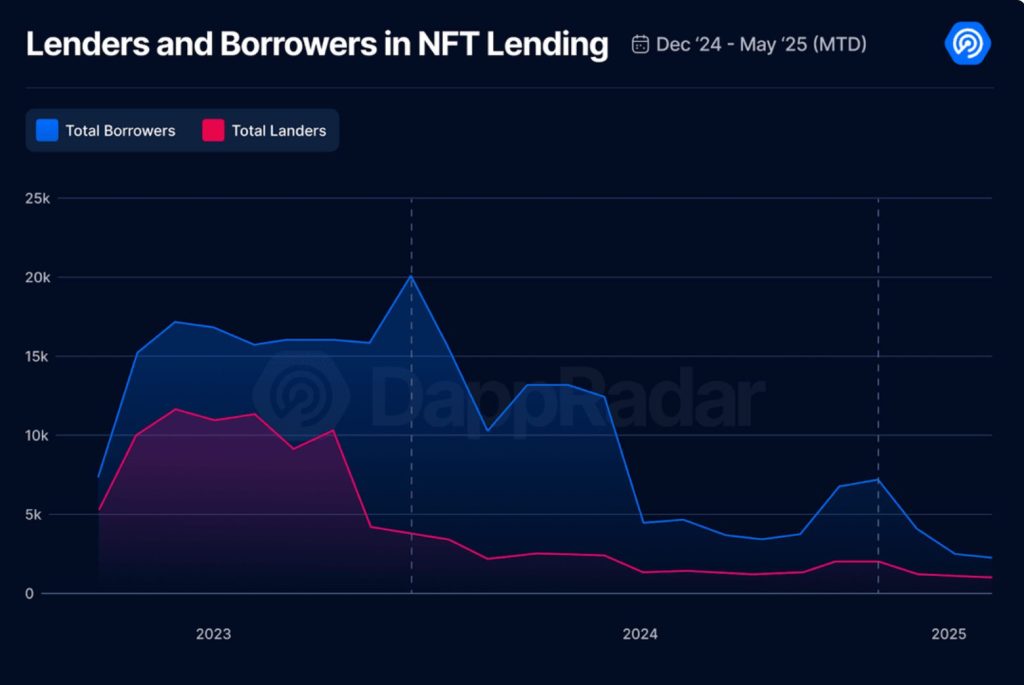

Once hailed as the future of decentralized finance, NFT lending just face-planted into reality. Loan activity cratered—users vanished, deal sizes shriveled, and the sector now looks like a ghost town.

Where Did All the ’Diamond Hands’ Go?

The hype cycle strikes again. Borrowers who swore they’d ’never sell’ their JPEGs suddenly discovered liquidity matters when floor prices evaporate. Turns out lending against speculative assets works... until it doesn’t.

Bankers 1, Degens 0

Traditional finance sharks are circling—nothing makes legacy institutions happier than watching crypto ’innovation’ eat its own tail. Maybe next time, folks will demand actual cash flow instead of vibes.

GONDI Overtakes Blur to Lead NFT Lending Market

The shift in platform dominance underscores the change in user behavior. GONDI now leads the sector with 54.2% of total outstanding volume, overtaking Blur, whose Blend protocol once controlled over 96% of the market.

Blend’s rise was fueled by airdrop incentives and aggressive flipping, but that model hasn’t survived the bear market.

GONDI, by contrast, has gained ground by catering to users looking for longer-term, more stable lending options.

Collateral preferences have changed too. On traditional platforms like NFTfi and Arcade, Pudgy Penguins dominate, generating over $203 million in loans since January.

Azuki and Bored Apes follow, but volatility has hurt their lending reliability. Meanwhile, on GONDI, the focus has shifted to art NFTs and 1/1 pieces.

CryptoPunks lead the way with over $21 million in active loans, followed by high-end generative collections like Fidenzas and Beeple works.

Loan durations are also tightening. The average in May 2025 stood at 31 days, down from around 40 days in 2023.

The shorter terms reflect a more cautious and tactical approach by borrowers who are no longer betting on big swings.

Eight protocols still hold meaningful market share, but only two are dominant.

Behind GONDI and Blend are NFTfi (7%), Arcade (4.7%), and JPEG’d (2%). Metastreet, Zharta, and X2Y2 trail far behind with sub-1% shares. The field has thinned significantly from its peak.

NFT Lending Isn’t Dead

DappRadar said the NFT lending market won’t bounce back on art-backed loans and protocol tweaks alone.

To MOVE from speculative niche to financial utility, the sector must embrace new use cases — from tokenized real-world assets and intent-based borrowing to credit-scored lending models.

“If the next wave builds on utility, culture, and better design, NFT lending might just find its second wind — one built to last,” it said.

Notably, in recent months, DraftKings, GameStop, and Bybit have all shut down their NFT platforms, with Bybit citing a steep decline in trading volumes in its April 8 announcement.

X2Y2 has also revealed plans to wind down its marketplace by April 30 to pivot toward artificial intelligence.

Back in March, Starbucks, the renowned multinational coffee chain, decided to terminate its NFT rewards program.