Bitcoin Smashes ATH on Pivotal Day for Crypto Markets

Digital gold just got shinier—BTC rockets past previous records as institutional FOMO meets a perfect storm of macro tailwinds. Wall Street analysts scramble to update price targets while crypto OGs mutter ’told you so’ into their cold wallets.

The timing? Poetic. This surge coincides with the anniversary of Bitcoin’s infamous 2010 pizza purchase—now worth roughly 500 Lambos. Meanwhile, traditional finance bros still can’t decide if blockchain is a ’speculative bubble’ or the backbone of their new ETF products.

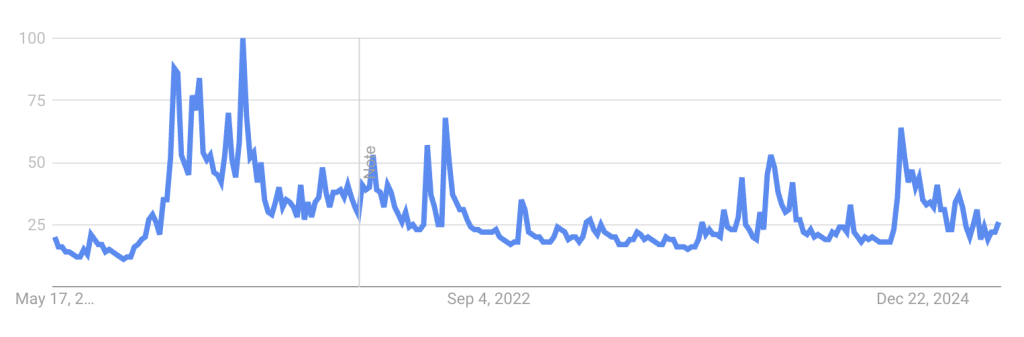

Searches for ‘Bitcoin’ on Google over the past five years

Searches for ‘Bitcoin’ on Google over the past five years

Solv Protocol CEO Ryan Chow told Cryptonews that the institutional embrace of Bitcoin comes against a backdrop of economic uncertainty, and earning a reputation for being a “macro asset, global edge and digital reserve asset.”

“A new all-time high sends a clear message: it’s validation that Bitcoin isn’t going away. This isn’t a passing trend. You don’t see BlackRock and Fidelity building infrastructure for a fad. TradFi is slowly embedding crypto into its Core business.”

But other executives have warned that challenges lie ahead — with vast improvements needed when it comes to usability, real-world applications, and scaling up infrastructure so it can accommodate more users. Cysic’s co-founder LEO Fan said:

“Crypto is still largely seen as a financial instrument where people MOVE money, speculate, or hedge, but very few engage with blockchain for the technology itself. For crypto to become truly mainstream, it must be seamlessly integrated into everyday systems that users barely notice.”

And Radix founder Dan Hughes says “we’re about to find out what happens when Wall Street meets dial-up internet,” telling Cryptonews:

“Bitcoin as digital gold? Perfect. Store of value? Absolutely. But if we’re serious about this institutional adoption narrative, and want crypto to be the foundation of the new financial system, we’re going to need infrastructure that can actually handle institutional volumes.”

Data from SoSoValue shows investment into spot Bitcoin ETFs on Wall Street stood at $609 million on May 21 as BTC entered uncharted price territory. But this is far from a record — with daily inflows exceeding $1.3 billion in the immediate aftermath of the U.S. election last November.

Meanwhile, bettors on Polymarket believe the odds that Bitcoin’s rally will continue are rising. There’s now said to be an 84% chance of BTC hitting $120,000 this year, compared with just 33% at the start of April. Meanwhile, there’s a 41% probability of $150,000 and a 20% chance of $200,000 as of now — compared with 11% and 13% respectively just six weeks ago.