Bitcoin Miners WULF and MARA Command Absurd 4× Revenue Premiums—While IREN Eats Their Dust

Wall Street’s latest crypto darling? Bitcoin miners trading like meme stocks. WULF and MARA now fetch four times their actual revenue—because nothing says ’sound investment’ like ignoring fundamentals.

Meanwhile, IREN trails like a dial-up connection in a 5G world. Maybe they forgot to hire the right Wall Street narrative-spinners.

Bonus jab: If revenues ever catch up to valuations, we’ll all be retired on the moon—or filing for bankruptcy. Place your bets.

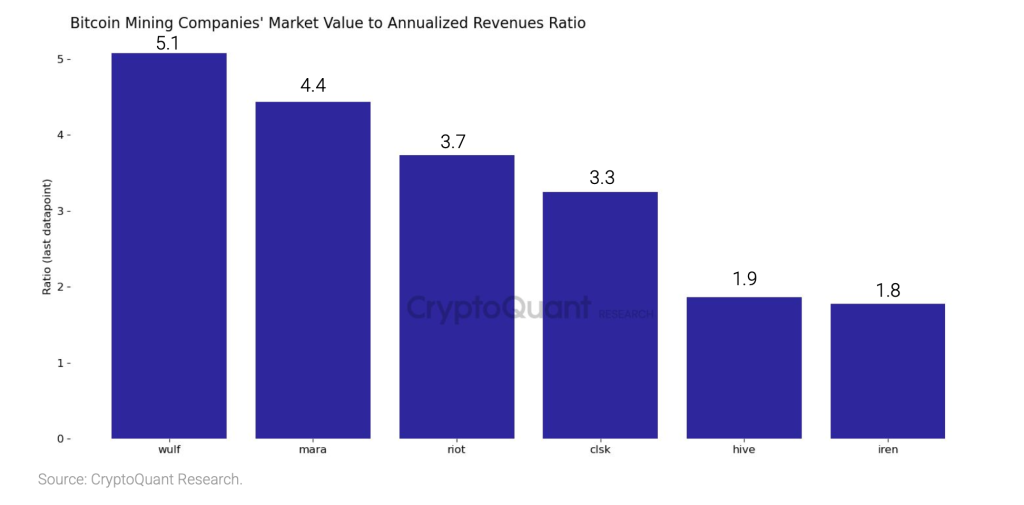

WULF and MARA Trade at the Highest Valuation Multiples

A recent analysis revealed that WULF (Terawulf) and MARA (Marathon Digital Holdings) are currently trading at the highest valuation multiples across the sector, with market value-to-annualized revenue ratios exceeding 4.4.

This suggests that investors are willing to pay a large premium for each dollar of expected annual revenue generated by these companies.

Such elevated multiples may reflect strong investor confidence in the long-term growth potential or operational efficiency of WULF and MARA. However, it also shows that these stocks may be priced for “perfection,” and any misstep in earnings or production could lead to valuation corrections, said CryptoQuant.

Iris Energy Shows the Lowest Valuation

At the opposite end of the spectrum is IREN (Iris Energy), which shows the lowest valuation multiple among its peers. This low ratio stands in contrast to the company’s recent growth in Bitcoin production, indicating a potential disconnect between its operational performance and market valuation.

CryptoQuant analysts said that for investors, this could represent a relative value opportunity, especially if IREN’s fundamentals continue to improve and the market eventually re-rates the stock.

The dispersion in valuation multiples across Bitcoin miners presents opportunities for both long-only and delta-neutral strategies. Investors might overweight undervalued firms like IREN while underweighting or hedging exposure to firms trading at rich premiums, such as WULF and MARA.

As on-chain data provides deeper, real-time insights into Bitcoin miner performance, valuation strategies are becoming more nuanced and data-driven, says CryptoQuant.

With daily visibility into miner revenues, investors now have the tools to fine-tune allocations based on actual economic output—an edge that could prove essential in managing the volatile crypto-equity market.