Bitcoin Nears ATH as Kiyosaki Declares War on ’Fake Money’—Can BTC Really Hit $200K?

Robert Kiyosaki’s latest rallying cry against fiat currencies coincides with Bitcoin’s surge toward record highs. The ’Rich Dad’ author’s timing couldn’t be sharper—or more calculated—as institutional money floods into crypto while central banks keep printing what he calls ’Monopoly money.’

With BTC’s price action mirroring previous bull run patterns, analysts debate whether this cycle could smash through the $200,000 barrier. Meanwhile, Wall Street hedges its bets by quietly accumulating Bitcoin ETFs—because nothing says ’distrust the system’ like billionaires diversifying into decentralized assets while still collecting their bonuses.

US-China Trade Optimism Fuels Risk Appetite and Bitcoin Demand

Moreover, the surge in Bitcoin’s price can also be attributed to the positive developments surrounding US-China trade relations. As of May 10, President TRUMP shared optimistic updates regarding trade talks between the two economic giants, suggesting that a potential deal could ease geopolitical tensions.

This Optimism has extended to global financial markets, including Bitcoin, which often reacts favorably to risk-on sentiment.

Bitcoin Surges Toward New All-Time High After Trump Hints at Positive Progress with China!

Global tensions easing + growing institutional momentum.

Buckle up—this bull run is just getting started. pic.twitter.com/0jjPxNd8x8

pic.twitter.com/0jjPxNd8x8

These developments indicate that Bitcoin’s price is benefiting not only from the rising discontent with traditional financial systems but also from a broader economic optimism fueled by potential global trade resolution.

- Bitcoin’s price surge is influenced by positive updates on US-China trade talks.

- President Trump’s optimism about a trade deal boosts global financial markets, including Bitcoin.

- Bitcoin benefits from both dissatisfaction with traditional financial systems and broader economic optimism.

Institutional Inflows Provide Strong Support

Bitcoin’s breakout above $104,000 also reflects strong institutional demand. BlackRock’s iShares bitcoin Trust (IBIT) recently recorded over $1 billion in net inflows, highlighting growing interest from institutional investors.

This is part of a broader trend, with Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF collectively adding nearly $1 billion in the past week.

These inflows suggest that institutional investors are increasingly viewing Bitcoin as a strategic long-term asset.

- BlackRock’s ETF leads with $1B in net inflows.

- Institutional interest supports Bitcoin’s long-term growth.

- ETFs add nearly $1B in a single week.

BLACKROCK’S #BITCOIN ETF: 19 DAYS OF STRAIGHT INFLOWS#IBIT just locked in $356M on May 9 — over $1B this week

BLACKROCK’S #BITCOIN ETF: 19 DAYS OF STRAIGHT INFLOWS#IBIT just locked in $356M on May 9 — over $1B this week

That’s 19 green days and counting. $BTC above $100K

$BTC above $100K Institutions accumulating

Institutions accumulating IBIT crowned “Best New ETF”

IBIT crowned “Best New ETF” $1M $BTC? Suddenly not so crazy… pic.twitter.com/uAw25MU4Oa

$1M $BTC? Suddenly not so crazy… pic.twitter.com/uAw25MU4Oa

Bitcoin Technical Analysis: Key Levels to Watch

From a technical standpoint, Bitcoin is trading around $104,276, just below the critical 2.618 Fibonacci extension at $105,250. This level is a significant barrier, representing a potential profit-taking zone for short-term traders.

If BTC clears this resistance, the next target is the 2.786 extension at $106,864, offering a potential 2.5% upside. However, early signs of a bearish MACD crossover suggest that momentum could be fading, which might lead to a short-term pullback.

- Buy Above: $105,250

- Take Profit: $106,864

- Stop Loss: $103,681

Consider buying if BTC breaks above $105,250, targeting $106,864. Use a tight stop below $103,681 to manage downside risk, as a drop below this level could trigger a deeper correction.

Conclusion

With strong institutional support, high-profile endorsements, and a growing anti-fiat narrative, Bitcoin appears well-positioned for further gains.

However, traders should remain cautious as BTC approaches critical resistance levels, where profit-taking could trigger short-term volatility.

The path to $200,000 remains possible, but will likely depend on continued institutional interest and broader market sentiment.

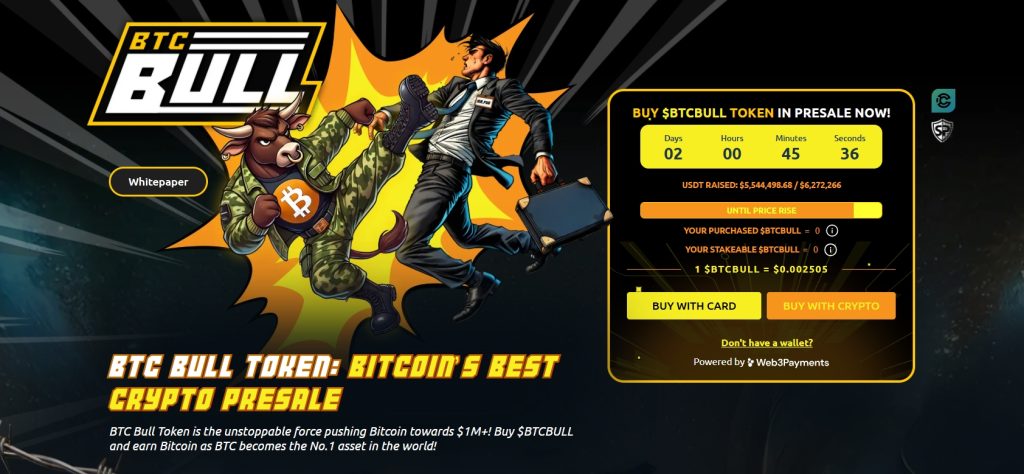

BTC Bull Token Crosses $5.58M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) continues to gain traction, crossing $5.58 million in funds raised as it nears its $6.27 million presale cap.

Priced at $0.002505, the token has positioned itself as more than just a meme coin—offering real utility through flexible, high-yield staking.

Utility-Driven Tokenomics Fuel Demand

Unlike typical meme tokens, BTCBULL blends crypto culture appeal with tangible staking rewards. Investors can currently earn an estimated 78% APY while keeping their tokens fully liquid—unstaking is allowed at any time without penalties or lockup periods.

This model has resonated with investors who seek yield without sacrificing access, especially in a volatile crypto environment.

- USDT Raised: $5,581,603.93 of $6,272,266

- Current Price: $0.002505 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With less than $727K left before the next milestone, the presale window is narrowing fast. For investors chasing high yields with exit flexibility, BTCBULL is becoming an increasingly compelling contender in the 2025 crypto cycle.