Metaplanet Bets Big on US Expansion—Florida Subsidiary Targets $250M Raise

Tokyo-based Metaplanet is planting its flag in American soil with a new Florida subsidiary—and they’re not coming empty-handed. The Web3 firm aims to scoop up $250 million in fresh capital, signaling aggressive global ambitions.

Why Florida? Tax breaks, crypto-friendly regulators, and that sweet, sweet proximity to Miami’s ’Bitcoin Beach’ crowd. Because nothing says decentralization like setting up shop next to retired Wall Street bros trading NFTs between mojitos.

This move follows Metaplanet’s recent pivot from legacy consulting to blockchain infrastructure—a reinvention that’s either visionary or desperately opportunistic, depending on which hedge fund manager you ask.

Metaplanet Picks Bitcoin-Friendly Florida

Gerovich said that the firm is keen on establishing its US office in the state of Florida, calling it as a “rapidly emerging” global hub for crypto innovation.

“The reason for choosing Florida is clear,” said Gerovich. “The state is rapidly emerging as a global hub where Bitcoin innovation, corporate adoption, and financial liberalization are accelerating.”

Further, he also noted that the new establishment will help Metaplanet strengthen its strategic position in the US market.

Florida’s Bitcoin Investment Move: What it Means for State

The state of Florida has long positioned itself as a hub for crypto and blockchain innovation, attracting startups and investors.

Last month, the Sunshine State’s House Insurance and Banking Committee passed Bitcoin reserve bill with a unanimous vote. The legislation has three committees to clear before heading to Florida’s House.

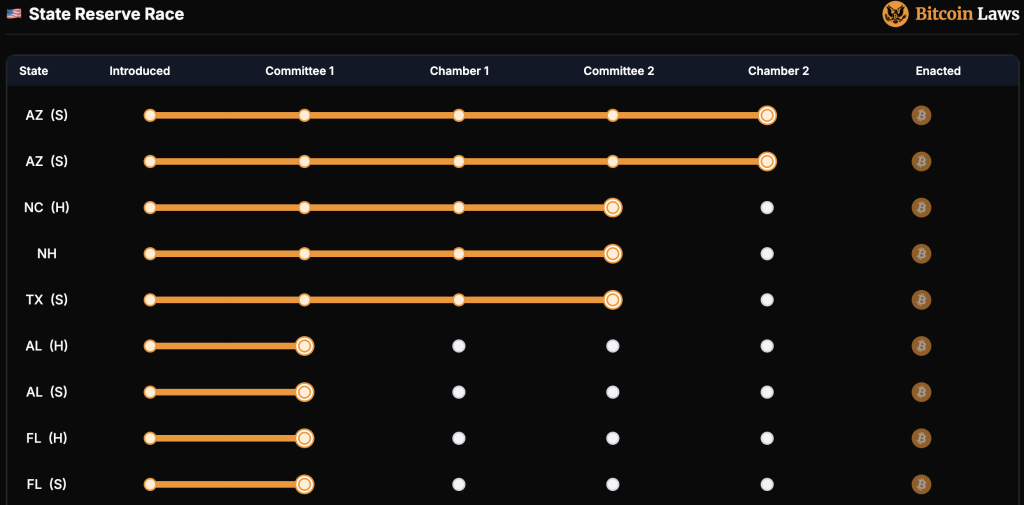

According to Bitcoin Laws data, that tracks the progress of crypto legislation in the US, Florida stands sixth in the race to become the first US state to establish a strategic Bitcoin reserve.

If passed, the bill would have multiple economic impacts, including diversification of state assets and attracting more crypto businesses.

Besides, Jimmy Patronis, the state’s Chief Financial Officer, has already indicated that the state holds approximately $800 million in crypto-related investments. He also proposed to include Bitcoin in state pension funds, calling it “digital gold.”