Robinhood’s Crypto Revenue Explodes 100%—Proving Even Meme-Stock Platforms Can’t Ignore Bitcoin

Q1 earnings just dropped the mic: Robinhood’s crypto division now accounts for a staggering 50% of total revenue growth. Retail traders are back—and this time they’re gambling with digital assets instead of GameStop shares.

The kicker? This surge comes despite the platform’s notorious history of ’protecting’ users from volatile assets by freezing trades. Nothing says financial sovereignty like a broker that flips the off switch during rallies.

With institutional players circling crypto like vultures, Robinhood’s pivot proves one thing—the house always wins, whether you’re trading dogecoins or blue chips.

Robinhood Leans on Crypto Success but Aims to Diversify for Long-Term Stability

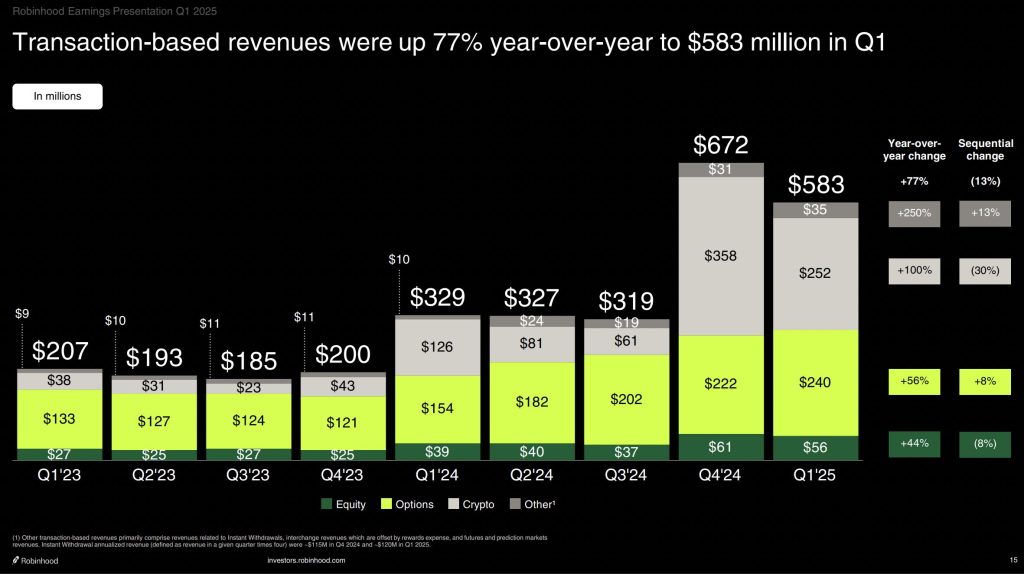

Crypto trading, particularly Bitcoin, was a big driver of growth. Despite market volatility, crypto transactions remained strong, a trend that’s been crucial for Robinhood’s success.

CEO Vlad Tenev said that while the company continues to rely on crypto volumes, it’s working to diversify beyond that. Over time, Robinhood plans to make the crypto side of its business less dependent on transaction volumes.

“We’re focused on diversifying the business outside of crypto,” Tenev said during the earnings call. “This will make us less reliant on crypto transaction volumes in the future.”

Image Source: Robinhood

Strong Performance Across Options, Equities, and Margin Investments Fuel Robinhood’s Q1 Success

But it wasn’t just crypto that fueled Robinhood’s success. The company also saw impressive growth in options and equities trading. Revenue from options jumped 56%, while equities grew by 44%.

Net interest revenue, which mainly comes from margin investing, jumped 14% to $290m. Robinhood’s platform assets ROSE by 70% year-over-year, reaching $221b, with record net deposits of $18b.

Tenev pointed out that customers are not only trading more, but they’re also entrusting Robinhood with more of their assets. The company’s net income for the quarter hit $336m, or 37 cents per share, compared to $157m, or 18 cents per share, last year. Analysts had forecasted a profit of 33 cents per share.

This strong performance came despite the ongoing trade tensions between the US and China, which kept markets on edge. The first quarter was marked by significant swings in both stocks and crypto prices, largely due to President Donald Trump’s trade policies.

While some markets have started to recover from the losses in April, the uncertainty continues, creating opportunities for platforms like Robinhood to succeed in the current volatile environment.