Polygon NFTs Crush Ethereum: $22M Weekly Sales Boom as Real-World Assets Steal Spotlight

Move over, Ethereum—Polygon just lapped you. NFT sales on the scaling network hit $22 million last week, outpacing the former heavyweight as tokenized real estate, carbon credits, and other tangible assets drive demand. Gas fees under a penny don’t hurt either. Yet another ’flippening’ that won’t make ETH maxis lose sleep... until it does.

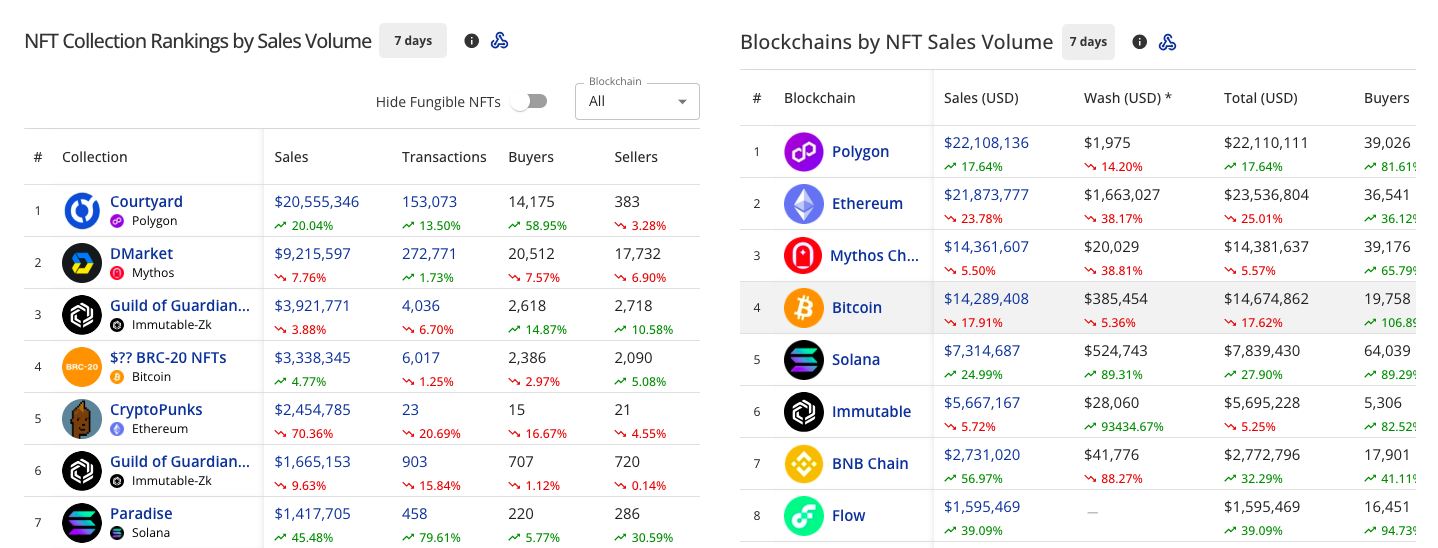

Polygon leads weekly NFT sales volume/ Source: CryptoSlam

Polygon leads weekly NFT sales volume/ Source: CryptoSlam

This surge elevated Polygon’s market share to 24% of global NFT transaction volume from an overall weekly NFT sales total of $92.9 million.

The number of active buyers on Polygon soared by 58.95%, reaching over 14,000 wallets for the week.

RWA-Backed NFTs Turn Polygon Into a Commodities Marketplace

The standout performer behind Polygon’s rise is the Courtyard NFT collection, a real-world asset (RWA) platform that tokenizes physical collectible cards.

.@0xPolygon NFTs led the market last week with $22.3M in sales, up 20%.

They made up 24% of all NFT sales and had over 39K buyers — an 81% jump from the week before.

Ethereum came in second with $19.2M, followed by Mythos and Bitcoin. pic.twitter.com/Pv1YlDz4nX

Courtyard alone clocked $20.7 million in weekly sales, outpacing every other NFT project across all chains.

Data from DappRadar shows over 11,000 Courtyard NFT sales in the past 24 hours, representing 11.39% of all NFT transactions.

Among the most sought-after items in the collection are the 2016 Pokémon Sun & Moon Collection, which sold for 147.9 MATIC, the 2022 Pokémon SWSH Black Star Promo card, and the 1953 Bowman Color #63 Gil McDougald baseball card.

Originally dropped 2017 in the Japan‑only Sun & Moon Alolan Vulpix & Vulpix Poncho‑Pikachu Special Box

Buyback offer = $691. WWYD — sell or hold? pic.twitter.com/eCRryxyY8J

What sets Courtyard apart is its unique real-world asset model.

All collectibles are professionally graded and securely stored in insured vaults managed by Brink’s, the global security company.

Holders of Courtyard NFTs can retain their digital asset or burn the NFT to redeem the physical collectible, introducing a hybrid ownership model that blends the liquidity of Web3 with the trust of tangible items.

Are Physical Assets Giving NFTs New Life?

Launched in 2022 and backed by Y Combinator, Courtyard raised $7 million to reinvent the NFT space.

The platform seeks to bridge traditional collecting and digital trading, offering users a more secure and meaningful experience beyond speculative art trades.

The NFT market’s transformation couldn’t be timelier. Following its 2021 peak, trading activity collapsed—plunging more than 60% by February 2025.

The decline, steady since early 2024, seemed unstoppable. Then came a turning point. In mid-February, the Kanbas Collection made headlines with a $3 million purchase of a unique digital artwork.

This landmark deal didn’t just break the slump. It reignited market confidence, proving serious collectors still see value in premium NFTs.

The artwork came from Sam Spratt, an acclaimed digital artist known for his LUCI series, which debuted on SuperRare in 2021.

Sam Spratt sold his 1-of-1 for $3,000,000 and his 613 editions for $2,190,945, earning more than $5mn this month for his past year’s work.

Even in what has been a very difficult market for digital art.

Extremely impressive and shows that at the high-end there is almost always… pic.twitter.com/qGklbiaYlc

LUCI blends digital paintings with written psalms and has since generated $6.2 million in primary sales across 10 releases.

Spratt’s recent $3 million sale is reportedly the highest NFT sale in the last three years, helping to reignite interest in the digital art scene.

How Regulations and RWAs Are Reshaping the NFT Market

Beyond sales, the on-chain real-world asset market is exploding.

According to CoinMarketCap, the RWA sector has grown by over 28,000% since February 2023, reaching a $42 billion market cap.

Meanwhile, regulatory sentiment has also improved.

On February 21, the U.S. SEC abruptly ended its OpenSea investigation. This surprise decision sent shockwaves through the NFT space, suggesting regulators may be softening their stance.

OpenSea founder Devin Finzer immediately hailed it as a watershed moment.

“This is a major victory for our community,” he declared. The relief was palpable—had the SEC classified NFTs as securities, it could have stalled innovation across the digital collectibles market.