Bitcoin’s Demand Engine Sputters as ETF Tap Runs Dry—642K BTC Momentum Evaporates

The crypto casino’s hottest slot machine—BTC ETF inflows—just coughed up its last coin. Demand tanks as Wall Street’s shiny new toy loses its luster. Guess even digital gold gets dull when the suits stop playing.

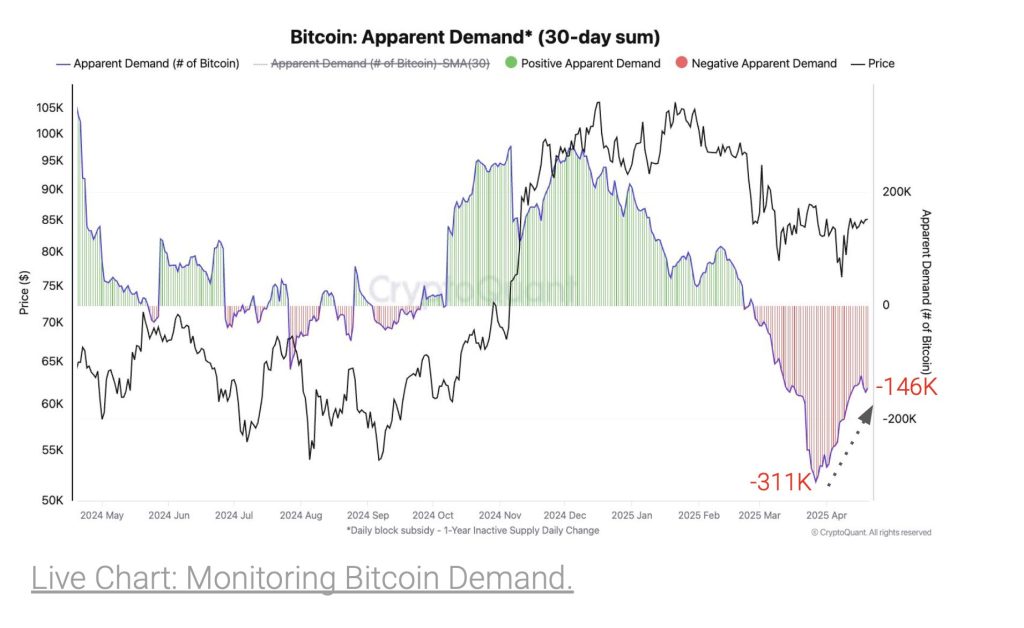

Analysts warn that for Bitcoin to resume a sustainable rally, both demand and momentum must not only stabilize but return to consistent positive growth.

ETF Inflows Flatline Amid Weakened Institutional Interest

Institutional participation through U.S.-based spot Bitcoin ETFs has also plateaued, indicating a broader cooling in appetite.

Since late March, net purchases by these ETFs have fluctuated between -5,000 and +3,000 BTC per day—well below the highs of 8,000+ daily inflows recorded during the bullish surge of November–December 2024.

Comparative data further reveals the scale of this slowdown: U.S. Bitcoin ETFs have sold a net 10,000 BTC so far in 2025. This is in stark contrast to the same period in 2024, when they had purchased a net 208,000 BTC.

Market analysts suggest that increased ETF participation is a key component for reigniting upward price momentum, which remains lacking.

Adding to the caution, large Bitcoin holders have begun to reduce their positions. Their collective holdings have decreased by roughly 30,000 BTC over the past week, and their monthly accumulation rate has dipped from 2.7% in late March to just 0.4%—the slowest pace since February 20.

Liquidity Growth Still Lags Market Needs

While crypto market liquidity is expanding modestly, it’s doing so below trend. USDT market cap, a widely used proxy for crypto liquidity, has grown by $2.9 billion over the last two months.

However, this increase falls short of the $5 billion benchmark typically associated with strong Bitcoin rallies. It also remains below the 30-day moving average, emphasizing ongoing liquidity constraints.

Price-wise, Bitcoin is facing technical resistance around the $91,000–$92,000 range, corresponding with the trader’s on-chain realized price level.

This metric can serve as either support or resistance, depending on market sentiment. For now, prevailing bearish conditions suggest it is acting as a ceiling, further capping upside potential.