Japan’s Bold Move: Strict Bond Standards for Stablecoin Collateral – Can Issuers Clear the High Bar?

Japan's financial regulators just dropped a bombshell on the stablecoin market. The proposed framework demands collateral quality that would make traditional bankers blush—and could separate the real contenders from the pretenders.

The Collateral Conundrum

Forget vague promises and shaky reserves. The draft rules specify bond-backed collateral with stringent credit ratings and liquidity requirements. We're talking government-grade or equivalent—no junk bonds hiding in the shadows. This isn't a suggestion; it's a line in the sand.

Why This Changes Everything

Most stablecoins rely on commercial paper or mixed baskets that wouldn't pass muster here. Japan's approach treats stablecoins like actual financial instruments, not tech experiments. The Financial Services Agency (FSA) clearly remembers past crypto meltdowns and isn't taking chances.

The Issuer Squeeze

Meeting these standards requires deep pockets and serious financial engineering. Smaller players might get squeezed out, while established institutions could gain unfair advantage—because nothing says 'innovation' like regulatory barriers that favor incumbents.

The Global Ripple Effect

Watch other regulators take notes. Japan often sets trends in Asian financial regulation, and this move pressures everyone to raise their game. The era of 'trust us, we have reserves' is ending.

Will this kill innovation or finally give stablecoins the credibility they desperately need? Probably both—welcome to regulated finance, where the rules are written by people who still think blockchain is something you use to secure bicycles.

Deadline Feb 27, 2026.

The message is clear: stablecoins are moving from experiment to regulated money. pic.twitter.com/iUhbGdUlQs — Roxom TV (@RoxomTV) January 27, 2026

Japan Sets 100 trillion Yen As Minimum Bond Collateral

The proposed FSA notice restricts eligible backing assets to foreign bonds that meet dual criteria, favoring only the world’s largest sovereign and corporate issuers.

Qualifying bonds must achieve a credit risk rating ofor higher from designated agencies while originating from entities whose total bond issuance reaches the 100 trillion yen minimum.

Beyond collateral standards, new supervisory guidelines target banks and insurance subsidiaries offering cryptocurrency intermediation services.

Financial institutions must now explicitly warn customers not to underestimate digital asset risks simply because products carry a traditional banking brand.

The FSA also introduced screening requirements for businesses handling foreign stablecoins, demanding confirmation that overseas issuers will not directly solicit Japanese retail customers.

Regulators plan to coordinate cross-border with foreign authorities to monitor these instruments and their originators.

The consultation period runs through, implementing Act No. 66 of 2025 that revised Japan’s settlement and electronic payment framework last June.

After public comments close, the rules will undergo final procedures before taking effect.

Stablecoins Reshape Japan’s $9 Trillion Bond Market

While the FSA tightens oversight, Japan’s emerging stablecoin sector is potentially set to transform the country’s sovereign debt landscape, with implications for the Bank of Japan’s (BOJ) influence over its $9 trillion Japanese government bond (JGB) market.

JPYC, the Tokyo-based issuer of Japan’s first yen-pegged stablecoin, suggests that digital asset companies could become significant holders of government bonds as reserve requirements expand.

The company launched its yen-backed stablecoin on October 27 under Japan’s revised Payment Services Act, marking the nation’s inaugural legal framework for stablecoins.

Founder and CEO Noritaka Okabe told Reuters that stablecoin issuers might assume roles traditionally occupied by the BOJ, which has been reducing bond purchases following years of aggressive monetary easing.

“With the BOJ tapering bond buying, stablecoin issuers could emerge as the biggest holders of JGBs in the next few years,” Okabe stated, adding that while authorities could influence bond duration, controlling total holdings WOULD prove challenging.

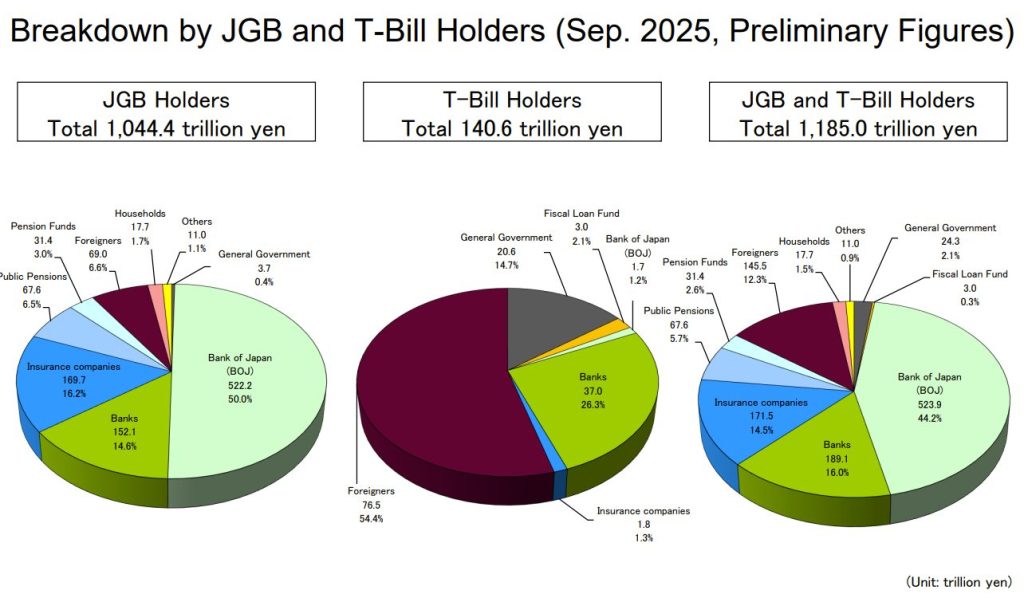

Currently, the BOJ dominates Japan’s JGB market, holding, followed by insurance companies and domestic banks. Foreign investors and public pensions represent smaller market shares.

Okabe proposed that stablecoin issuers could fill emerging gaps, with JPYC planning to allocate 80% of proceeds to JGBs and 20% to bank deposits.

Major Banks Unite for Yen Stablecoin Initiative

Despite strict regulations, Japan’s three largest financial institutions, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group, are collaborating on a joint initiative to launch yen-backed stablecoins for domestic users.

The banking trio intends to promote settlements using pegged cryptocurrencies, challenging the market dominance of dollar-denominated stablecoins like USDT and USDC.

According to Nikkei, the banks will establish infrastructure enabling corporate clients to transfer stablecoins between entities in accordance with standardized protocols, initially focusing on yen-pegged tokens, with potential dollar-pegged versions planned for future deployment.

![]() Japan’s Nomura Holdings and SBI Holdings are developing the first crypto ETF products, awaiting approval for listing on the Tokyo Stock Exchange. #JapanCryptoETF #NomuraHoldings #SBIHoldingshttps://t.co/zT14u2QbqK

Japan’s Nomura Holdings and SBI Holdings are developing the first crypto ETF products, awaiting approval for listing on the Tokyo Stock Exchange. #JapanCryptoETF #NomuraHoldings #SBIHoldingshttps://t.co/zT14u2QbqK

These developments align with Japan’s broader digital finance transformation, as cashless payment adoption surged to 42.8% in 2024 from just 13.2% in 2010.

Reports also indicate that Japan’s financial watchdog is considering allowing banks to purchase and hold digital assets such as bitcoin for investment purposes before 2028.