Australia’s Crypto Regulation Gaps Emerge as 2026’s Top Financial Risk – What’s the Next Move?

Australia just slapped a 'high risk' label on its own crypto regulatory framework—and the clock is ticking toward 2026. What happens when a G20 nation admits its rulebook has more holes than Swiss cheese?

The Regulatory Void

No comprehensive licensing regime. No clear custody rules. No harmonized consumer protections across states. Australia's Treasury flagged these gaps as systemic vulnerabilities that could let bad actors waltz through the front door. Traditional finance has guardrails; crypto's playing field still looks like the Wild West.

Why 2026 Matters

That's the deadline Australia set for itself to either build a coherent framework or watch institutional capital flee to clearer jurisdictions. Singapore's MAS and the EU's MiCA are already eating their lunch. Delay means losing the Asia-Pacific innovation race—and potentially triggering a regulatory arbitrage free-for-all.

The Institutional Stalemate

Banks and asset managers are stuck in limbo. They can't deploy at scale without compliance certainty, while DeFi protocols operate in gray zones. This creates a perverse incentive: regulated entities hesitate, while unregulated projects capture market share. It's the financial equivalent of watching from the sidelines while someone else plays your game.

The Political Calculus

Election cycles clash with regulatory timelines. Politicians want headlines about 'cracking down' or 'embracing innovation'—not the boring details of cross-border settlement rules. Meanwhile, the Australian Securities and Investments Commission (ASIC) stretches existing laws to cover crypto assets they were never designed to handle.

What Actually Comes Next?

Three likely scenarios emerge: a rushed patchwork of state-level regulations that create compliance nightmares, a copy-paste of EU-style rules that ignore local market nuances, or—most cynically—another round of consultations that kick the can past 2026. The smart money's betting on option three, because why solve today what you can study tomorrow?

Australia's warning isn't just bureaucratic noise—it's a distress signal from a system playing catch-up. Get the regulations right, and Sydney could challenge Singapore as Asia's crypto hub. Get them wrong, and watch billions flow to jurisdictions that actually understand how digital assets work. The gap between regulatory ambition and execution remains crypto's favorite punchline—right after 'stable' coins that aren't.

Regulatory Perimeter Creates Enforcement Challenges

ASIC’s Key Issues Outlook 2026, released Tuesday, highlighted that rapid innovation by participants unfamiliar with financial services rules continues creating risks across the crypto sector.

The regulator noted that while some businesses currently operate legitimately outside existing frameworks, determining whether new product classes or services should fall within licensing regimes ultimately rests with the government.

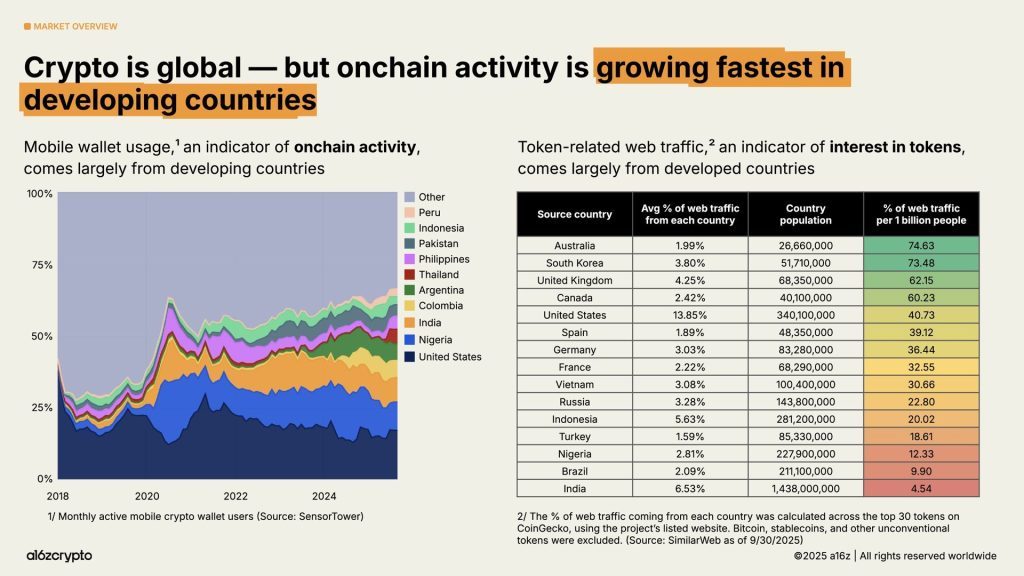

The warning arrives as Australia’s crypto adoption rate reached 31% in 2025, up from 28% the previous year, placing the nation among the world’s most crypto-engaged populations.

Self-managed superannuation funds have increased their crypto exposure sevenfold since 2021 to A$1.7 billion, while major exchanges, including Coinbase, prepare dedicated pension account services targeting the country’s retirement pool.

Despite this growth, regulatory fragmentation persists.

ASIC Chair Joe Longo warned in November that Australia risks becoming a “” unless it adapts to blockchain-driven tokenization that reshapes global markets.

“Australia must innovate or stagnate. Seize the opportunity or be left behind,” Longo said at the National Press Club, noting that J.P. Morgan told him their money market funds will be entirely tokenized within two years.

Government Advances Comprehensive Licensing Framework

Parliament is currently debating the Corporations Amendment (Digital Assets Framework) Bill 2025, introduced last November by Treasurer Jim Chalmers and Financial Services Minister Daniel Mulino.

The legislation WOULD require crypto exchanges and custody providers to obtain Australian Financial Services Licenses, bringing them under ASIC supervision, with potential penalties of up to 10% of annual turnover for rule breaches.

The bill creates two new license categories for digital asset platforms and tokenized custody platforms, focusing regulation on companies that control customer funds rather than on underlying technology.

Licensed firms must comply with ASIC standards for transactions, settlement processes, and asset custody, while small operators handling less than A$10 million annually would be exempt.

![]() Australia has introduced its first full regulatory framework for crypto custody and exchange platforms that promises tougher oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I

Australia has introduced its first full regulatory framework for crypto custody and exchange platforms that promises tougher oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I

Mulino said the reforms target companies controlling customer assets and warned that “it’s currently possible for a company to hold an unlimited amount of client crypto without any financial law safeguards.“

The government projects the framework could unlock A$24 billion in annual productivity gains while strengthening investor protections.

Temporary Relief Bridges Regulatory Transition Period

While permanent legislation advances, ASIC has introduced temporary exemptions easing compliance burdens during the transition.

The regulator finalized class relief in December, allowing intermediaries to distribute certain stablecoins and wrapped tokens without separate licenses until mid-2028, provided they maintain proper records and offer Product Disclosure Statements to retail investors.

The relief extends to omnibus custody structures, widely adopted across traditional markets but previously restricted in crypto.

ASIC positioned the temporary measures as supporting responsible innovation while awaiting broader digital asset reforms addressing tokenized payments and custody frameworks.

![]() ASIC has removed separate licensing requirements for intermediaries distributing stablecoins and wrapped tokens.#Australia #Cryptohttps://t.co/f3qXjkjyym

ASIC has removed separate licensing requirements for intermediaries distributing stablecoins and wrapped tokens.#Australia #Cryptohttps://t.co/f3qXjkjyym

The regulator also adopted a sector-wide no-action stance until June 2026, giving companies time to review updated guidance, lodge license applications, or adjust operations.

ASIC’s INFO 225 guidance confirmed that many stablecoins, wrapped tokens, tokenized securities, and digital asset wallets fall under existing financial product rules requiring AFS licenses.

Beyond digital assets, ASIC flagged nine other critical risks for 2026, including increased retail exposure to private credit markets, operational failures by superannuation trustees, cyber-attacks undermining market confidence, and potential CHESS infrastructure outages.

The regulator emphasized that global regulatory divergence is creating growing fragmentation that complicates compliance and risks uneven consumer protections across jurisdictions.

For now, Australia’s regulatory push aims to catch up with global competitors while addressing vulnerabilities that have left investors exposed to fraud, operational failures, and unclear legal protections.