Gold Shatters $5,100 Barrier Amid Trump Tariff Fears; Ethereum Stumbles Below $2,900

Traditional safe havens roar while crypto wobbles. Gold just blasted through a historic ceiling, fueled by geopolitical jitters and the specter of new trade wars. Meanwhile, Ethereum—the backbone of the decentralized web—finds itself grappling with gravity south of a key psychological level.

The Great Unhedge

Institutional money is scrambling. The old playbook says buy gold when political winds shift. The price surge past $5,100 isn't just a number—it's a massive vote of no-confidence in 'business as usual.' Capital is seeking a tangible escape hatch, a trend that's been building as digital and traditional assets increasingly dance to different tunes.

Ethereum's Pressure Test

Over in digital asset land, Ethereum's slide under $2,900 paints a contrasting picture. It's a reminder that crypto markets, for all their future promise, still wrestle with present-day sentiment and liquidity flows. The network continues to hum with activity, but its native token is taking the heat—classic case of the product outperforming the stock, a familiar tune for tech investors.

Diverging Destinies?

One market is pricing in fear of the old system. The other is digesting the growing pains of the new one. This isn't a simple risk-on/risk-off story. It's a narrative of asset classes beginning to fundamentally decouple, driven by different catalysts and investor bases. Gold's rally is a hedge against political volatility. Ethereum's current price action reflects the volatile birth pangs of a new financial layer.

So, while gold bugs celebrate a record high fueled by the very chaos they predict, crypto builders keep their heads down and code. After all, in the long run, protocol adoption trumps daily price quotes—a concept as foreign to traditional finance as a balanced budget. The real story isn't today's prices, but which store of value narrative wins the next decade.

The $5K Race Ends

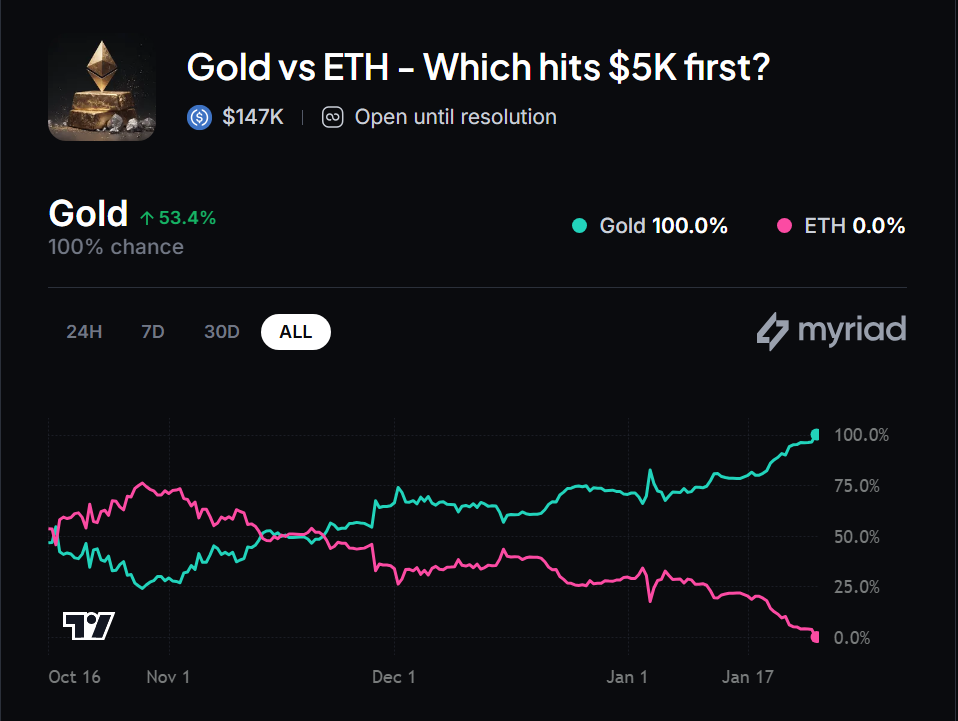

The “Gold versus ETH: Which hits $5K first?” market on Myriad has reached a resolution, with gold hitting the $5k mark first. The precious metal jumped 7.28% on the week and was recently priced at $4,938 before Monday’s breakout.

While gold is typically compared to Bitcoin, predictors on Myriad favored ETH for months, betting on its volatile upward mobility, but they’ve become less confident as crypto markets slide. The prediction market opened in October 2025.

Institutional Flows Tell the Story

Western ETF holdings have climbed by about 500 tonnes since the start of 2025. Goldman Sachs lifted its December 2026 gold price forecast to $5,400 an ounce, up from $4,900, arguing that hedges against global macro and policy risks have become “sticky.”

Central bank purchases remain robust as Goldman estimates central-bank purchases are averaging around 60 tonnes a month, far above the pre-2022 average of 17 tonnes.

“While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted,” Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan, stated. “The long-term trend of official reserve and investor diversification into gold has further to run.”

Ethereum saw $630 million in outflows last week, reflecting bearish sentiment as investors withdraw funds. A whale that had been dormant for nine years transferred 50,000 ETH, worth $145 million, to a Gemini wallet, a MOVE often associated with liquidation intent.

According to @EmberCN monitoring, a dormant 9-year ETH whale address activated in the last 12 hours, transferring 50,000 ETH (worth $145 million) to Gemini exchange. The address withdrew 135,000 ETH ($12.17 million) from Bitfinex 9 years ago when ETH was priced ~$90, representing… pic.twitter.com/akGYWcKoVC

— Wu Blockchain (@WuBlockchain) January 26, 2026Geopolitical Catalyst

The precious metal’s surge comes as flashpoints from Greenland and Venezuela to the Middle East reflect higher geopolitical risk. Trump’s tariff threat follows tensions that mounted after Canadian Prime Minister Mark Carney delivered an address at the World Economic Forum in Davos that was widely seen as a rebuke of the Trump administration’s policies.

Earlier this month, Carney announced that Canada and China reached a preliminary deal to remove trade barriers. Under the tentative agreement, Beijing cut tariffs on some Canadian agricultural products, while Ottawa increased quotas for imports of Chinese electric vehicles.

Canadian Prime Minister Mark Carney said on Sunday that Ottawa has no plans to pursue a free trade deal with China, noting that the recent agreement only reduces tariffs on select sectors. Carney’s remarks came a day after President Trump threatened a 100% tariff on Canadian goods.

What Desks Are Watching

The gold-crypto divergence indicates a broader risk recalibration. Following a record-breaking 2025, gold entered 2026 with momentum intact as geopolitical tensions, falling real interest rates, and efforts by investors and central banks to diversify away from the dollar reinforce its safe-haven role.

ETH failed to reclaim its “digital gold” narrative during peak macro stress. Analysts note that if ETH maintains support around the $2,500 level, it could reach an all-time high of $6,000 by 2026, but that thesis requires risk appetite to return. In August 2025, Trump raised the tariff on Canadian goods to 35%. A 100% tariff threat marks a major escalation.

Markets are pricing in two interest-rate cuts by the Federal Reserve later this year. Traders await this week’s FOMC meeting, where the central bank is widely expected to hold rates steady.