Solana Price Prediction: 200+ U.S. Stocks Just Landed on SOL – Is This the Most Bullish News of the Year?

More than 200 traditional U.S. equities just got a Solana address. The blockchain's rails are now carrying fractionalized stock tokens—a direct bridge between Wall Street and Web3 that bypasses decades of financial gatekeeping.

The Tokenization Tidal Wave

Forget slow-moving ETFs and brokerage approvals. This integration slashes settlement times from days to seconds and opens 24/7 global trading. It's not a future promise—it's live infrastructure. Suddenly, your stock portfolio and your SOL exist in the same digital wallet.

Why This Isn't Just Another Partnership

Scale matters. Two hundred-plus stocks represent a critical mass of traditional market value, not a niche experiment. It validates Solana's throughput and low fees as viable for serious capital—not just memecoin rallies. The network handles the load while legacy finance still debates blockchain use cases in committee meetings.

The Liquidity Engine Ignites

Every tokenized stock becomes a potential trading pair against SOL, creating new liquidity pools and arbitrage opportunities. It pulls institutional capital onto the chain, capital that looks for yield beyond stagnant traditional finance products. Watch for treasury departments to wake up—slowly—to on-chain yields that outpace their beloved bond portfolios.

A Cynical Footnote from Finance

Let's be real: Wall Street adopts innovation only when it can't ignore the fees it's missing. This move reeks of defensive strategy—getting ahead of the disruption that's already eating their lunch. They'll call it 'innovation' while quietly sweating over their legacy revenue streams.

Bottom line: This isn't just bullish news for Solana's price. It's a structural shift. The line between crypto and traditional assets just blurred beyond recognition. The real question isn't if SOL reacts—it's how fast the rest of finance scrambles to catch up.

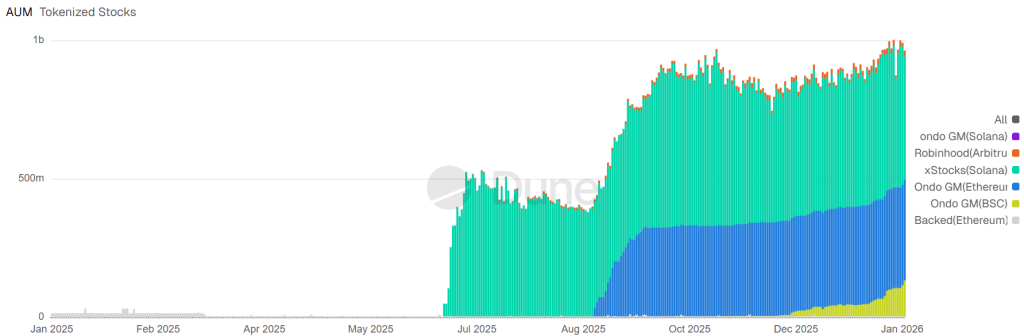

Tokenised Stock assets under managment (AUM) by platform ($). Source: Dune Analytics.

Tokenised Stock assets under managment (AUM) by platform ($). Source: Dune Analytics.

Until now, however, growth has been constrained by limited liquidity depth and asset selection.

That ceiling may be lifting. With regulation pushing tokenization deeper into the mainstream, even a small fraction of the U.S. stock market’s massive trading volume could send SOL significantly higher.

Solana Price Prediction: Could Ondo Help Fuel a SOL Surge?

As the bull market matures, sticky adoption of RWAs could bring the demand Solana needs to finally realise a year-long descending channel.

Momentum indicators suggest the shift may already be underway, with a potential higher low setting focus on a breakout attempt.

The RSI has once again affirmed its uptrend with another higher low after falling below the 50 neutral line, a sign of strength beneath the surface.

The MACD shows a potential trend shift, levelling off below the signal line around bottoms that previously marked the end of consolidation within the structure.

The recent bounce from the patterns $120 support could be the last, but the resistance that has capped upside since September at $145 will be the key proving grounds.

From there, the key breakout threshold sits at $210.

And with that level confirmed as support, a breakout push eyes past all-time highs at $300 for ainto new price discovery.

However, as Solana permeates deeper into the mainstream TradFi markets and infrastructure, fresh liquidity and use cases could send the altcoin much higher, eying a.

Bitcoin Hyper: Don’t Back Solana Until You’ve Seen This

Those who chose Solana over the leading cryptocurrency may soon need to reconsider, as the bitcoin ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Whatever Solana can do, Bitcoin can now do – top-performing narratives like DeFi and real-world assets could be Bitcoin’s for the taking.

The project has already raised almost $31 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here