SEC Crypto Crackdown Plummets 60% Under Trump Appointee Paul Atkins - A New Era for Digital Assets?

Regulatory winds are shifting—and crypto is catching the breeze.

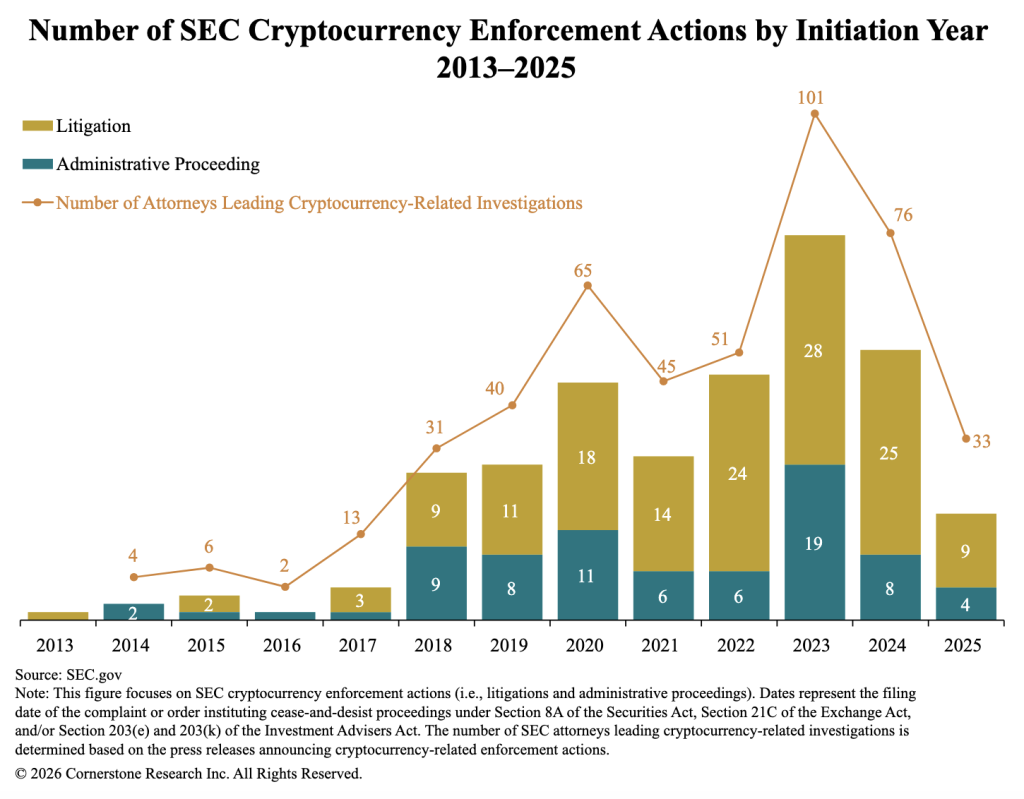

The Securities and Exchange Commission's aggressive stance toward digital assets has undergone a dramatic reversal. Enforcement actions have dropped by a staggering 60% since Paul Atkins, a former SEC commissioner appointed during the Trump administration, assumed a key advisory role. The slowdown isn't subtle; it's a seismic policy pivot.

The Enforcement Cliff

Gone are the days of blanket Wells notices and high-profile lawsuits launched like clockwork. The current climate feels less like a crackdown and more like a cautious reassessment. Legal teams across the industry are reporting fewer inbound inquiries, and settlement talks have taken on a distinctly different tone. The message from the top appears to favor clarity over confrontation.

Atkins' Philosophy in Action

This isn't an accident. Atkins has long been a vocal critic of what he calls 'regulation by enforcement'—a strategy he views as inefficient and unfair to innovators. His influence seems to be steering the agency toward a more principles-based framework, prioritizing formal guidance that companies can actually follow. It’s a move that bypasses the legal quagmire and aims for sustainable rules of the road. Some on Wall Street call it common sense; others whisper it's a calculated political gift to a booming sector.

The Market Responds

Unsurprisingly, the regulatory thaw is being felt on the charts. Venture capital, which had grown skittish, is tentatively returning to the space. Developers are breathing a sigh of relief, focusing on build rather than legal defense. The change underscores a brutal truth in fintech: innovation flows where friction is lowest. A 60% reduction in regulatory headwinds isn't just a statistic—it's rocket fuel for growth, proving once again that in finance, the most powerful force isn't a bull market; it's a friendly regulator.

So, is this the dawn of a pragmatic partnership between crypto and its overseers? Or just a temporary lull before the next political storm? The data suggests a profound change is already underway. The SEC hasn't gone soft—it's just finally learning that you can't litigate a trillion-dollar industry into a shape you prefer. Sometimes, you have to let the market build it first. Even the suits are figuring that out.

Image Source: Cornerstone Research

Fewer Cases, But A Sharper Focus Under Atkins

With the SEC focusing new crypto cases on fraud, the focus has shifted away from broad registration theories and toward cases built around clear investor harm that are easier to argue in court.

The same report also found 29 crypto-related actions were resolved in 2025, including seven that the SEC dismissed under Atkins.

Meanwhile, total monetary penalties imposed against digital asset market participants came to $142M in 2025, which Cornerstone said was less than 3% of the penalties imposed in 2024.

SEC Focus Turns To Frameworks Beyond Courtrooms

“Enforcement actions under Chair Atkins reflect a shift in the SEC’s approach to digital-asset oversight, consistent with the priorities laid out in early 2025,” said Robert Letson, a principal at Cornerstone Research.

“Digital asset regulation continues to evolve and is something we will be watching closely in 2026.”

Atkins took office in April 2025 after a brief period with an acting chair, and legal observers have tracked a broader reset in tone across the agency since the leadership change.

If the SEC keeps prioritizing cases it can frame as fraud, the next phase of US crypto oversight may hinge less on surprise lawsuits and more on what rulemaking, guidance, or negotiated standards the commission chooses to put on the table in 2026.