XRP Price Prediction 2026: Accumulation Breakout Nears as $1.85 Holds Firm – Are Bulls Targeting $4 Next?

XRP flirts with a critical technical threshold. The $1.85 support level isn't just holding—it's becoming a launchpad. Traders are watching for the signal that could ignite the next major leg up.

The Accumulation Phase

Charts show a textbook consolidation pattern. Price action has been coiling, compressing volatility, and building energy. This isn't stagnation; it's accumulation. Smart money positions itself before the crowd rushes in.

Breaking the Pattern

A decisive close above the current range's upper boundary triggers the breakout. That's the technical green light. Momentum indicators are primed to flip from neutral to bullish, confirming the shift from accumulation to distribution—to the sellers' detriment.

The $4 Target: Ambitious or Inevitable?

The path to $4 requires sustained buying pressure. It's a multi-resistance journey, not a single leap. Each previous high becomes a new test. But in crypto, once a key level breaks, the move can be explosive—often leaving traditional finance analysts scrambling to update their models days too late.

Risks in the Rearview

Of course, failure to hold $1.85 invalidates the setup. A breakdown here would see the chart revisit lower supports, forcing a narrative rewrite. It's the perpetual dance between breakout and fakeout. Remember, for every 'parabolic' call, there's a chart that just wanted to retest the lows—usually right after you've finished your celebratory tweet.

The bottom line? The setup is there. The levels are clear. Now, the market decides if this is the real deal or just another tease in an asset class that treats patience as both a virtue and a punishment.

Ripple’s President Says 2026 Set to Be XRP’s Breakthrough Year

Ripple President Monica Long recently predicted 2026 is set to be XRP’s big year as real utility sees banks, corporates, and providers pilot stablecoins like RLUSD, on-chain assets, crypto custody, and broader institutional investment.

After one of crypto’s most exciting years (and Ripple’s), the industry is entering its production era. In 2026 we’ll see the institutionalization of crypto — trusted infrastructure and real utility will push banks, corporates, and providers from pilots to scale — across…

— Monica Long (@MonicaLongSF) January 20, 2026“Crypto is no longer speculative—it’s becoming the operating LAYER of modern finance,” Long stated.

She projected that this year, approximately 50% of Fortune 500 companies will have crypto exposure or formalized Digital Asset Treasury (DAT) strategies, actively holding tokenized assets, on-chain T-bills, stablecoins, and programmable financial instruments.

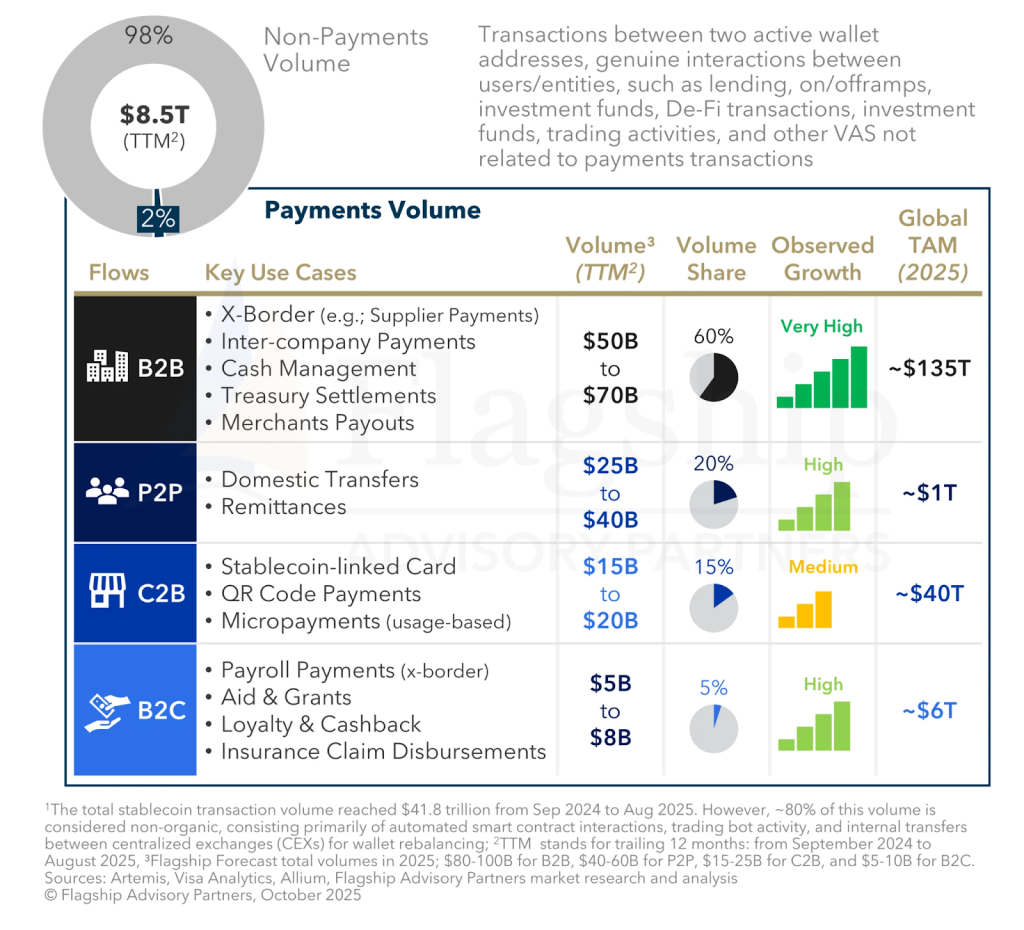

Research shows that last year, B2B payments became the largest real-world use case for stablecoins, reaching an annualized run-rate of $76 billion. That’s a dramatic jump from early 2023, when monthly B2B stablecoin transfers sat below $100 million.

According to Long, the opportunity with XRP and crypto generally goes far beyond faster settlement. Companies are sitting on unprecedented amounts of trapped working capital, over $700 billion sitting idle on S&P 1500 balance sheets alone, and more than €1.3 trillion across Europe.

“By the end of 2026, balance sheets will hold over $1 trillion in digital assets, and roughly half of Fortune 500 companies will have formalized digital asset strategies,” Long concluded.

Similarly, according to observations shared by crypto analyst Paul Bennett, while “weak hands” are panic-selling, the XRP Ledger (XRPL) is signaling “bull market.”

Activity on the XRP blockchain just hit a massive 24-hour peak of 1.59 million transactions.

Although XRP’s price recently dipped 13% following geopolitical tensions that sent retail into “,” historically, when activity stays high while price drops, it’s a coiled spring ready for an impulsive reversal.

XRP Price Prediction: Daily Chart Shows Constructive Retest

The daily XRP/USD chart shows price previously respected a well-defined descending trendline, then broke above it with a strong impulsive move, signaling a momentum shift.

The subsequent pullback has behaved constructively thus far, with XRP retesting the former breakout zone NEAR the $1.90-$2.00 area and holding above it, suggesting buyers are still defending this level rather than capitulating.

However, the chart also makes clear upside is not yet free. Multiple supply zones are stacked above price, particularly between roughly $2.30 and $2.70, where prior breakdowns and aggressive selling occurred.

These zones represent areas where rallies are likely to face selling pressure and potential rejection.

From here, provided XRP continues holding above the retest area near $1.90-$2.00, the structure favors a gradual push higher, with a likely attempt to revisit the $2.30-$2.40 resistance first.

A clean daily close above that zone WOULD strengthen the bullish case and open the door to higher resistance near the mid-$2.60s.

Maxi Doge Presale Offers Investors 70% APY Ahead of XRP Rally

If XRP reclaims $3.00 and resumes a bullish trajectory, presale projects like Maxi DOGE (MAXI) would attract capital from investors pursuing high ROI opportunities.

Maxi Doge is an early-stage memecoin following the Dogecoin playbook, which helped it surge over 10x during the 2023-2024 breakout.

MAXI presale has raised over $4.5million and offers 70% annual staking rewards for early participants at the current $0.000278 price.

The presale has established an alpha channel to help traders share trade ideas, mirroring early dogecoin days.

To buy early, visit the official Maxi Doge website and connect a crypto wallet like Best Wallet.

You can pay with USDT, ETH, or use a bank card immediately.

Visit the Official Maxi Doge Website Here