Bitcoin’s On-Chain Profit Dynamics Flip Negative as Loss Realization Phase Kicks In: CryptoQuant Report

Bitcoin's on-chain profit dynamics just flipped negative—and the market's entering what analysts call the 'loss realization phase.'

What the Flip Means

For months, the network's aggregate profit metric—a key on-chain health indicator—stayed in the green. Now, it's dipped below the zero line. That's the signal. More coins are being spent at a loss than at a profit across the entire blockchain. It's a psychological shift, a collective sigh from the market as short-term holders start to capitulate.

The Realization Phase Begins

This isn't just a data point; it's a behavioral trigger. When profit turns to loss on-chain, holders face a choice: sell and realize that loss, or hold and hope. This phase often flushes out weak hands, transferring coins to more conviction-driven buyers at lower prices. It's a necessary, if painful, cleansing—the kind Wall Street analysts would charge a fortune to overcomplicate in a 50-page report.

Market Mechanics in Motion

The process is brutal but efficient. Selling pressure mounts from those cutting losses. This can suppress prices in the near term, creating what long-term bulls see as a prime accumulation zone. It's the old game: fear transfers assets from impatient hands to patient ones. The blockchain ledger doesn't lie—it just shows the money moving from the nervous to the steadfast.

Looking Beyond the Red

History suggests these phases don't last forever. They're a feature, not a bug, of Bitcoin's volatile cycles. Each major drawdown has preceded a new paradigm of adoption and price discovery. So while the on-chain numbers print red today, the infrastructure being built—the real, boring stuff like settlements and custody—keeps growing. The market might be realizing losses, but the network's realizing its potential. Funny how that works.

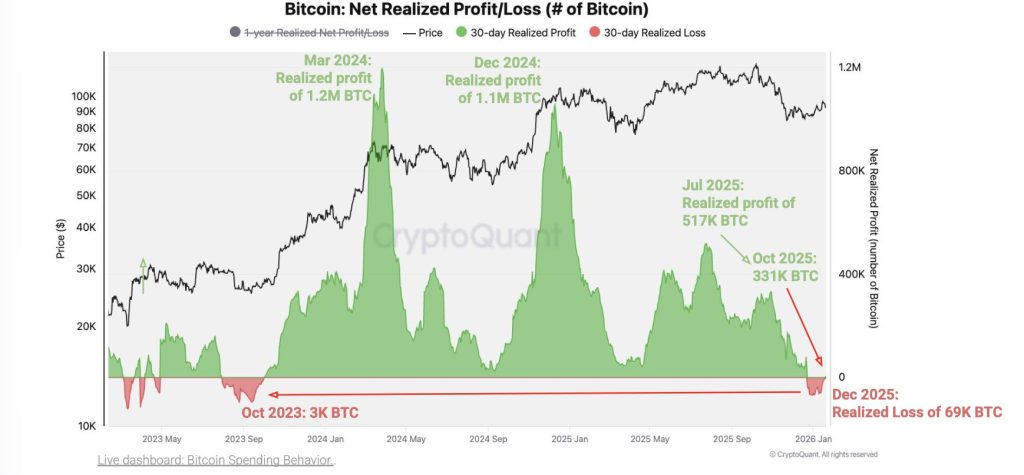

Realized Profit Momentum Has Been Deteriorating Since 2024

CryptoQuant data shows that realized profit momentum has been declining steadily since early 2024. Rather than a single breakdown the market has formed a series of lower realized-profit peaks—first in January 2024, followed by December 2024, July 2025 and then October 2025.

The pattern also suggests that each rally has generated less profit-taking than the previous one, even when spot prices appeared resilient. On-chain this is often interpreted as a sign of diminishing demand strength where buyers are increasingly unwilling to absorb supply at higher prices.

Parallels With the 2021–2022 Market Transition

The current on-chain structure closely resembles Bitcoin’s 2021–2022 bull-to-bear transition, CryptoQuant notes. During that cycle realized profits peaked in January 2021 and gradually formed lower highs throughout the year before flipping into net losses ahead of the 2022 bear market.

This loss realization phase has coincided with a prolonged downturn as sentiment shifted from Optimism to capital preservation. While history does not repeat exactly CryptoQuant analysts highlight the similarity as a cautionary sign rather than a definitive forecast.

Annual Profits Compress to Bear-Market Levels

Another key indicator is the sharp compression in annual net realized profits. CryptoQuant reports that annual realized profits have fallen to approximately 2.5 million BTC down from around 4.4 million BTC in October. These levels are comparable to March 2022, a period widely viewed as early-stage bear market territory.

Such compression implies fewer coins are being sold at a profit across the network, reinforcing the view that Bitcoin’s on-chain profit dynamics are no longer consistent with a strong bull market environment.

What the Shift Means for the Market

While net realized losses alone do not guarantee an immediate price decline, CryptoQuant emphasizes that prolonged loss realization phases typically align with weaker sentiment and reduced speculative appetite.

If this trend persists bitcoin may face a period where rallies are sold into and downside volatility becomes more pronounced, reflecting a market adjusting to lower expectations.