Billionaire Michael Saylor Hints at More Bitcoin Buying in Mid-Week Post

Michael Saylor just dropped another crypto breadcrumb—and the market's watching his wallet.

The MicroStrategy founder's latest social media post reads like a shopping list for digital gold. No explicit numbers, no dollar figures—just the kind of strategic ambiguity that sends Bitcoin maximalists into a frenzy.

Reading Between the Tweets

Saylor's communication style has become a market signal in itself. A cryptic quote, a Bitcoin symbol, a timestamp during trading hours—each element gets parsed by algorithms and analysts hunting for the next big move. His company already holds a treasury-sized stash, making any hint of accumulation a headline event.

The Institutional Follow-Through

When Saylor speaks, corporate treasuries listen. His playbook—treating Bitcoin as the primary reserve asset—has moved from fringe theory to boardroom discussion. Every hint of further buying reinforces the narrative that traditional finance's old guards are playing catch-up.

Timing Is Everything

A mid-week announcement isn't casual. It lands after morning volatility settles and before end-of-week profit-taking—prime positioning for maximum market impact. The message arrives without fanfare but carries the weight of billions in previous convictions.

The real question isn't if he'll buy more, but when. And for traditional finance? They're still debating the color of the boardroom chairs while Saylor's building a vault in cyberspace.

Latest Purchase Expands Strategy’s Bitcoin War Chest

The acquisition disclosed on January 20 was funded through proceeds from Strategy’s at-the-market equity and preferred stock sales conducted between January 12 and January 19.

The approach mirrors the company’s prior capital-raising playbook, which has repeatedly converted equity issuance into Bitcoin exposure during periods of market consolidation.

As of January 19, Strategy holds 709,715 bitcoin acquired for approximately $53.92 billion at an average price of $75,979 per BTC.

Bitcoin Price Action Shows Consolidation

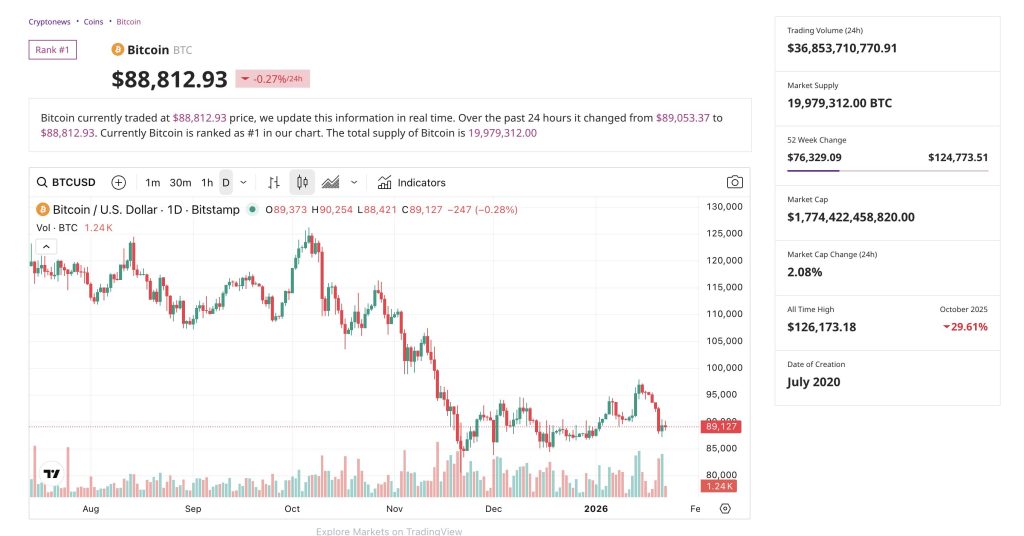

Bitcoin is trading around $88,800 on Thursday, down roughly 0.3% over the past 24 hours, according to CryptoNews data. The asset has retreated from recent highs above $95,000 and remains well below its October 2025 all-time high NEAR $126,000.

Recent price action shows bitcoin moving within a broad consolidation range, with buyers stepping in near the $85,000–$90,000 zone while upside momentum has stalled below $100,000.

Trading volumes have moderated, suggesting market participants are waiting for fresh catalysts amid tightening financial conditions and shifting macro expectations.

Despite the pullback bitcoin remains up on a year-over-year basis with its market capitalisation hovering near $1.77 trillion highlighting its position as the largest digital asset by a wide margin.

Markets convulsed after President Donald TRUMP threatened steep tariffs on eight European nations unless Denmark cedes Greenland, with rhetoric including hints the U.S. might seize the territory by force, triggering a global risk-off move on January 20.

Gold surged to record highs while Bitcoin plunged into the low-$90K range, with some intraday trades dipping as low as $87K.

Strategy’s Long-Term Conviction Remains Intact

Saylor has framed bitcoin as a long-duration treasury reserve asset rather than a short-term trade. Strategy’s accumulation pace has shown little sensitivity to near-term volatility with purchases continuing across both rising and falling markets.

The latest X post and buy earlier this week shows the company’s view that periods of consolidation represent accumulation opportunities rather than signals of weakness.

While the strategy has drawn both praise and criticism from market observers, Saylor has repeatedly argued that bitcoin’s long-term scarcity and monetary properties outweigh interim drawdowns.