Bitcoin Braces for Potential Plunge Below $88,000 - What’s Next for the King of Crypto?

Bitcoin's throne looks shaky. The flagship cryptocurrency is teetering on the edge of a critical support level, with market whispers growing louder about a potential descent below the $88,000 mark. This isn't just a dip—it's a test of conviction for the entire digital asset ecosystem.

The Pressure Cooker

Volatility is the name of the game, but this feels different. A confluence of macro pressures and sector-specific tremors is shaking the foundation. While traditional finance pundits clutch their pearls over every swing, seasoned crypto natives see this as another chapter in the asset's volatile—and ultimately upward—trajectory. Remember when a 10% drop was a crisis? Now it's Tuesday.

Navigating the Storm

Smart money isn't panicking; it's positioning. These moments separate the tourists from the residents. The underlying thesis—digital scarcity, decentralized infrastructure, a hedge against monetary debasement—hasn't changed. If anything, a healthy correction flushes out leverage and sets the stage for the next leg up. The real risk isn't a price drop; it's being on the sidelines when the music starts again.

The market giveth, and the market taketh away—usually right after you've finished explaining your genius investment strategy at a dinner party.

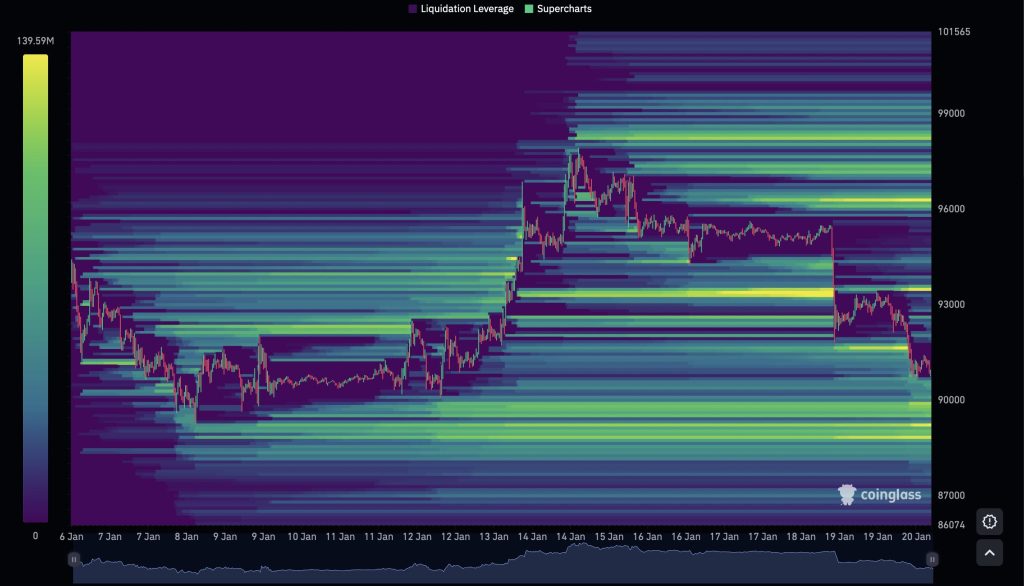

Source: CoinGlass

Source: CoinGlass

Where Is Bitcoin Price Bottom?

Some analysts believe Bitcoin’s local trend has turned bearish. Even so, many of them still expect BTC to recover and move higher later on. The main disagreement is how deep the pullback could go.

Bitcoin’s 2025 rally started NEAR the $74,000 level. A return to that zone is not being ruled out. For now, opinions remain split.

,, says institutional interest in Bitcoin remains intact:

Institutional demand for Bitcoin remains strong. US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included. 577K BTC ($53B) added over the past year, and still flowing in.

These figures suggest Bitcoin may be in a distribution phase. Large players appear to be reallocating liquidity. To get clarity on the next major move, the market likely needs to see a clearer accumulation phase first.

Trump’s Tariffs and Geopolitics Put Bitcoin to the Test

Despite optimistic forecasts from some analysts, who still expect a new Bitcoin all-time high in Q1–Q2 2026, political and economic instability could easily disrupt that outlook.

The US Supreme Court was expected to review the legality of Trump’s tariffs. Two sessions have already passed without a decision. Meanwhile, Donald TRUMP introduced a new 10% tariff package on selected countries, set to take effect on Feb. 1. The move was framed as a response to those countries supporting Greenland.

Greenland has now become a focal point of rising global tension. Since the start of the year, Trump has repeatedly stated that Greenland should become part of the United States. Given the events in Venezuela earlier in January, this rhetoric has raised concerns.

Bitcoin showed little immediate reaction to the situation in Venezuela. In fact, the price continued higher and briefly touched $98,000. That raised a key question. Was the reaction simply delayed, or had the risk already been priced in?

As tensions around Greenland intensified and new tariffs were announced, Bitcoin finally showed signs of weakness. BTC dropped sharply toward the $90,000 level. This is a key psychological zone. If sellers manage to push the price below it, the risk of further downside increases.

Liquidation data points to the next major levels around $88,000-89,000. Once again, buyer reaction will be crucial. If demand holds there, Bitcoin could stabilize and move back into its previous range.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.