Bitcoin’s Two-Month Dip: New Investors Face Red Numbers—What’s Next for Crypto’s Flagship Asset?

Fresh capital flowing into Bitcoin has hit a rough patch—two consecutive months in the red, according to on-chain metrics. For newcomers who timed their entry poorly, it's been a sobering welcome to crypto's volatility.

The Accumulation Phase

While short-term holders sweat, long-term believers see this as classic Bitcoin behavior. The asset doesn't move in straight lines—it consolidates, shakes out weak hands, and builds a stronger foundation for the next leg up. Remember: every major bull run was preceded by periods where buying felt like catching a falling knife.

Market Psychology at Play

Fear spikes when charts dip red for weeks. But seasoned traders watch these signals closely. When new buyers panic-sell at a loss, it often creates the exact liquidity and price floors that institutional players need to accumulate meaningfully—without moving the market against themselves. It's the old Wall Street game, just with a blockchain ledger.

Timing vs. Time In

The data highlights a brutal truth in crypto: trying to time the market usually backfires. Two months of losses for recent buyers serves as a stark reminder—this isn't a get-rich-quick scheme. It's a high-volatility asset class that rewards conviction and punishes impulsivity. Meanwhile, traditional finance pundits will undoubtedly use this to dust off their 'told-you-so' speeches—ignoring that every transformative asset has its messy adolescence.

Bottom line: Short-term pain for new entrants doesn't rewrite Bitcoin's long-term narrative. It just separates the tourists from the settlers.

Source: Glassnode

Source: Glassnode

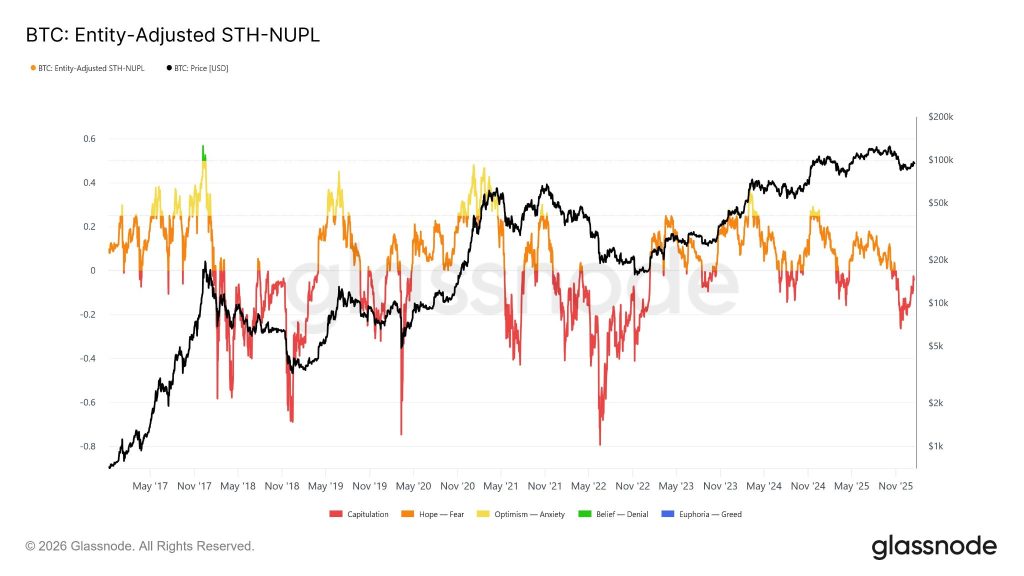

The metric tracking this cohort’s financial position, known as STH-NUPL (Short-Term Holder Net Unrealized Profit/Loss), has remained in negative territory throughout this period.

Glassnode noted that the aggregate entry price for recent investors is $98,300, a critical threshold for market sentiment.

“Historically, reclaiming and holding above the Short-Term Holder cost basis has marked the transition from corrective phases into more durable uptrends,” the firm stated in recent analysis.

Technical Convergence Points to Key Resistance

The $98,000 level carries additional significance beyond holder profitability.

According to LongCryptoClub analysis, large option demand has accumulated around the January 30th strikes at $98,000 and $100,000, creating potential for accelerated upside momentum if those levels break.

Market makers holding short positions on these calls would need to buy underlying bitcoin to maintain delta-neutral hedging as prices approach these strikes, potentially amplifying any breakout move.

Bitcoin briefly tested resistance NEAR the 38.2% Fibonacci retracement level formed between November’s local low and the all-time high during last week’s trading.

The crypto reached approximately $97,000 before pulling back sharply to $91,800 on Monday morning, triggering $233 million in long liquidations across derivatives markets.

Despite the volatility, the technical structure remains intact with higher highs and higher lows persisting on daily charts.

Hyblock Capital data showed approximately $250 million in net long positions filled near $92,000 during Monday’s dip, suggesting institutional buyers viewed the pullback as an accumulation opportunity rather than a distribution.

The institutional buyers’ accumulation was confirmed by the data from the founder of CryptoQuant, Ki Young Ju, who said, “institutional demand for Bitcoin remains strong.”

Institutional demand for Bitcoin remains strong.

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in. pic.twitter.com/kG1c8dTvlq

Bitcoin stabilized around $92,000 in Tuesday’s Asian session following the initial selloff.

Structural Headwinds Persist Amid Macro Uncertainty

The broader crypto market continues to underperform traditional risk assets amid multiple headwinds converging.

President Trump’s renewed tariff threats targeting eight European nations over Greenland negotiations pushed markets into defensive positioning, with crypto experiencing disproportionate weakness.

![]() Historical tariff patterns show 86% chance that TRUMP reverses Europe tariffs before February 1, as Bitcoin's 24/7 markets prepare to signal policy shifts first.#Trump #Tariffs #Europe #Bitcoinhttps://t.co/eGxEedfe06

Historical tariff patterns show 86% chance that TRUMP reverses Europe tariffs before February 1, as Bitcoin's 24/7 markets prepare to signal policy shifts first.#Trump #Tariffs #Europe #Bitcoinhttps://t.co/eGxEedfe06

Speaking with Cryptonews, Farzam Ehsani, CEO of crypto exchange VALR, observed that “while concerns about the US-EU trade war have had the greatest impact on sentiment, other risk assets, including the KOSPI, are trading flat or higher. This suggests that cryptocurrency-specific weakness persists.“

Monetary policy expectations compound the challenge. CME FedWatch tools indicate markets aren’t pricing the first interest rate cut until June 2026, meaning tight liquidity conditions will persist through the first half of the year.

“This means that monetary policy will remain tight, and the influx of new liquidity needed to FORM a full fledged bullish cycle is not expected in the coming months,” Ehsani explained.

Despite stabilization attempts near $100,000, Bitcoin remains vulnerable to macro shocks.

Monday’s selloff occurred during thin weekend liquidity, with elevated leverage positions amplifying the decline into a flash drop.

Total crypto market capitalization fell nearly 3%, while major altcoins, including SOL, DOGE, SUI, and XRP, dropped more than 5% as capital rotated into established SAFE havens like gold.

Long-term holder distribution has slowed significantly, with realized profits dropping to approximately 12,800 BTC per week, according to Bitfinex, well below earlier cycle peaks.

However, data from CryptoQuant Head of Research Julio Moreno revealed Bitcoin holders began realizing losses for a 30-day period since late December, marking the first sustained loss-taking since October 2023.

Bitfinex analysts noted that “for a more durable rally to take hold, market structure will need to transition into a regime where maturation supply begins to outweigh long-term holder spending.“

The crypto traded calmly near $92,000 on Tuesday despite broader macro turbulence, with dealers framing recent volatility as a leverage reset rather than a fundamental trend reversal.

While consolidation near $92,000 appears to have absorbed immediate selling pressure, the crypto market faces a critical test in the coming sessions as traders await clarity on the Federal Reserve’s policy direction and a resolution to escalating trade tensions that have kept institutional capital cautious throughout January.