Privacy Coins Soar 13% While Crypto Market Crashes—Defying Gravity Amid Mass Liquidations

While the rest of crypto bled, privacy coins went green.

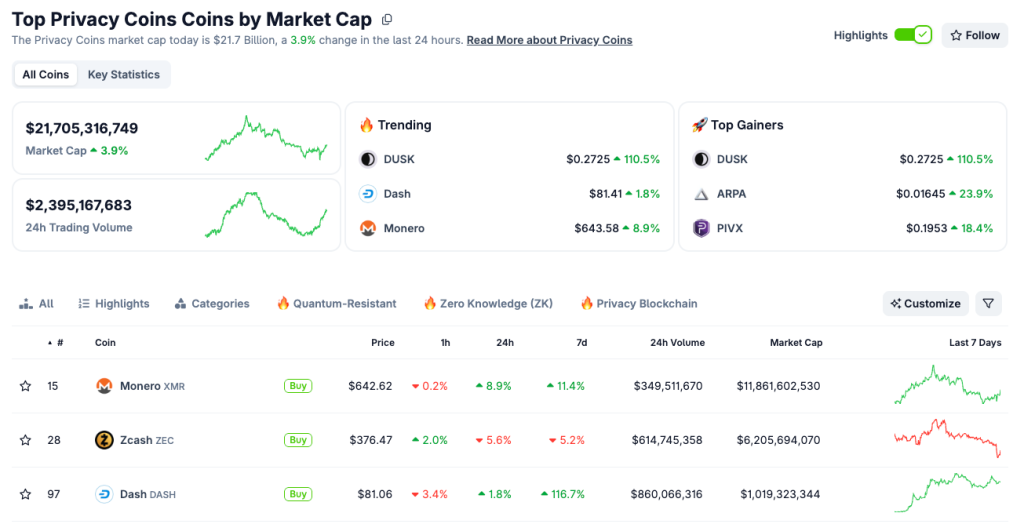

In a market-wide dump that vaporized billions in leveraged positions, privacy-focused cryptocurrencies staged a stunning counter-rally—climbing 13% while everything else tanked. No bailouts, no ETF hype, just pure stealth-mode momentum.

The Stealth Rally No One Saw Coming

Traders scrambling to cover margin calls missed it. Analysts glued to Bitcoin charts ignored it. But while major caps got liquidated, privacy protocols quietly stacked gains. These assets don’t wait for Wall Street’s permission—they move when traditional market logic breaks down.

Liquidation Bloodbath? More Like a Filter

Market-wide liquidations swept through overleveraged positions like a blunt instrument, clearing out the weak hands chasing quick gains. Meanwhile, coins built on actual utility—private transactions, censorship resistance—found their footing. Turns out, when trust in transparent ledgers wobbles, demand for financial opacity spikes.

Not a Fluke, a Feature

This isn’t random volatility. Privacy coins are engineered to decouple from mainstream sentiment. Their infrastructure bypasses surveillance, their economics ignore Fed speeches, and their communities couldn’t care less about CNBC’s commentary. While regulators draft another pointless framework, these networks just… work.

The Cynical Take

Let’s be real—half the finance sector still thinks privacy tech is solely for illicit activity, ignoring that every hedge fund worth its salt uses darker pools and offshore vehicles. But sure, focus on the transparency theater while the smart money quietly diversifies into assets that can’t be tracked.

So while paper-handed traders got wrecked, privacy coins did what they were built to do: operate independently. No approval needed. No explanation given. Just a 13% middle finger to conventional market logic.

Source: CoinGecko

Source: CoinGecko

DUSK posted the steepest gains, surging 110.5% daily and over 354% weekly, bringing the privacy coin category’s market capitalization to $21.7 billion with $2.4 billion in trading volume.

Structural Demand Replaces Stablecoins as Safe Haven

Speaking with Cryptonews, RAY Youssef, CEO of crypto app NoOnes, explained that the strength in assets like Monero, Dash, and DUSK reflects investors seeking to preserve capital without fully exiting crypto positions.

“Privacy coins’ outperformance during a broad market pullback is an indicator of selective risk-taking by investors who prefer not to fully de-risk or exit their positions in the crypto markets,” Youssef said, adding that while stablecoins traditionally served as the preferred SAFE haven during volatility, “privacy coins now offer a compelling alternative by aligning with the trend toward censorship resistance.“

The renewed interest comes amid ongoing debates over stablecoin rewards in the U.S. market structure bill and escalating trade tensions, creating conditions where some market participants anticipate continued volatility.

![]() Trump's Europe tariff threats erase $875 million in crypto positions as Bitcoin falls 3% to $92,000 amid geopolitical market shock.#Trump #Europe #Tariffs #Bitcoinhttps://t.co/heRs8hxlkV

Trump's Europe tariff threats erase $875 million in crypto positions as Bitcoin falls 3% to $92,000 amid geopolitical market shock.#Trump #Europe #Tariffs #Bitcoinhttps://t.co/heRs8hxlkV

Investors are increasingly seeking assets that can decouple from broader market weakness and show resilience during periods of macro stress.

Youssef pointed to tightening KYC and AML requirements worldwide as key catalysts pushing users toward protocol-embedded financial privacy.

The mass freezing of stablecoins has accelerated this shift, most notably Tether’s freezing of over $182 million in USDT across five addresses on January 11.

From 2023 to early 2026, Tether froze over 7,000 wallets totaling approximately $3.3 billion USDT, primarily citing illegal activity.

“This raises the question of complete centralized control over assets previously considered Immutable and decentralized,” Youssef noted, arguing that “privacy coins are taking on a new role, becoming a form of financial independence from corporate and regulatory structures.“

Dubai’s International Financial Centre’s prohibition on privacy tokens trading due to AML and sanctions risks announced last week has failed to interrupt the bullish trend.

Despite these regulatory headwinds, the sector has continued to post gains.

“Remarkably, even the ban on privacy coin trading announced last week by Dubai authorities hasn’t interrupted their bullish trend,” Youssef observed.

![]() Dubai has banned privacy tokens and anonymity tools in the DIFC to align with global AML and sanctions standards.#Dubai #Cryptohttps://t.co/CChT7Nd4mH

Dubai has banned privacy tokens and anonymity tools in the DIFC to align with global AML and sanctions standards.#Dubai #Cryptohttps://t.co/CChT7Nd4mH

Technical Momentum Points to Further Upside

Privacy coins have outperformed large-cap assets across several recent market downturns, establishing divergence patterns that could cement their role in strategic portfolios.

“Privacy is once again recognized as fundamental to decentralization,” Youssef said, noting that “the Core use case and technology of privacy coins remain relevant, especially amid ongoing concerns about peer risk, sovereign surveillance, and the future of digital finance.“

With DUSK posting over 540% growth in 30 days, market participants are watching whether it can sustain momentum and join established privacy leaders.

“If privacy coins’ strength endures, we could see XMR at $650, Dash at $90, and DUSK at $0.28 in the coming days,” Youssef projected.

Pavel Nikienkov, founder of Zano, also emphasized last week that privacy represents more than a passing trend.

“” Nikienkov stated, pointing to a16z’s 2025 State of Crypto report, which highlights sharp rises in Google search interest for privacy-related terms.

He argued that mainstream blockchains like ethereum and Solana, by integrating optional privacy layers, indicate the sector’s maturation, though “only systems designed for confidentiality” can meaningfully protect users in an increasingly surveilled digital landscape.