Bipartisan Senators Sound Alarm: Crypto Bill Risks Gutting Money Laundering Enforcement

Washington's crypto crackdown faces a new hurdle—from within.

The Regulatory Loophole

A proposed digital asset framework is drawing fire for what critics call a Swiss-cheese approach to financial oversight. The bill carves out exemptions and redefines key terms in ways that could let a chunk of crypto activity slip past traditional banking safeguards.

Enforcement on the Chopping Block

At stake are the tools agencies use to track illicit finance. The legislation could limit how and when regulators apply anti-money laundering rules to decentralized networks and non-custodial wallets—creating a potential blind spot just as institutional money floods in.

Innovation vs. Accountability

Proponents argue the rules are outdated for blockchain technology, but opponents see a dangerous precedent. It's the classic D.C. dance: promising a innovation-friendly sandbox while quietly moving the fence posts on compliance. Because nothing says 'financial revolution' like lobbying for weaker oversight—Wall Street would be proud.

The clash puts lawmakers in a bind: foster a booming industry or maintain the financial guardrails that, for all their flaws, keep the system from becoming a wild west. One side sees progress; the other sees a backdoor. And in crypto, backdoors have a habit of becoming main entrances.

Source: Politico

Source: Politico

Law Enforcement Warns of Prosecution Gaps

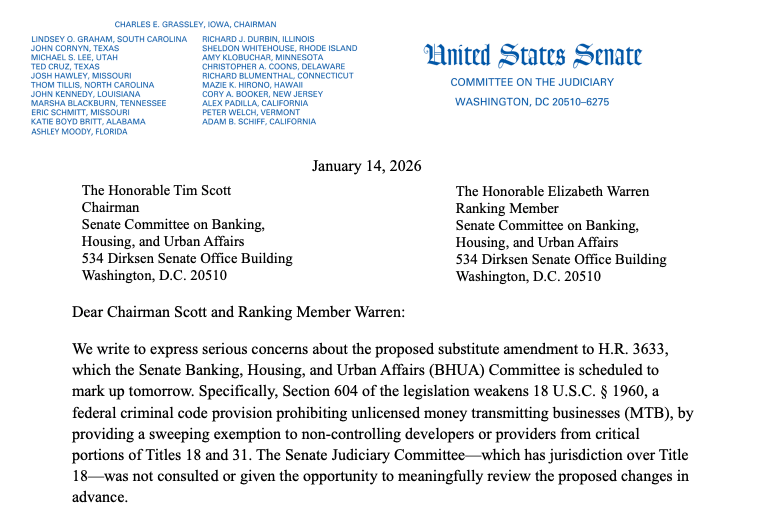

The disputed provision exempts “a dangerously broad category of actors” from criminal law treatment, according to the Grassley-Durbin letter.

They warned it would have “likely precluded the government from bringing charges against” the founder of Tornado Cash, a crypto mixer platform prosecutors said was used to launder money.

A co-founder of the platform was found guilty of operating an unlicensed money transmitting business last year, though crypto proponents and congressional Republicans have decried the conviction.

“Such a gap risks attracting illicit actors—like cartels and other sophisticated criminal organizations—to decentralized platforms,” the letter stated.

The National Association of Assistant United States Attorneys also echoed concerns, writing that the bill would “materially limit prosecutors’ ability to pursue financial crime cases involving the movement of funds outside established regulatory frameworks.“

A committee spokesperson for Scott defended the provision, stating the South Carolina Republican “remains committed to protecting software developers while ensuring that law enforcement has the necessary tools to prosecute actual illegal money transmission operations.“

The parliamentarian has ruled that the Blockchain Regulatory Certainty Act falls squarely within the Banking Committee’s jurisdiction, according to spokesperson Jeff Naft.

Developer Protections Collide With Financial Crime Concerns

The debate centers on decentralized finance platforms that use software to facilitate trading and lending without centralized intermediaries.

Democratic senators negotiating with Republicans have raised concerns about DeFi being used for illicit finance and pushed for changes to the developer exemption language.

They were preparing to try to amend it during a markup before the session was postponed.

GOP crypto allies maintain new exemptions are essential for innovation.

“Blockchain developers who have simply written code and maintain open-source infrastructure have lived under threat of being classified as money transmitters for far too long,” Lummis said when introducing the standalone BRCA.

After months of hard work, we have bipartisan text ready for Thursday’s markup. I urge my Democrat colleagues: don’t retreat from our progress. The Digital Asset Market Clarity Act will provide the clarity needed to keep innovation in the U.S. & protect consumers. Let’s do this! pic.twitter.com/fuu5CIQa8X

— Senator Cynthia Lummis (@SenLummis) January 13, 2026“This designation makes no sense when they never touch, control, or have access to user funds, and unnecessarily limits innovation.“

The solana Policy Institute also recently asked the SEC to grant explicit exemptions for developers of open-source, non-custodial software, arguing that existing frameworks built around centralized intermediaries do not fit smart-contract-based systems in which users retain custody of their assets.

In DeFi systems, users retain custody of their assets, approve their own transactions, and interact directly with public blockchains without the software holding funds or exercising discretion.

SEC Chairman Paul Atkins has criticized the agency’s past reliance on regulation by enforcement, arguing that “engineers should not be subject to securities laws” simply for publishing code.

Commissioner Hester Peirce has similarly stated that regulators should not impose obligations on developers who do not custody assets or override user decisions.

Thousands of Developers Face Regulatory Uncertainty

The outcome affects thousands of blockchain developers across ecosystems.

Ethereum added 16,181 new developers from January to September 2025 alone, maintaining 31,869 total active developers, while Solana added 11,534 new developers and grew its developer count 83% year-over-year to reach 17,708 active contributors.

Bitcoin ranked third with 7,494 new developers and 11,036 total active contributors.

For now, Scott has postponed the Banking Committee markup following Coinbase’s withdrawal of support for the broader market structure bill.

![]() Senate sets January 27 crypto bill markup as banking lobby secures stablecoin yield limits and Democrats demand WHITE House ethics guardrails.#Senate #Banking #CryptoBillhttps://t.co/iK8utlKRhr

Senate sets January 27 crypto bill markup as banking lobby secures stablecoin yield limits and Democrats demand WHITE House ethics guardrails.#Senate #Banking #CryptoBillhttps://t.co/iK8utlKRhr

Coinbase CEO Brian Armstrong called the latest draft “,” citing concerns over DeFi restrictions, tokenized equity bans, and stablecoin yield limitations.

“We’d rather have no bill than a bad bill,” Armstrong wrote, while expressing hope for a better compromise.

Galaxy Digital also warned the bill could grant Treasury “” surveillance powers, including authority to freeze transactions for up to 30 days without court orders and label foreign jurisdictions or transaction categories as money-laundering concerns.

The legislative path remains uncertain as lawmakers attempt to balance developer protections with law enforcement capabilities while navigating industry opposition and jurisdictional disputes between Senate committees.