Solana’s Future Demands Relentless Innovation, Co-Founder Declares

Solana's co-founder just laid down the law: innovate or die. The blockchain's path forward isn't about resting on past performance—it's a sprint to build what comes next.

The Innovation Imperative

Standing still in crypto is a one-way ticket to irrelevance. Networks that hit a technical plateau get overtaken. For Solana, that means pushing transaction speeds beyond current limits, slashing finality times, and expanding its developer ecosystem daily. The co-founder's message cuts through the noise: survival hinges on out-building everyone else.

Beyond the Hype Cycle

It's not about chasing the next narrative. Real innovation solves real user pain points—congestion, cost, complexity. The focus shifts to infrastructure most users never see but all rely on: state compression, parallel execution, and global validator dispersion. These aren't marketing bullet points; they're the unsexy plumbing that keeps the whole system from backing up.

The Finance Jab

Let's be cynical for a second. In traditional finance, 'innovation' often means a new fee structure or a convoluted derivative. In crypto, it still has to mean something that works. Solana's bet is that actual technological throughput will matter more than yet another re-hypothecation scheme dressed up as DeFi 2.0.

The clock is ticking. Competitors aren't sleeping, and neither are the users. They'll flock to whatever chain delivers—no loyalty, just results. Solana's future isn't promised; it's engineered.

Protocol Evolution as Existential Requirement

Yakovenko rejected the premise that blockchain protocols should aim for completion, instead framing continuous adaptation as the only path to long-term viability.

“It shouldn’t depend on any single group or individual to do so, but if it ever stops changing to fit the needs of its devs and users, it will die,” he stated.

The co-founder outlined a vision where protocol improvements are funded directly by developers whose livelihoods depend on network transactions.

“It needs to be so materially useful to humans and used by so many devs that are gainfully employed from the value of the transactions on solana, that the devs have spare LLM token credits to upstream improvements to this common open source protocol,” Yakovenko explained.

He emphasized that maintaining utility requires disciplined governance alongside relentless innovation.

“To not die requires to always be useful. So the primary goal of protocol changes should be to solve a dev or user problem. That doesn’t mean solve every problem, in fact, saying no to most problems is necessary,” he added.

Decentralized Development Beyond Core Teams

Yakovenko’s comments suggest that future Solana upgrades will increasingly originate outside established development organizations such as Anza, Solana Labs, and Firedancer.

“You should always count on there being a next version of solana, just not necessarily from anza or labs or fd,” he wrote.

The co-founder suggested emerging governance models could fundamentally reshape how protocol changes are proposed and funded.

“The way things are going we are likely to end up in a world where a simd vote pays for the GPUs that write the code,” Yakovenko stated, referencing Solana’s improvement proposal process.

This decentralized development philosophy comes as Solana demonstrates resilience under extreme stress.

The network withstood a sustained distributed denial-of-service attack peaking NEAR 6 terabits per second last month (the fourth-largest DDoS attack in internet history) without visible performance degradation or delayed block production.

![]() Solana has weathered one of the most powerful DDoS attacks ever recorded without any visible impact on network performance.#Solana #Suihttps://t.co/JC9BdGbU5e

Solana has weathered one of the most powerful DDoS attacks ever recorded without any visible impact on network performance.#Solana #Suihttps://t.co/JC9BdGbU5e

Network Metrics Show Steady Growth Amid Market Volatility

Solana’s technical positioning contrasts with recent liquidity challenges.

Last month, on-chain data from Glassnode shows the network’s 30-day realized profit-to-loss ratio has remained below 1 since mid-November, typically indicating bearish conditions where traders realize losses more frequently than gains.

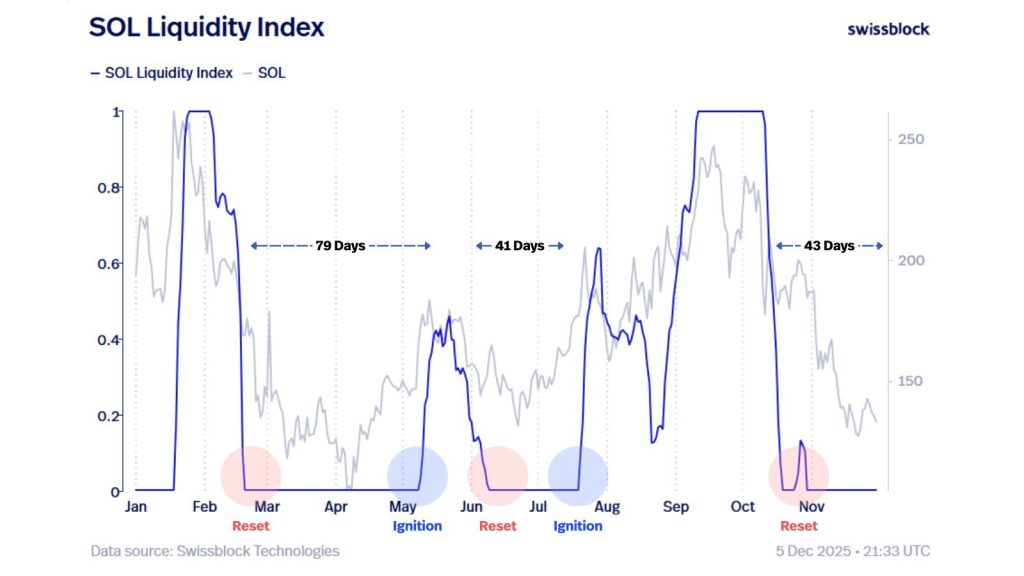

Analysts at Altcoin Vector described the current environment as a “,” a pattern that has historically marked the beginning of new liquidity cycles and preceded market bottoms.

If the structure mirrors April’s setup, liquidity could begin to recover in roughly 4 weeks, potentially setting the stage for renewed momentum by now.

Despite near-term headwinds, fundamental network activity continues expanding.

Average daily active addresses reached 2.4 million, up 5.64% over 30 days, while total value locked in decentralized finance protocols stands at $11.80 billion according to Messari, representing a 6.98% monthly increase.

Transaction fees generated $21.65 million over the past 30 days, up 19.61% from the previous period, while the network processed 2.3 billion total transactions. DeFi protocols on Solana recorded $9.086 billion in total value locked according to DefiLlama, with decentralized exchanges handling $2.956 billion in 24-hour trading volume.

The Solana Policy Institute has also intensified efforts to reduce regulatory friction for developers, submitting a letter to the SEC on January 10 requesting explicit exemptions for non-custodial DeFi software.

The nonprofit argued that applying broker-dealer or exchange rules to open-source smart contracts would force protocols to either shut down or reintroduce centralized control, undermining the investor protections regulators seek to preserve.