Venezuelan Man Faces 20 Years in Prison Over Alleged $1 Billion Crypto Money Laundering Scheme

Crypto's shadow economy faces a billion-dollar reckoning.

The Case That Exposes the Seams

A single indictment now threatens to unravel a labyrinthine operation. Prosecutors allege a Venezuelan national masterminded a money laundering network moving a staggering $1 billion through cryptocurrency channels. The scheme reportedly exploited digital assets' pseudonymous nature to shuffle illicit funds across borders—cutting through traditional financial gatekeepers with a few lines of code.

The 20-Year Stakes

The potential penalty underscores the severity: two decades behind bars. This isn't a slap on the wrist for regulatory paperwork; it's a hardline stance against using crypto as a bypass for anti-money laundering (AML) frameworks. The case pivots on proving intentional obfuscation—turning blockchain's transparency into a sophisticated smokescreen.

Balancing Innovation and Enforcement

For every legitimate protocol streamlining cross-border payments, there's a dark counterpart testing its limits. This prosecution walks a tightrope—demonstrating robust enforcement without vilifying the underlying technology. It sends a clear signal: building on blockchain doesn't grant immunity from financial surveillance laws. The old rules still apply, even if the assets are new.

The Bottom Line

The industry's growth hinges on separating technological promise from criminal misuse. A $1 billion laundering claim—whether proven or not—fuels the narrative that crypto remains the wild west of finance. It's a costly reminder that for all the talk of decentralization, a centralized justice system still holds the keys. Sometimes, the most disruptive technology just makes old-fashioned crime more efficient—a cynical twist even the most bullish investors didn't price in.

Billion-Dollar Network Operated Through Multiple Jurisdictions

Court documents reveal that Figueira allegedly enlisted subordinates to execute hundreds of transfers designed to obscure the origins and destinations of funds.

The operation relied on various bank accounts, crypto exchange accounts, private digital wallets, and shell companies to move voluminous amounts of illicit money into and out of the United States, according to federal investigators.

FBI Washington Field Office Criminal Division Special Agent in Charge Reid Davis said the bureau identified approximately $1 billion in crypto passing through wallets used by Figueira’s laundering operation.

The network allegedly served individuals and businesses worldwide while conducting scores of transfers intended to conceal the nature of funds and potentially facilitate criminal activity across numerous countries.

U.S. Attorney Lindsey Halligan emphasized the scale of alleged criminal conduct, stating that “money laundering at this level enables transnational criminal organizations to operate, expand, and inflict real-world harm.”

“Those who MOVE illicit funds in the billions should expect to be identified, disrupted, and held fully accountable under federal law,” she warned.

Federal Crackdown Extends Across Multiple Crypto Crime Networks

The charges against Figueira arrive amid intensified federal enforcement targeting crypto-related money laundering nationwide.

In fact, earlier this week, Manhattan District Attorney Alvin Bragg urged New York lawmakers to criminalize unlicensed crypto operations he characterized as a ““

Federal data shows the scope of crypto-enabled crime, with the FBI reporting nearly 11,000 crypto ATM-related complaints in 2024 totaling more than $246 million.

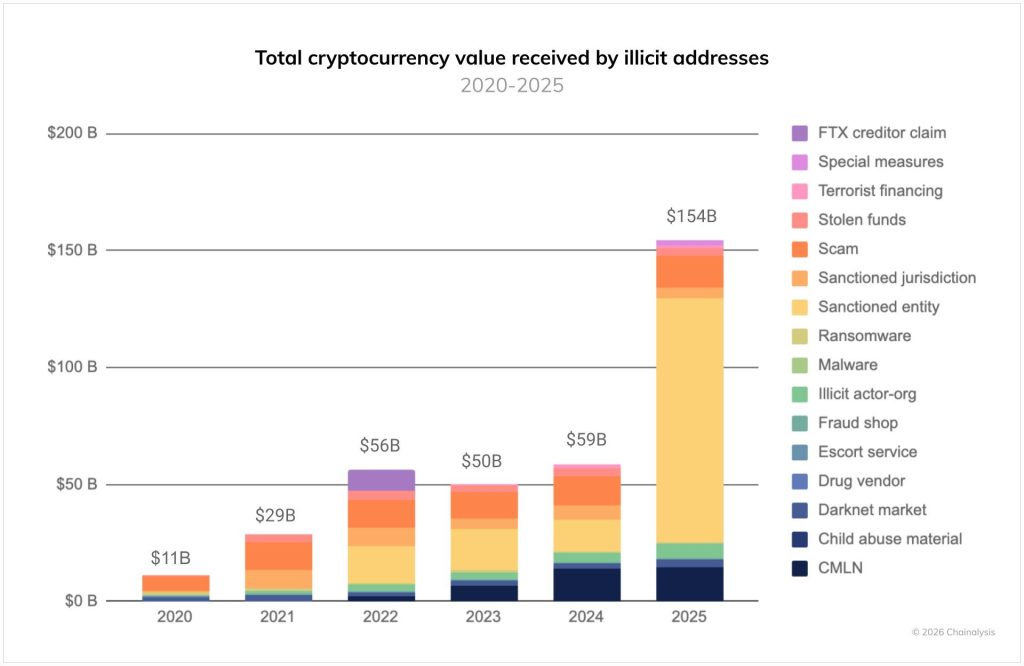

Separately, blockchain analytics firm Chainalysis found that illicit crypto addresses received a record $154 billion in 2025, a sharp increase from previous years.

Recent prosecutions have targeted operations across the criminal spectrum.

On Thursday, Utah resident Brian Garry Sewell was sentenced to three years in prison for running a $2.9 million fraud scheme while simultaneously operating an unlicensed cash-to-crypto business that converted more than $5.4 million in bulk cash.

Last month, prosecutors charged another 23-year-old Brooklyn resident, Ronald Spektor, with stealing roughly $16 million from approximately 100 Coinbase users through alleged phishing schemes that relied on panic tactics rather than technical hacks.

With all these massive seizures that keep growing, the government has moved to establish the StrategicReserve, formalizing the retention of seized crypto rather than auctioning it.

This was one of the first things Donald TRUMP did when he took office, even signing an executive order to support it.

Recently, things took a different turn when it was discovered that the U.S. Department of Justice appears to have sold 57 bitcoin forfeited by Samourai Wallet developers.

![]() A White House crypto advisor said the US government has not sold any Bitcoin forfeited in the Samourai Wallet case.#DOJ #Bitcoinhttps://t.co/pfX7fkilo8

A White House crypto advisor said the US government has not sold any Bitcoin forfeited in the Samourai Wallet case.#DOJ #Bitcoinhttps://t.co/pfX7fkilo8

However, WHITE House crypto advisor Patrick Witt confirmed yesterday, Friday, that the Bitcoin forfeited in the case has not been liquidated and will remain part of the reserve per executive order, with current federal holdings estimated at 328,372 BTC valued at over $31 billion.

For now, a criminal complaint is merely an accusation, and Figueira is presumed innocent until proven guilty. Assistant U.S. Attorney Catherine Rosenberg is prosecuting the case, with sentencing guidelines and statutory factors to be considered if a conviction occurs.