Bitcoin Becomes Lifeline as Iranians Flee Crashing Rial Amid Protests and Economic Crisis

When the state currency fails, citizens turn to the one that can't be printed into oblivion.

The Digital Run for the Border

Forget gold or dollars. Iran's latest capital flight is happening on the blockchain. As street protests flare and the rial tanks to another record low, a quiet, decentralized exodus is underway. People aren't just withdrawing Bitcoin—they're executing a sovereign-grade hedge against a collapsing system.

Bypassing the Broken Gates

Traditional capital controls? Rendered obsolete. Bitcoin doesn't ask for permission or a passport. It moves at the speed of the internet, slipping past centralized choke points that have trapped wealth for generations. This isn't speculation; it's preservation. Every transaction is a vote of no confidence in the old financial guard.

The Ultimate Stress Test

Forget the lab. Real-world crises like this are where crypto proves its core thesis: digital, bearer assets provide freedom when trust in institutions evaporates. It's a brutal, real-time demonstration of value transfer without intermediaries—while traditional finance scrambles to sanction the very people it claims to protect.

The revolution won't be televised. It'll be hashed, timestamped, and immutable. And for those watching from plush Wall Street offices—worry less about the volatility and more about the fact that your product is now in direct competition with human survival instinct. Tough sell.

Iranians Respond to Rial Collapse

Iranian currency – rial – sank to an all-time low, nearly losing all of its value against major currencies like the euro. Since late 2025, the currency has continued to weaken sharply in the open market with viral claims that it has fallen to ‘zero’ against USD.

As reported earlier, the country has also been offering to sell advanced weapons systems, including missiles and warships, to foreign governments for crypto.

For many Iranians, digital assets have become an “element of resistance,” providing liquidity in the restricted economic environment.

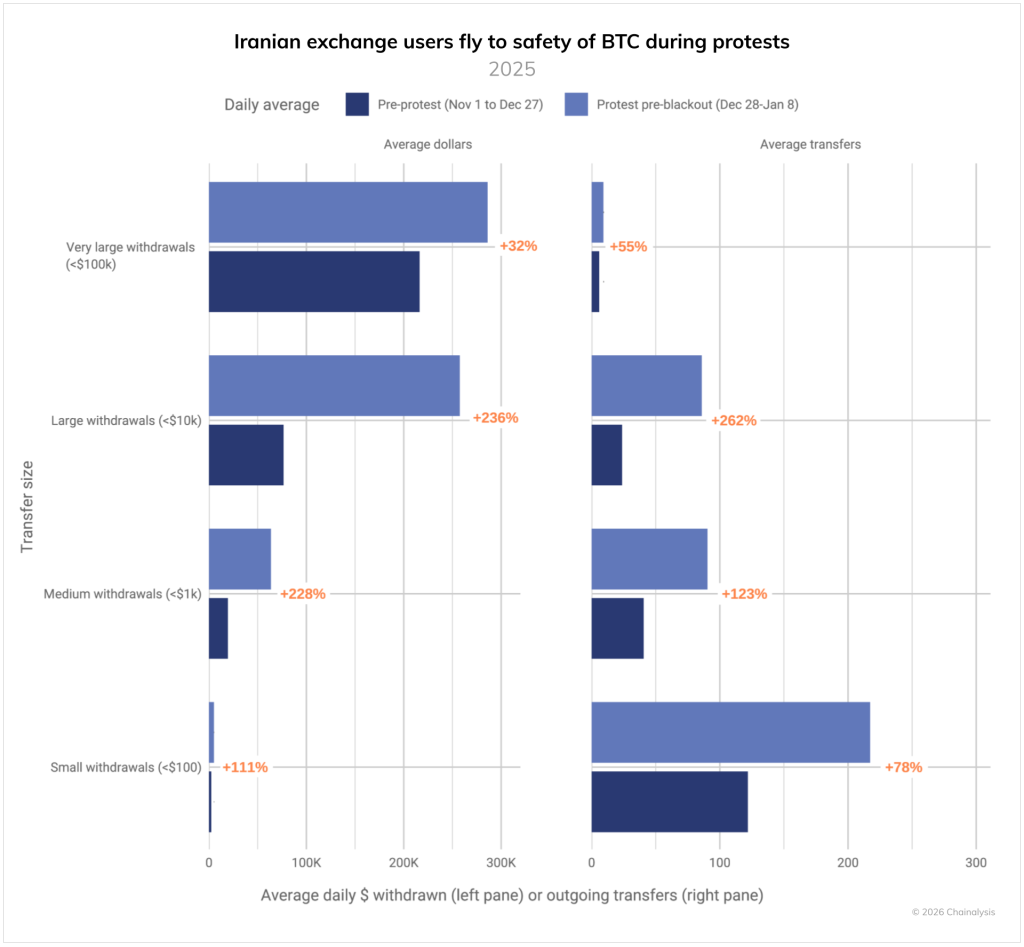

“The pattern of increased BTC withdrawals during times of heightened instability reflects a global trend we’ve observed in other regions experiencing war, economic turmoil, or government crackdowns,” Chainalysis report noted.

IRGC’s Dominance Within Iran’s Crypto Landscape

Chainalysis noted that apart from ordinary Iranians, the Islamic Revolutionary Guard Corps (IRGC), a multi-service primary branch of the Iranian Armed Forces, has also extensively pivoted to crypto.

The IRGC’s on-chain activity showed 50% of Iran’s crypto ecosystem in Q4 2025, reflecting its dominance in the nation’s economy.

“Iran’s crypto ecosystem reached over $7.78 billion in 2025, having grown at a notably faster pace compared to the year prior,” the report added.

Last week, two UK-based crypto exchanges processed approximately $1 billion in transactions linked to the IRGC.