Crypto Card Market Explodes 15x as Stablecoin Spending Soars 106% Annually: The Payment Revolution Is Here

Forget speculation—crypto's killer app just might be your wallet. Literally.

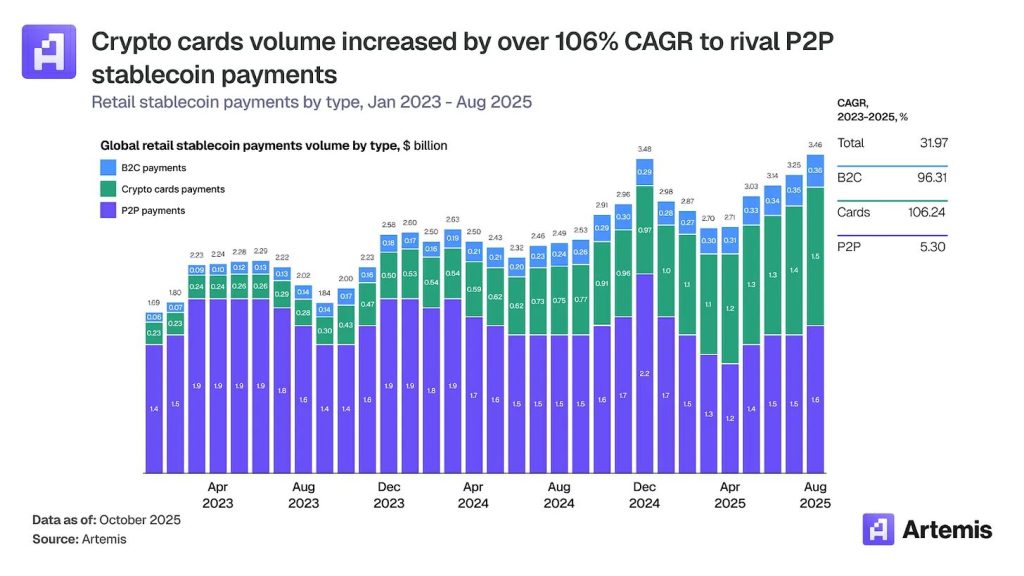

Digital payment rails are getting a blockchain-powered overhaul, and the numbers don't lie. The market for crypto-linked cards has multiplied by a staggering factor, while stablecoin transaction volume is climbing at a triple-digit annual pace. This isn't just traders moving money—it's mainstream adoption in real time.

From Plastic to Protocol

The shift is seismic. Traditional finance built walls; crypto cards are building bridges. Users aren't just holding assets—they're spending them directly, bypassing the slow, costly legacy systems that have dominated for decades. The infrastructure is moving from back-office settlements to front-pocket utility.

Stablecoins: The Steady Hand

The explosive growth in stablecoin spending is the real story. It signals a massive vote of confidence in digital dollars for everyday use. People are choosing the predictability of a pegged asset over the volatility of pure crypto—proving that for mass adoption, sometimes you need a familiar face on revolutionary tech. It’s the boring, reliable engine powering the flashy new car.

The Bottom Line

This data cuts through the hype. It shows a market maturing from a speculative playground into a functional payment layer. While Wall Street still debates ETFs, the real action is at the checkout counter. The future of spending isn't being debated in boardrooms—it's being activated with a tap. And let's be honest, watching legacy banks scramble to keep up is almost as satisfying as the 15x growth itself.

Source: Artemis

Source: Artemis

The explosive growth positions crypto cards as the primary bridge between digital assets and everyday commerce, with annualized volumes exceeding $18 billion while traditional P2P transfers grew just 5% to $19 billion over the same period.

Visa has emerged as the dominant force in crypto card infrastructure, capturing over 90% of on-chain card volume through early partnerships with emerging program managers and full-stack issuers.

Artemis noted that the payment giant’s strategy of engaging infrastructure providers like Rain and Reap has proven more scalable than Mastercard’s approach of direct exchange partnerships.

Full-Stack Issuers Reshape Card Economics

The crypto card infrastructure spans three critical layers (payment networks, card-issuing platforms, and consumer-facing products), with the most significant development being the emergence of full-stack issuers holding direct Visa principal membership.

Companies like Rain and Reap have collapsed traditional card issuance dependencies by combining BIN sponsorship, lender-of-record status, and direct Visa network settlement into single platforms, capturing economics previously distributed across multiple intermediaries.

Visa’s stablecoin-linked card spend reached a $3.5 billion annualized run rate in Q4 fiscal 2025, marking 460% year-over-year growth, though still representing roughly 19% of total crypto card settlement volume.

Centralized exchanges deploy cards as user-acquisition funnels, with platforms like Gemini absorbing ongoing losses from credit card programs to drive platform engagement.

DeFi protocols such as Ether.fi offer structurally higher cashback through token rewards, delivering approximately 4.08% returns while driving protocol TVL through collateralized borrowing features.

Geographic Opportunities Concentrate Where Stablecoins Solve Real Problems

Notably, India and Argentina stand out as global outliers where USDC approaches parity with USDT in market share, presenting vastly different opportunities for crypto card adoption.

India recorded $338 billion in crypto inflows over the 12 months ending June 2025, yet harsh tax policies pushed most activity offshore, creating massive latent demand for compliant crypto products constrained by regulatory friction rather than user interest.

Argentina’s opportunity centers on stablecoin debit cards for inflation hedging, where no competing digital rail exists, while India’s potential lies in crypto-backed credit cards, given that UPI has already commoditized debit functionality.

However, Artemis noted that in developed markets, the opportunity lies in capturing a differentiated, high-value user segment with greater financial sophistication and growing digital asset balances, rather than solving unmet payment needs.

For instance, the mature U.S. credit card market. Despite credit card revenues growing significantly across issuers, a new segment is emerging.

Consumers are now holding meaningful stablecoin balances who increasingly expect seamless spending capabilities, creating opportunities for traditional issuers who combine scale advantages with stablecoin-native capabilities before crypto-native competitors solidify user relationships.

Cards Remain Strategic Despite Native Acceptance Push

While major networks, including Visa, Mastercard, PayPal, and Stripe, are building stablecoin-native merchant acceptance architectures, three structural realities suggest that crypto cards will maintain strategic relevance.

Artemis noted that network effects spanning 150 million merchant locations globally remain exceptionally difficult to replicate, requiring years of coordinated infrastructure investment that stablecoin-native systems must rebuild from near-zero merchant coverage.

Card networks bundle services consumers expect, such as fraud protection, dispute resolution, unsecured credit, rewards programs, and purchase protections, which stablecoin payments cannot easily replicate.

Notably, earlier this month, Anthony Yim, co-founder of Artemis, noted that DeFi traders prefer USDC because it “frequently MOVE in and out of positions,” while broader adoption reflects an “unstable geopolitical landscape” driving demand for the digital dollar.

Global stablecoin transaction value totaled $33 trillion in 2025, up 72% year-over-year, with Bloomberg Intelligence projecting $56 trillion by 2030.

Revolut’s stablecoin payment volumes alone surged 156% to approximately $10.5 billion, with everyday transactions between $100 and $500 accounting for 30% to 40% of platform activity.

Despite surging adoption, major banks have escalated resistance to yield-bearing stablecoins, warning they could drain trillions from traditional deposits.

![]() Bank of America CEO Brian Moynihan has warned that stablecoins could pull trillions of dollars out of the US banking system.#Stablecoins #Cryptohttps://t.co/TTQ8cqCSm6

Bank of America CEO Brian Moynihan has warned that stablecoins could pull trillions of dollars out of the US banking system.#Stablecoins #Cryptohttps://t.co/TTQ8cqCSm6

Bank of America CEO Brian Moynihan cautioned that up to $6 trillion could migrate into stablecoins, while JPMorgan’s Jeremy Barnum warned against “the creation of a parallel banking system” without prudential safeguards.

The pushback contributed to the Senate Banking Committee postponing its planned markup of a sweeping crypto market structure bill after Coinbase withdrew support, with Chairman Tim Scott citing ongoing bipartisan negotiations over provisions that would restrict stablecoin yield payments.