Pi Coin Price Prediction 2026: Mainnet Tokens Just Unlocked – What This Means for Your Holdings

Mainnet floodgates swing open—Pi Network’s locked reserves hit the market. A liquidity surge or a sell-off tsunami?

The Unlock Impact

Token unlocks cut both ways. Fresh supply injects liquidity, greasing the wheels for real utility and exchange listings. But it also tests holder conviction—sudden abundance often triggers a race to the exit. For Pi, this moment separates speculative miners from long-term believers.

Price Trajectory Post-Unlock

History doesn’t repeat, but it rhymes. Past unlocks for major assets saw initial pressure followed by stabilization—if fundamentals hold. Pi’s price now hinges on actual adoption, not just mining app screens. Can its community-built economy absorb the new tokens without crashing the party? Watch trading volume and exchange depth; they’ll tell the real story.

Strategic Moves for Holders

Don’t just HODL blindly. Diversify exposure, set clear profit-taking levels, and monitor network activity metrics. This unlock bypasses the testnet phase—real value gets assigned by a market with zero sentiment. Consider staking mechanisms if available; they often lock supply back up and yield rewards, creating a natural buffer against volatility.

The Verdict

This unlock forces Pi to grow up. No more hypothetical valuations. Price discovery gets brutal and public. For disciplined holders, it’s a long-awaited legitimacy test. For the rest—well, another lesson in crypto’s favorite pastime: turning digital hope into a taxable event.

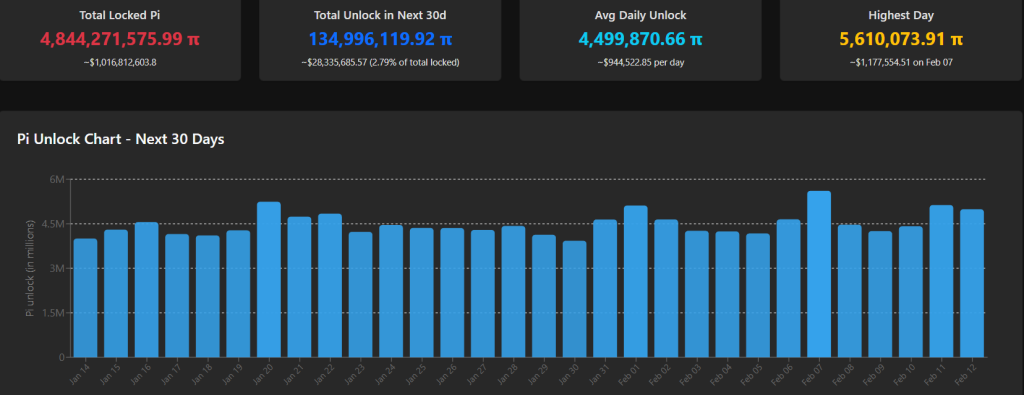

Pi 30-day Pi token unlock schedule. Source: Piscan.

Pi 30-day Pi token unlock schedule. Source: Piscan.

This steady release of newly transferable tokens boosts liquidity at price levels where demand is still selective, making rebounds more likely to die than become long-term trends.

A cycle that feeds into Pi Network’s biggest problem: adoption. It lacks a meaningful use case to sustain long-term growth, leaving price action vulnerable to short-term speculative trading.

However, that dynamic may finally be shifting. The recent rollout of developer toolkits like the streamlined in-app payment integration library allows DApps to add Core functionality in minutes.

As the new year starts, it’s time to build! Pi Network has released a new developer library that enables Pi payments to be integrated into Pi apps in under ten minutes. The library combines the Pi SDK and backend APIs into a single setup, reducing integration time across common…

— Pi Network (@PiCoreTeam) January 9, 2026By fast-tracking common integrations like this, Pi Network becomes a more attractive platform for builders, contributing to a thriving ecosystem that drives adoption.

It could mark a turning point for sticky, lasting demand to balance the scales against an expanding supply.

Pi Coin Price Prediction: Price Action Could Soon Catch On

More favorable demand dynamics could push the Pi coin price to escape the 3-month parallel channel consolidation created by its liquidity struggle.

Momentum indicators are finally seeing sustained traction. The RSI is back to pushing for a break above the signal line after its brief lapse, showing underlying strength.

The MACD reads much the same, narrowly avoiding a death cross below the signal line as buyers retain control of the prevailing trend.

The key breakout threshold sits around the channel’s upper resistance at $0.285. With a higher and firmer footing here, amove tocould be in focus.

Over the long-term, the introduction of fresh use cases with adoption from developers and users could put past resistance aroundinto focus for a.

Bitcoin Hyper: The Biggest Layer-1 Just Got Better

Those who chose alternative layer-1s like Pi Network over the leading cryptocurrency may soon need to reconsider, as the bitcoin ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Whatever solana can do, Bitcoin could soon do too.

The project has already raised almost $30.5 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here