Zcash Foundation Cleared: SEC Ends Multi-Year Investigation Without Enforcement Action

Regulatory clouds part for privacy-focused crypto project.

The Securities and Exchange Commission has officially closed its probe into the Zcash Foundation, delivering a verdict that echoes through the corridors of crypto compliance: no charges, no penalties, no enforcement action. After years of regulatory scrutiny that had many in the sector holding their breath, the foundation emerges unscathed—a rare win in an environment where regulatory ambiguity often feels like playing financial whack-a-mole.

The Investigation That Wasn't

Sources close to the matter confirm the SEC's enforcement division has wrapped its examination without recommending action. The investigation, which spanned multiple fiscal years and consumed countless legal billable hours, focused on whether Zcash's initial development and distribution violated securities laws. The silence from regulators speaks volumes—sometimes the loudest statement is the absence of a fine.

Privacy Tech Gets Breathing Room

Zcash's zero-knowledge proof technology, which enables transactions without revealing sender, receiver, or amount, has long danced on the regulatory edge. The SEC's decision not to pursue the foundation suggests regulators may be drawing distinctions between privacy technology itself and how it's deployed—a nuance that matters for Monero, Dash, and other privacy coins watching from the sidelines. The foundation maintained throughout that it developed open-source technology, not an investment contract—an argument that apparently held water in Washington.

Broader Implications for Crypto Compliance

This closure arrives as multiple crypto projects face existential regulatory threats. The SEC's restraint here contrasts sharply with its aggressive posture toward other tokens it deems unregistered securities. Legal experts note the decision could signal a more nuanced approach to foundational entities that support protocol development without directly profiting from token appreciation—or it could simply mean the enforcement division had bigger fish to fry (looking at you, stablecoin issuers).

Market Reaction and Moving Forward

While Zcash trading volumes showed modest upticks on the news, the real victory lies in precedent. Foundation executives can now focus on protocol upgrades rather than deposition prep. The resolution removes a major overhang for developers and investors who value transactional privacy—even as traditional finance types continue to view privacy features as something between a nuisance and a threat to their surveillance-based revenue models.

In an industry where regulatory scrutiny often feels like death by a thousand legal inquiries, the Zcash Foundation just received something rarer than a Bitcoin block reward: regulatory clarity without the accompanying enforcement headache. Now back to building—the lawyers have finally left the room.

The probe began in August 2023, when the foundation received a subpoena as part of a broader SEC effort to assess whether specific digital asset offerings fell under federal securities laws.

The case was internally designated SF-04569 and remained open for more than two years.

Zcash’s Privacy Model Back in Spotlight After SEC Review Closes

The foundation said the outcome reflected its cooperation throughout the process and its focus on operating within existing regulatory requirements.

It added that its work WOULD remain centered on advancing privacy-preserving financial infrastructure. The SEC did not issue a public statement on the matter, but the foundation said it had received confirmation that the review was formally closed.

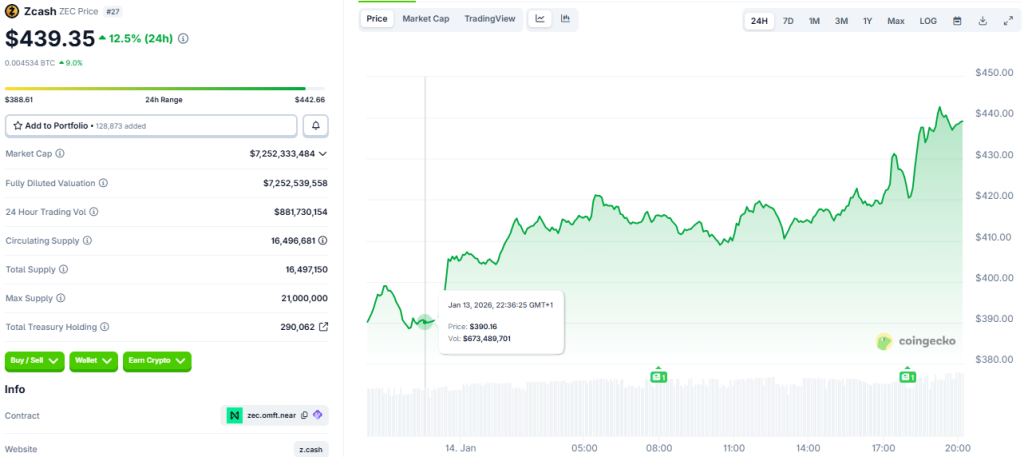

The decision comes amid renewed market activity around Zcash, with ZEC trading around $439 on Wednesday, up roughly 13% over the most recent trading period, with 24-hour trading volume climbing more than 30% to about $881 million.

Despite the rebound, the token remains far below its early-cycle peak, trading more than 86% under its all-time high of $3,191 set during the 2017 bull market.

One of the most prevalent aspects of privacy-oriented cryptocurrency has always been the regulatory oversight of such initiatives, which have been based on cryptographic solutions to conceal the information on transactions and remain functional in the open blockchain.

Zcash was introduced in 2016, and it uses zero-knowledge proofs to enable users to transact shielded transactions without the information about the sender, receiver, or amount being disclosed.

That design has put it in the middle of multiple discussions on financial surveillance, compliance, and the boundaries of privacy on-chain many times.

SEC’s Zcash Decision Mirrors Evolving U.S. Regulatory Playbook

The SEC’s review of the Zcash Foundation unfolded alongside other inquiries touching the ecosystem.

In past correspondence, the agency sought analysis from Grayscale Investments on whether ZEC could be classified as a security in the context of its Zcash Trust.

SEC officials have also engaged directly with Zcash founder Zooko Wilcox, including participation in roundtable discussions on privacy technologies and regulatory oversight.

The closure of the Zcash probe also fits into a broader shift in US crypto enforcement since 2025.

Under new leadership and following the appointment of Paul Atkins as SEC chair, the agency has dropped or settled a string of high-profile cases launched during the prior administration.

Paul Atkins was sworn in as SEC Chairman on Monday, and is expected to have a private ceremony with President TRUMP at the Oval Office today.#PaulAtkins #SECChair https://t.co/lqyUZN3B7H

— Cryptonews.com (@cryptonews) April 22, 2025Lawsuits against Coinbase and Kraken were dismissed without penalties, investigations into Robinhood’s crypto unit, Uniswap Labs, OpenSea, and Gemini were closed, and a multi-year inquiry into Ondo Finance ended without charges late last year.

While the SEC has continued to pursue cases involving alleged fraud, the pattern has pointed toward a pullback from expansive enforcement actions tied to token classification alone.

The end of the SEC probe arrives during a turbulent moment internally for Zcash, as last week, governance disputes between the Electric Coin Company and the nonprofit Bootstrap escalated into a public split, with core developers leaving to FORM a new independent entity.

![]() @ Zcash Split Update: $ZEC slides 16% as Bootstrap blames nonprofit rules, not mission misalignment, or the split#Zcash #BlockchainGovernancehttps://t.co/62gTfuz4lx

@ Zcash Split Update: $ZEC slides 16% as Bootstrap blames nonprofit rules, not mission misalignment, or the split#Zcash #BlockchainGovernancehttps://t.co/62gTfuz4lx

That episode briefly weighed on market sentiment, even as network operations continued uninterrupted and project leaders stressed that the conflict did not affect Zcash’s underlying security or privacy guarantees.