Bitcoin Price Prediction: CPI Surprise Sends BTC Flying – Wall Street’s Next All-In Move?

Bitcoin rockets on CPI shocker—institutional floodgates creaking open.

The Inflation Catalyst

Forget gentle nudges. The latest Consumer Price Index data hit markets like a defibrillator paddle—jolting risk assets back to life. Bitcoin, ever the canary in the coal mine, didn't just tick up; it surged. The move screams one thing: macro winds are shifting, and digital gold is catching the breeze first. It's the kind of surprise that turns cautious whispers into decisive action on trading floors.

Wall Street's Calculated Gaze

Don't call it FOMO. This is colder, more clinical. When traditional inflation hedges stutter, big money starts recalculating. Bitcoin's liquidity and 24/7 market suddenly look less like quirks and more like features. Asset allocators aren't watching the charts—they're watching the Fed, and the correlation breakdown between equities and crypto is blinking green. The 'uncorrelated asset' thesis just got a steroid shot.

The Institutional On-Ramp Widens

Spot ETFs were the trojan horse. Now the army inside is mobilizing. We're not talking dip-buying retail traders; this is systematic reallocation. Treasury yields twitch, and pension fund models spit out new optimal portfolio mixes. Bitcoin's volatility? Suddenly it's 'strategic asymmetry' in a quarterly report. The infrastructure built during the last cycle—custody, derivatives, prime brokerage—isn't sitting idle. It's humming, ready to scale.

A Prediction Forged in Macro Fire

Price targets get tossed around like confetti. Ignore them. Watch the flows. The real signal won't be a magic number, but a sustained volume surge from known institutional wallet clusters. If this CPI print marks a genuine inflationary pivot, not a blip, then capital rotation could dwarf 2021's inflows. The plumbing can handle it now. The will? That's being decided in boardrooms that still think blockchain is something you get at Home Depot.

Closing thought: Wall Street loves a narrative it can sell. 'Inflation hedge' fits on a PowerPoint slide. Bitcoin, once the rebel, now wears a suit—tailored by the very system it was built to bypass. The ultimate finance jab? They'll make billions selling the dream of decentralization back to you.

Core CPI at 2.6% Lifts Bitcoin Toward $95,000

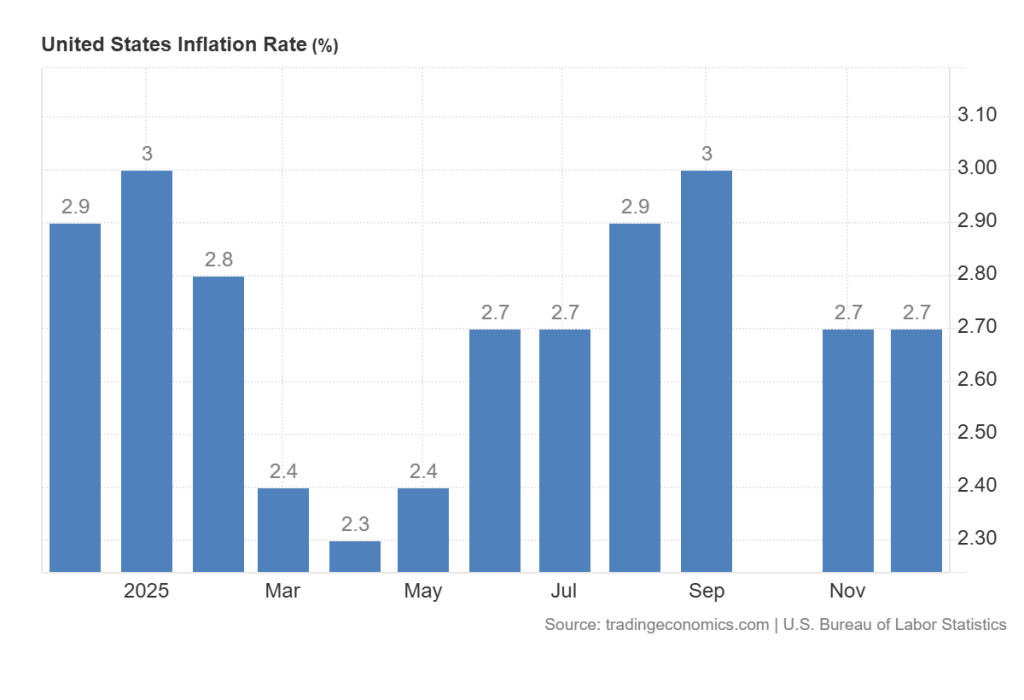

Bitcoin is trading NEAR the $95,000 level after gaining more than 3% over the past 24 hours, supported by softer inflation data and a modest pullback in the US dollar. The latest US Consumer Price Index report showed headline inflation holding steady at 2.7% year over year in December, in line with market expectations, while core inflation remained unchanged at 2.6%, its lowest level since 2021.

On a monthly basis, CPI ROSE 0.3%, matching forecasts, with shelter costs accounting for much of the increase. Energy prices climbed 2.3%, while food prices rose 3.1%, underscoring that price pressures remain uneven rather than accelerating broadly. Crucially for markets, the absence of an upside surprise in core inflation eased concerns that the Federal Reserve may need to keep monetary policy restrictive for longer.

For Bitcoin, this environment matters. Stable inflation and a contained core reading reduce pressure on Treasury yields and the US dollar, allowing capital to rotate toward alternative stores of value. With real yields stabilizing, Bitcoin benefited alongside broader risk assets.

Japan’s finance minister and US Treasury Secretary Scott Bessent shared concerns about the weakening yen during a bilateral meeting as the currency edged toward a key threshold where authorities have intervened in the past https://t.co/el2QVQwBT1

— Bloomberg (@business) January 13, 2026Currency markets echoed this shift. The Japanese yen slid to multi-month lows, while the euro and British pound traded with limited follow-through, highlighting continued unease around global monetary and fiscal conditions.

Against this landscape of fiat uncertainty and moderating US inflation, Bitcoin’s role as a policy-insensitive asset gained renewed attention from both institutional and macro-focused investors.

Fitch Warns on BTC-Backed Securities Risk

Fitch Ratings recently cautioned that Bitcoin-backed debt instruments carry elevated risk due to BTC’s price volatility, particularly where leverage and collateralized lending are involved. Crucially, the agency excluded spot BTC ETFs from this warning, noting that broader ETF adoption could help dampen long-term volatility rather than increase it.

![]() Fitch Ratings warns of the risks of Bitcoin-backed securities

Fitch Ratings warns of the risks of Bitcoin-backed securities

Fitch Ratings, one of the leading rating agencies, has warned that Bitcoin-backed securities carry high risks and speculative credit profiles.

The inherent volatility of BTC prices can quickly erode the value of… pic.twitter.com/B4kDhYp2kC

That distinction is significant for institutional investors. Exposure to Bitcoin is increasingly shifting toward regulated, transparent structures instead of speculative credit products. A clear example is the launch of 21Shares’ Bitcoin Gold ETP (BOLD) on the London Stock Exchange, which allocates roughly two-thirds to gold and one-third to Bitcoin, positioning BTC alongside a traditional safe-haven asset

Together, expanding spot ETF access and hybrid products are reinforcing Bitcoin’s institutional appeal while reducing dependence on leverage-driven crypto credit models.

BTC and Gold Converge as 21Shares Launches BOLD ETP in the UK

21Shares has launched its Bitcoin Gold ETP (BOLD) on the London Stock Exchange, giving UK investors access to a regulated product that combines gold and Bitcoin in a single structure. The fund allocates roughly two-thirds to gold and one-third to Bitcoin and trades in both US dollars (BOLU) and British pounds (BOLD).

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more: https://t.co/d9gFbwImMu![]() Introducing the 21shares Bitcoin Gold ETP… pic.twitter.com/neRbphESOr

Introducing the 21shares Bitcoin Gold ETP… pic.twitter.com/neRbphESOr

BOLD is fully physically backed, holding real gold and Bitcoin, and was developed in partnership with ByteTree Asset Management. By pairing gold’s long-standing role as a SAFE haven with Bitcoin’s growing reputation as “digital gold,” the product targets inflation protection and macro volatility.

The listing strengthens Bitcoin’s institutional credibility and supports long-term demand through regulated investment channels.

Bitcoin (BTC/USD) Technical Outlook: BTC Breaks Symmetrical Triangle as $95,000 Turns Into Support

From a technical standpoint, Bitcoin price prediction seems bullish as BTC’s structure has turned decisively constructive. On the 2-hour chart, BTC has broken cleanly above a long-developing symmetrical triangle that constrained price action through early January. The breakout followed a clear sequence of higher lows pressing against descending resistance, a classic setup for directional expansion.

Former resistance between $94,500 and $95,000 has now flipped into support, creating a firm demand zone reinforced by shallow pullbacks and tight-bodied candles. The leading indicator, RSI, remains elevated near the upper-60s without showing bearish divergence, indicating momentum is strong but not overstretched.

If Bitcoin holds above $95,000, the technical roadmap points toward:

- Initial resistance near $97,600

- A higher extension toward $98,800–$99,000

A pullback toward $95,000–$94,500 would likely be viewed as constructive, with downside risk contained below $93,000. As long as BTC remains above broken triangle resistance, the broader trend favors continuation, keeping Optimism alive for the next leg higher.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.4 million, with tokens priced at just $0.013575 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale