Indonesia’s OJK Whitelists 29 Licensed Crypto Platforms: Here’s Who Made the Cut in 2025

Indonesia just greenlit crypto's big players—and slammed the door on everyone else.

The Financial Services Authority (OJK) dropped its official whitelist, granting 29 platforms the golden ticket to operate legally. That's the number that matters now. Forget the hundreds of hopefuls—this list defines the entire playing field.

What This Whitelist Actually Means

This isn't a suggestion; it's a mandate. The OJK's move cuts through the regulatory fog, drawing a bright line between legitimate operators and the rest. For users, it's a safety net. For the approved platforms, it's a massive competitive moat. For everyone else? It's a one-way ticket out of one of Southeast Asia's hottest markets.

The New Gatekeepers of Digital Finance

The approved entities aren't just exchanges; they're becoming the de facto gatekeepers. They'll handle the onboarding, the compliance, and the flow of billions in digital asset volume. This consolidation hands immense power to a few—a move that would make a traditional finance cartel blush, if it weren't so efficient.

Regulation Isn't a Wall—It's a Filter

Critics will call it crackdown. They're missing the point. This whitelist doesn't stop crypto; it filters it. It strains out the noise and lets the established, compliant projects build with authority. It's the kind of boring, bureaucratic step that actually fuels mainstream adoption, while giving regulators a clear list of who to blame when things go sideways.

The message is clear: play by the new rules, or don't play at all. Indonesia isn't betting against digital assets—it's just deciding who gets to hold the chips.

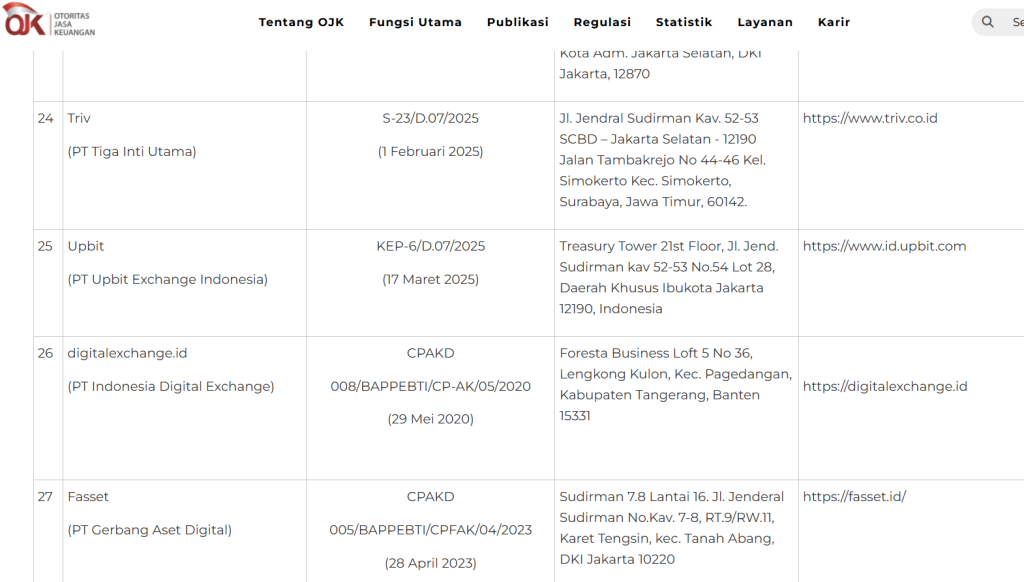

Who Made the Cut? A list of crypto platforms that made the OJK Whitelist

The whitelist, released on December 19, 2025, names platforms that have either received full licenses from OJK, referred to as PAKD, or are registered as prospective traders under the CPAKD category while completing their approval process.

OJK said the list is intended to serve as an official reference point for users, allowing them to verify whether a crypto platform or application is properly licensed and operating under regulatory supervision before trading.

Among the fully licensed platforms are some of Indonesia’s most established crypto exchanges, including Indodax, Pintu, Pluang, Reku, Upbit Indonesia, Stockbit Crypto, Tokocrypto, Triv, Nanovest, Bittime, CoinX, Cyra Exchange, BTSE Indonesia, and Ajaib Kripto.

OJK also listed several prospective traders still undergoing the licensing process, including Luno Indonesia, Fasset, Digitalexchange.id, and Crypto Warehouse, which remain under regulatory supervision.

Beyond trading platforms, the authority confirmed the Core infrastructure supporting the digital asset market.

PT Bursa Komoditi Nusantara, operating as CFX, is listed as the licensed digital asset exchange, while PT Kliring Komoditi Indonesia serves as the clearing and settlement institution.

Custody services are handled by PT Kustodian Koin Indonesia and PT Tennet Depository Indonesia, which are responsible for safeguarding user assets.

OJK Takes the Helm as Indonesia Tightens Control Over Crypto Markets

The publication follows the formal transfer of regulatory authority over crypto and digital financial assets from Indonesia’s commodities regulator, Bappebti, to OJK, a shift mandated under Law Number 4 of 2023 on the Development and Strengthening of the Financial Sector.

Under the law, all digital financial asset service providers must meet licensing requirements set by OJK or Bank Indonesia, with unlicensed operations subject to criminal penalties, including prison sentences and substantial fines.

![]() Indonesia’s crypto regulation transfer to OJK, set for Jan. 12, faces setbacks due to incomplete government frameworks.#Indonesia #CryptoRegulation https://t.co/2V7xIu94eI

Indonesia’s crypto regulation transfer to OJK, set for Jan. 12, faces setbacks due to incomplete government frameworks.#Indonesia #CryptoRegulation https://t.co/2V7xIu94eI

The regulator warned that platforms operating outside the list are not licensed or supervised and therefore present heightened risks to consumers.

It also cautioned against fake links, lookalike domains, and promotions spread through social media or private messaging groups, particularly those framed as educational programs or investment communities that promote unapproved platforms.

Indonesia Tightens the Screws on Crypto as Millions of Users Fuel Market Growth

The whitelist comes alongside tighter rules under OJK Regulation No. 23/2025, which strengthens oversight of digital financial assets and related derivatives.

The regulation bars exchanges from facilitating trades in assets that are not registered or approved and introduces stricter requirements for derivatives trading, including margin mechanisms, segregated funds, and mandatory knowledge tests for users.

Indonesia’s regulatory push is unfolding as the country cements its status as a major global crypto market.

Chainalysis ranked Indonesia among the world’s top ten for crypto adoption in 2025 and first in Southeast Asia, reflecting tens of millions of users across digital assets and capital markets.

The country is home to around 17 million crypto traders and more than 19 million capital market investors, according to recent data.