Michael Saylor’s $748M Move: How the Billionaire’s Strategy Skyrocketed USD Reserves to $2.19B

Another quarter, another massive cash injection. A single corporate strategy just funneled three-quarters of a billion dollars into the company's war chest—proving once again that in the world of high finance, the boldest moves often look the simplest.

The Mechanics of the Mega-Accumulation

Forget complex derivatives or opaque offshore vehicles. This capital surge stems from a disciplined, almost surgical approach to asset management. The playbook prioritizes liquidity and strategic optionality, converting non-core holdings into the ultimate flexible asset: cold, hard U.S. dollars. It’s a hedge, a runway extender, and a dry-powder reserve all rolled into one—a classic case of preparing for opportunity while the rest of the market debates the noise.

Why a $2.19B Treasury Matters Now

In an era where 'cash is trash' gets meme'd into oblivion, building a fortress balance sheet is the ultimate contrarian power move. That $2.19 billion reserve isn't just sitting idle; it's a strategic asset that provides immense leverage. It allows for aggressive expansion when competitors are retrenching, funds opportunistic acquisitions at distressed prices, and sends a clear signal of long-term conviction to both markets and regulators. It’s financial armor in a volatile landscape.

The move underscores a timeless—if cynical—truth in finance: the real money isn't always made in the trade, but in having the unwavering capital to wait for the perfect pitch. While speculators chase the next hype cycle, the game is often won by those who master the art of the patient, cash-backed strike.

ATM Program Raises $747.8M in Net Proceeds

The increase in cash reserves stems from sales conducted under Strategy’s at-the-market (ATM) offering program. During the period from December 15 to December 21, the company reports it sold approximately 4.54 million shares of its Class A common stock (MSTR), generating net proceeds of $747.8 million after sales commissions.

No preferred stock sales were recorded during the week, despite multiple preferred share classes remaining available for issuance.

As of December 21, Strategy reported over $41 billion in aggregate capacity remaining across its various common and preferred stock ATM programs highlighting substantial financial flexibility should the company choose to raise additional capital.

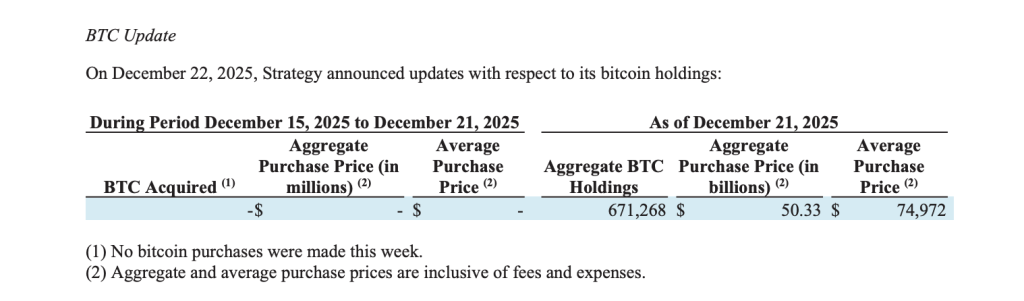

Bitcoin Holdings Remain Unchanged at 671,268 BTC

The filing shows that Strategy did not acquire any bitcoin during the reported period. Its aggregate bitcoin holdings remained steady at 671,268 BTC as of December 21, with an aggregate purchase price of approximately $50.33 billion.

The average purchase price across the company’s bitcoin holdings stood at $74,972 per bitcoin, inclusive of fees and expenses.

While the company has historically used equity and debt issuances to fund bitcoin acquisitions the absence of purchases this week suggests a pause in accumulation amid market conditions or a strategic decision to prioritize liquidity.

Liquidity Strengthens Balance Sheet Optionality

By lifting its USD reserves to $2.19 billion, Strategy strengthens its balance sheet and near-term optionality. The cash buffer provides flexibility to service obligations, manage volatility or fund future bitcoin purchases without immediate reliance on capital markets.

The filing does not specify how or when the cash will be deployed. Strategy has consistently framed capital raises as a means to support long-term bitcoin accumulation while maintaining sufficient liquidity to navigate market cycles.

Capital Markets Activity Shows Long-Term Strategy

The continued use of ATM programs shows Strategy’s willingness to actively tap equity markets to reinforce its capital structure. With no bitcoin purchases made during the week. This latest update suggests a tactical pause rather than a shift in long-term strategy.

Strategy’s expanding cash reserves alongside unchanged bitcoin holdings indicate a dual focus on balance-sheet resilience and readiness for future opportunities.

Bitcoin Slips Below $90K

Bitcoin has fallen below the $90,000 level, extending a pullback from its recent peak NEAR $120,000 as investors grapple with uncertain macroeconomic signals and uneven liquidity conditions.

As interest rates stay elevated, the cost of capital continues to weigh on speculative assets. One analyst notes that Bitcoin tends to respond to forward-looking liquidity expectations, meaning that without clear conviction around a sustained easing cycle, institutional capital is likely to remain selective or sidelined.