Bitcoin Price in 2026: Analysts See ’Mixed’ Signals - What’s Next?

Bitcoin's 2026 forecast splits the room—bulls see stratospheric highs, bears spot storm clouds gathering.

The Bull Case: Institutional Avalanche

Forget retail FOMO. The real fuel comes from pension funds and sovereign wealth managers finally diving in. They're not buying dips—they're building generational positions. Regulatory clarity acts as a green light, turning cautious capital into a torrent.

The Bear Trap: Macro Headwinds

High interest rates don't just hurt tech stocks—they suck liquidity from every risky asset. Bitcoin isn't an island. A global recession could trigger a sell-off that makes 2022 look tame. Plus, let's be honest, some 'institutional adoption' is just hedge funds playing the same old volatility game with a new toy.

The Wild Card: Tech vs. Tribe

Network upgrades boost efficiency, but the real battle is narrative. Does Bitcoin cement itself as 'digital gold,' or get outshone by smarter contracts elsewhere? The community's dogma could be its biggest strength—or its most expensive limitation.

The Bottom Line

Predicting price is a fool's errand, often dressed up in complex charts by analysts who missed the last three crashes. One thing's certain: volatility isn't going away. Buckle up.

Bitcoin Price Signals ‘Mixed’ Expectations

Cryptonews has previously noted that market sentiment shifted after the October crypto sell-off but remained mixed. Price action suggests a local downtrend, yet there is no clear dominance of bears over bulls. At the same time, bullish momentum also appears limited.

Bitcoin’s recent price action reflects these “mixed” expectations.,, told Cryptonews that a wide range of factors continues to shape Bitcoin’s performance, making market sentiment more complex and harder to interpret this year:

When looking ahead to Bitcoin in 2026, expectations across the market remain mixed and highly dependent on broader conditions rather than a single clear narrative. Some analysts anticipate that Bitcoin could revisit or exceed previous highs, mainly if institutional adoption continues, spot ETFs maintain steady inflows, and crypto becomes more integrated into traditional financial systems.

Abdul Sater notes that several scenarios remain on the table. One of them points to slower growth in 2026, reflecting broader economic conditions:

On the other hand, more conservative views suggest that Bitcoin may experience consolidation or slower growth by 2026. These scenarios assume tighter global liquidity, regulatory pressure, or reduced speculative momentum compared to earlier cycle peaks. In such cases, price expectations are notably lower and emphasize stability rather than aggressive expansion.

He also highlights the limits of cycle-based expectations, stressing that Bitcoin remains closely tied to macroeconomic conditions:

There are also downside scenarios that can’t be ignored. If macroeconomic conditions deteriorate or risk appetite weakens, Bitcoin could face prolonged corrections even several years after a halving event. This highlights how sensitive the asset remains to external factors beyond the crypto market itself.

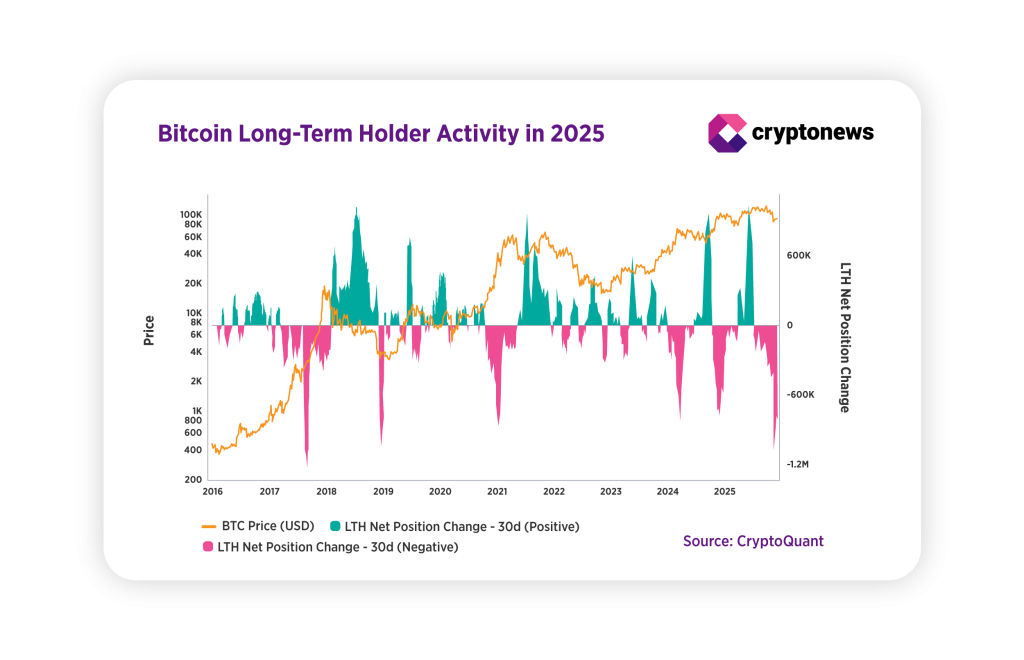

On-chain data supports the view that expectations around Bitcoin remain “mixed”. Since autumn 2025, long-term holders have stayed in net distribution. Following Bitcoin’s price drop, the LTH net position change remained predominantly negative, indicating continued reductions in holdings rather than renewed accumulation. Despite periods of price stabilization, long-term holder behavior did not return to sustained positive territory.

A ‘Soft’ Bear Market?

Analysts at CryptoQuant believe Bitcoin entered a bearish phase following the October drop. One indicator they point to is the decline in capital inflows. Earlier in the year, strong demand was driven by institutional participation, including Bitcoin ETFs and corporate Bitcoin treasuries. The U.S. presidential election also added interest in crypto. Paradoxically, these same factors now appear to be weighing on Bitcoin price and the broader market.

Bitcoin ETF holdings data shows capital outflows after October, similar to what was observed in February and March. This time, however, the picture is complicated by weak macroeconomic data and uncertainty around interest rates. The decline is visible but remains moderate. Political uncertainty has also contributed, pushing investors, including large players, toward lower-risk positioning.

,, told Cryptonews that the impact of the broader economic environment on Bitcoin became much more pronounced this year, catching many investors off guard:

Investors misjudged the market’s sensitivity to global macroeconomic factors, as crypto no longer operates outside traditional liquidity and interest rate cycles.

Whales Are Still Here

On-chain data shows a sharp increase in activity among Bitcoin wallets holding between 100 and 1,000 BTC following the October drop. During this period, one of the strongest spikes in net accumulation this year was recorded, pointing to a meaningful rise in aggregate Bitcoin holdings within this group.

This does not mean that bitcoin price is set for a rapid reversal. The market likely needs time to absorb the correction and remain in an accumulation phase. At the same time, the data does not point to capitulation. Despite declining ETF flows, metrics suggest the market has not entered a final distribution phase.

The behavior of so-called “sharks” indicates that these holders may not view current levels as the end of the cycle or may still be positioning for another growth phase.

Asr adds:

2026 is often seen as a continuation or late phase of the post-halving cycle rather than a starting point for a new one.

Conclusion

As Bitcoin moves toward 2026, the outlook remains unclear. The market is neither clearly bullish nor fully bearish, and there is still no single trend driving price action. Data, institutional flows, and investor behavior all point to a period of adjustment rather than a strong directional move.

Rather than a sharp rally or a deep downturn, Bitcoin price looks set to trade in a range. With questions over whether that range will form NEAR current levels or further down. Its performance increasingly reflects broader economic conditions and shifts in risk appetite, rather than purely crypto-specific cycles.

Asexplains:

Overall, 2026 appears to be less about explosive upside and more about how Bitcoin positions itself as a maturing asset. Outcomes range widely, and the year is likely to reflect a balance between adoption progress and global economic realities rather than a one-directional move.

Key Crypto & Macro Events to Watch in January 2026

• S&P Global Services PMI (December) – USD

• ISM Manufacturing PMI (December) – USD

• ISM Manufacturing Prices (December) – USD

• CPI (YoY) (December) – EUR

• ADP Nonfarm Employment Change (December) – USD

• ISM Non-Manufacturing PMI (December) – USD

• ISM Non-Manufacturing Prices (December) – USD

• JOLTS Job Openings (November) – USD

• Average Hourly Earnings (MoM) (December) – USD

• Nonfarm Payrolls (December) – USD

• Unemployment Rate (December) – USD

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.