Uniswap Fee Switch Vote Passes — Historic Token Burns Ignite $10 UNI Price Speculation

Uniswap's governance just flipped the switch. The long-debated fee mechanism is now active, setting the stage for the largest token burn in the protocol's history and sending shockwaves through the DeFi landscape.

The Mechanics of the Burn

This isn't a simple tweak—it's a fundamental shift in value accrual. The newly activated system redirects a portion of protocol fees away from pure liquidity provision and into a mechanism that permanently removes UNI tokens from circulation. It's a supply shock engineered by code, cutting the available float with every swap that flows through the network's pools.

A $10 Token on the Horizon?

Markets are forward-looking machines, and the calculus for UNI just changed. Analysts are scrambling to model the deflationary pressure against trading volume projections. The narrative has pivoted from a purely governance-focused asset to one with a tangible, fee-backed sink. While past performance offers no guarantees—a lesson Wall Street veterans know all too well—the new economic model bypasses traditional dilution, creating a scarcity play that has traders watching the charts.

The move reframes Uniswap's value proposition, tethering its token directly to its own economic engine. Whether this translates to a sustained march toward double digits or becomes another case of 'buy the rumor, sell the news' remains the billion-dollar question. For now, the protocol has taken a definitive step from governance experiment to economic powerhouse.

Notably, this will set the stage for changes that WOULD directly tie Uniswap’s protocol activity to the UNI token’s supply dynamics for the first time since launch.

Uniswap Vote Nears Finish With Overwhelming Support

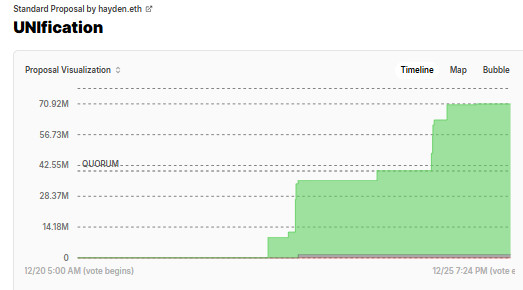

As of early Monday, more than 69 million UNI tokens had been used to vote in favor of the proposal, far above the 40 million required for approval.

Voting opened on Dec. 20 and runs through Christmas Day, though opposition has been negligible. Only around 740 votes, roughly 0.001% of those cast, were against the proposal, while about 1.5 million UNI were marked as abstentions.

More than 6,000 addresses have participated, with support hovering NEAR 100% among active voters.

Uniswap Labs CEO, Hayden Adams said once the vote formally closes, the changes will be subject to a two-day time lock before implementation.

Just submitted the Unification proposal for final governance vote

Voting starts on 12/19 at 10.30pm EST and ends on 12/25

If it passes, after a 2 day timelock period:![]() 100m UNI will be burned

100m UNI will be burned![]() v2 + v3 fee switches will flip on mainnet and begin burning UNI, along with…

v2 + v3 fee switches will flip on mainnet and begin burning UNI, along with…

![]()

The proposal also authorizes the immediate burning of 100 million UNI from the Uniswap Foundation’s treasury.

The governance package also introduces a Protocol Fee Discount Auctions system designed to improve returns for liquidity providers while aligning Uniswap Labs, the Uniswap Foundation, and on-chain governance under a single legal structure using Wyoming’s DUNA framework.

Several influential figures in decentralized finance backed the UNIfication proposal, including Variant founder Jesse Waldren, Synthetix and Infinex founder Kain Warwick, and former Uniswap Labs engineer Ian Lapham, all of whom hold substantial voting power.

Can the Fee Switch Finally Give UNI Holders a Direct Payoff?

The vote comes amid wider debate across DeFi about sustainable token economics and long-term value capture.

Many protocols have struggled to translate heavy usage into tangible benefits for token holders, a criticism that has followed Uniswap for years despite its dominant market position.

Uniswap remains the largest decentralized exchange by volume, having processed more than $4 trillion in trades since launching in 2018, yet UNI holders have historically had limited direct exposure to protocol revenue.

Supporters of the fee switch argue that tying protocol revenue more directly to UNI supply dynamics could reshape that narrative.

The market reaction has been swift. UNI has gained roughly 25% since voting began, trading near $6.08 after recovering from a month-long slump that pushed the token to a seven-month low of $4.88.

Earlier signs of the proposal in November sparked an even sharper move, with UNI climbing close to 40% in a matter of days and briefly touching $9.70 on Nov. 11 before broader market weakness set in.

Can UNI Reach $10 Before the Year End?

According to CoinGecko data, UNI is currently the 38th largest cryptocurrency by market capitalization, valued at around $3.8 billion.

From a technical perspective, UNI’s price action has drawn renewed attention as the governance process nears completion.

The token recently bounced from the lower boundary of a multi-year ascending channel that has guided its recovery since the post-2021 drawdown.

Analysts tracking the structure note that this zone has historically acted as strong demand, with each retest followed by higher reaction highs.

In the near term, UNI faces resistance around the $6.80 to $7.20 range, with heavier supply clustered closer to $9 and above.