Vitalik Buterin Declares: Prediction Markets Outperform Social Media in Uncovering Truth

Forget trending topics and viral threads. The real signal is buried in the betting slips.

Ethereum co-founder Vitalik Buterin just threw a grenade into the digital town square. His latest argument? The chaotic, opinion-saturated world of social media is getting schooled by a more primal force: prediction markets. It's not about likes or shares—it's about putting your money where your mouth is.

The Wisdom of the Wager

Prediction markets operate on a brutally simple premise. Participants buy and sell shares based on the likelihood of a future event. A 'YES' share on "Will the Fed cut rates in Q1?" trading at $0.70 implies a 70% market-assigned probability. Misinformation costs you cash. Get it right, you profit. This financial skin in the game, Buterin suggests, acts as a powerful filter for noise, cutting through the performative outrage and algorithmic echo chambers that define platforms like X.

Cash Over Clout

The mechanism bypasses the need for centralized truth arbiters. Instead of a fact-checker's label, you have a price. Collective intelligence, fueled by potential profit and loss, aggregates disparate information into a single, actionable metric. It turns speculation into a public utility. While your social feed amplifies the loudest voice, a prediction market surface quietly calculates what the smart money actually believes—often a sobering contrast to the narrative du jour. It's a hedge fund's research desk, democratized.

So, the next time you see a market pricing a political upset at 20%, but your timeline is screaming it's a certainty, maybe trust the ledger over the likes. After all, in finance, the only thing sharper than a trader's suit is their incentive to be right.

Source: Farcaster

Source: Farcaster

Truth-Seeking Versus Social Media Sensationalism

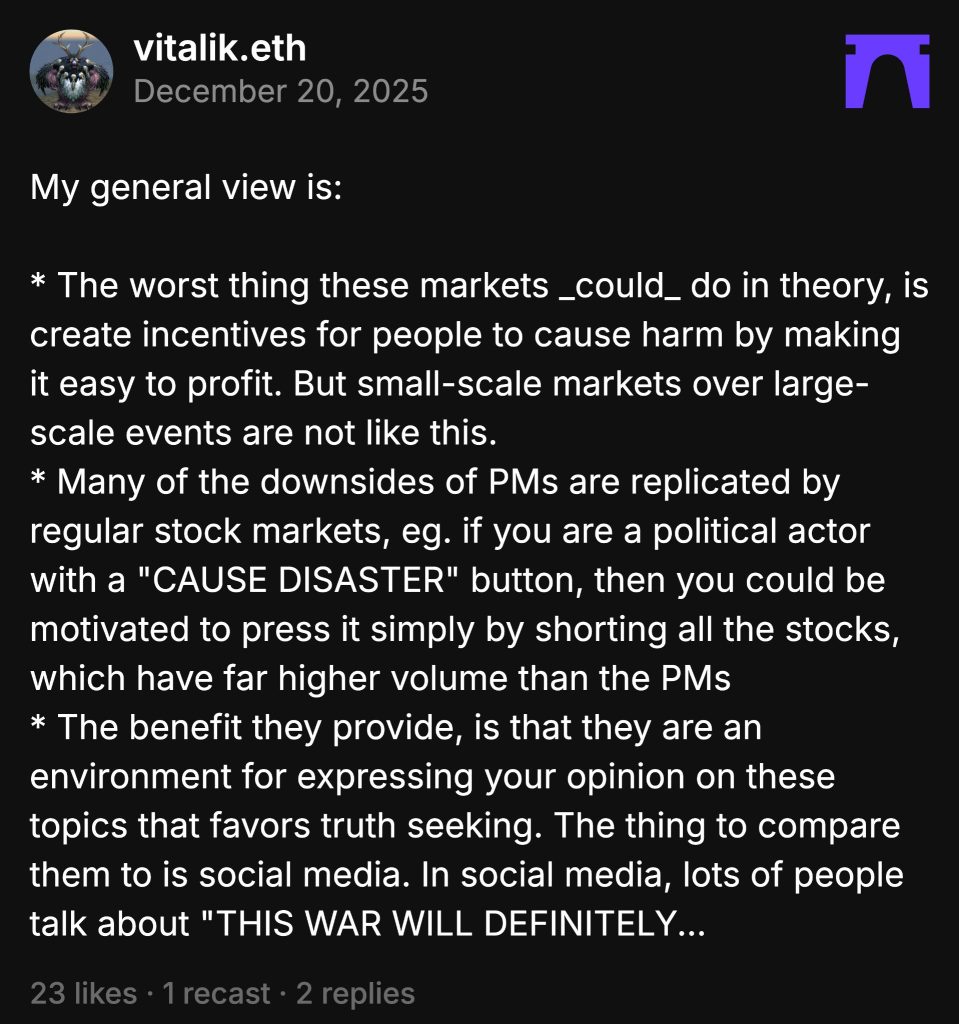

Buterin positioned prediction markets as solutions to social media’s fundamental accountability gap.

“The thing to compare them to is social media,” he wrote, explaining how platforms reward sensationalism over accuracy.

“In social media, lots of people talk about ‘THIS WAR WILL DEFINITELY HAPPEN’ and scare people, and there’s no real accountability: you gain clout in the moment (and that clout is often very monetizable clout!), and no accountability after the fact.“

He contrasted this with prediction markets where financial stakes enforce truth-seeking.

“With prediction markets, if you make a dumb bet, you lose, and the system (i) over time becomes more truth-seeking, and (ii) shows probabilities that reflect genuine uncertainty in the world much more faithfully than these other systems,” Buterin explained.

The ethereum founder shared personal experiences using prediction markets to verify alarming news.

“I can personally report a few times reading a news headline, feeling scared, then checking polymarket prices and feeling calmer – the people who have experience on that topic know what’s going on and the probability of anything unusual happening is only 4%,” he wrote.

Buterin also defended prediction markets against comparisons with financial markets.

“I actually find prediction markets to be healthier to participate in than regular markets,” he stated, explaining that “prices are bounded between 0 and 1, so they are much less dominated by reflexivity effects, ‘greater fool theory’, pump-and-dumps, etc.“

Fierce Ethical Debate Divides Industry

Buterin’s defense sparked heated exchanges with critics led by Quilibrium founder Cassie Heart, who argued that betting on deaths explains mainstream hatred toward crypto.

“I don’t know fam but if you ask me the idea of gambling on whether a bunch of people are going to die is why this industry is hated by the majority,” Heart wrote on Farcaster.

Heart escalated her criticism with provocative scenarios. “Maybe they’ll start slapping sponsor labels on missiles while we’re at it,” she suggested, adding,

“These children were slaughtered thanks to the good bidders at Polymarket and Kalshi. Thank you Coinbase!“

When Buterin presented prediction markets as information tools, Heart challenged the framing directly.

“Ok, so here’s my counter: a prediction market for whether or not someone will get killed in order to influence a prediction market result,” she posed, questioning whether Buterin accepted such outcomes.

Other commenters provided historical context supporting the use of prediction markets.

One user referenced “,” noting that the NSA under Bush and Obama ran private prediction markets in which participants acting as information gatherers outperformed CIA and NSA operatives.

“We can have moral arguments about this but the short and sweet is governments and people have been doing financializing war swaps since the Dutch East India company,” the user explained, arguing democratization simply expanded access beyond elite bankers.

Heart rejected this defense outright. “Oh good, let’s democratize making money on killing people, that’s much better,” she responded.

Rapid Mainstream Adoption Continues

Despite moral objections, prediction markets continue their explosive expansion into traditional finance.

Google Finance recently integrated live data from Polymarket and Kalshi, allowing users to query future events and view market probabilities alongside historical sentiment shifts.

Competition is also intensifying as major exchanges rush into the sector.

Just last week, Coinbase filed lawsuits against Michigan, Illinois, and Connecticut to challenge state authority over prediction markets, arguing that they fall under the exclusive jurisdiction of the CFTC ahead of its January 2026 launch with Kalshi.

![]() @Coinbase has filed lawsuits against the US states of Michigan, Illinois, and Connecticut, escalating a growing legal fight.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

@Coinbase has filed lawsuits against the US states of Michigan, Illinois, and Connecticut, escalating a growing legal fight.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

Chief Legal Officer Paul Grewal stated, “Prediction markets fall squarely under the jurisdiction of the CFTC, not any individual state gaming regulator.“

Regulatory clarity has also emerged when the CFTC granted no-action relief to Polymarket US, LedgerX, PredictIt, and Gemini Titan early this month, reducing enforcement pressure while requiring full collateralization and transparent transaction data.