Ethereum Pivots: Security Takes Priority Over Speed with 2026 Deadline

Ethereum's roadmap just got a major rewrite. The network is hitting the brakes on raw throughput to double down on its bedrock—security. The new target? A fortified, resilient core by 2026.

The New North Star

Forget chasing transaction-per-second vanity metrics. The focus has officially shifted from speed to structural integrity. This isn't a delay; it's a strategic recalibration. The core devs are betting that in the long game, an unbreakable foundation will attract more value than a fast but fragile one. After all, what good is a sports car if the brakes fail?

Building the Fortress

The next phase of development will channel resources into hardening the protocol against all conceivable threats. Think enhanced cryptographic safeguards, more robust consensus mechanisms, and battle-tested resilience against novel attack vectors. It's the digital equivalent of reinforcing the vault while others are busy polishing the front door.

The 2026 Horizon

That's the new deadline etched on the whiteboard. It sets a clear, ambitious timeline for this security-first overhaul. The move signals a maturation—a recognition that for Ethereum to become the global settlement layer, trust must be its primary feature, not an afterthought. It's a calculated play for institutional confidence, the kind that views 'move fast and break things' as a liability, not a motto.

This pivot may frustrate speculators waiting for a quick scalability fix to pump token prices, but it's a masterclass in long-term thinking. In a sector obsessed with the next quarterly hype cycle, Ethereum is quietly investing in the next decade. Sometimes the smartest trade isn't chasing the next meme coin; it's backing the network that's building the fortress everyone else will eventually need to hide in.

2026 boss: 128-bit provable security

New blog post on the next level for Ethereum zkEVMs: three milestones, paving the path to mainnet-grade L1 zkEVMs.https://t.co/mueR1JWW6c

Game on. — George Kadianakis (@asn_d6) December 19, 2025

Provable Security Becomes Non-Negotiable Standard

The foundation established 128-bit provable security as the mandatory target for mainnet-grade zkEVMs, aligning with standards recommended by cryptographic standardization bodies.

The first milestone requires zkEVM teams to integrate their proof system components with soundcalc, a newly created security estimation tool, by the end of February 2026.

By May 2026, teams must achieve 100-bit provable security with final proof sizes under 600 kilobytes while providing compact descriptions of their recursion architecture.

The final milestone requires 128-bit provable security, with proof sizes limited to 300 kilobytes, and formal security arguments for recursion soundness by year-end 2026.

George Kadianakis from the EF cryptography team emphasized the strategic timing of securing zkEVM architectures before they become moving targets.

“Once teams have hit these targets and zkVM architectures stabilize, the formal verification work we’ve been investing in can reach its full potential,” he wrote.

Recent cryptographic advances, including compact polynomial commitment schemes like WHIR, techniques such as JaggedPCS, and well-structured recursion topologies, now make these ambitious security targets achievable.

The foundation plans to publish detailed technical posts in January outlining proof system techniques for reaching the security and proof size requirements.

Foundation Expands Institutional Adoption Push

While tightening technical standards, Ethereum has simultaneously accelerated institutional outreach through its new “” portal launched in October.

The platform guides enterprises and financial institutions building on Ethereum’s infrastructure, highlighting the network’s decade-long reliability with over 1.1 million validators and continuous uptime.

The foundation emphasized privacy-preserving technologies, including zero-knowledge proofs, fully homomorphic encryption, and trusted execution environments, as essential for compliant institutional applications.

“Privacy solutions are no longer theoretical — they’re live and scaling in production,” the foundation noted, pointing to projects like Chainlink, RAILGUN, and Aztec Network.

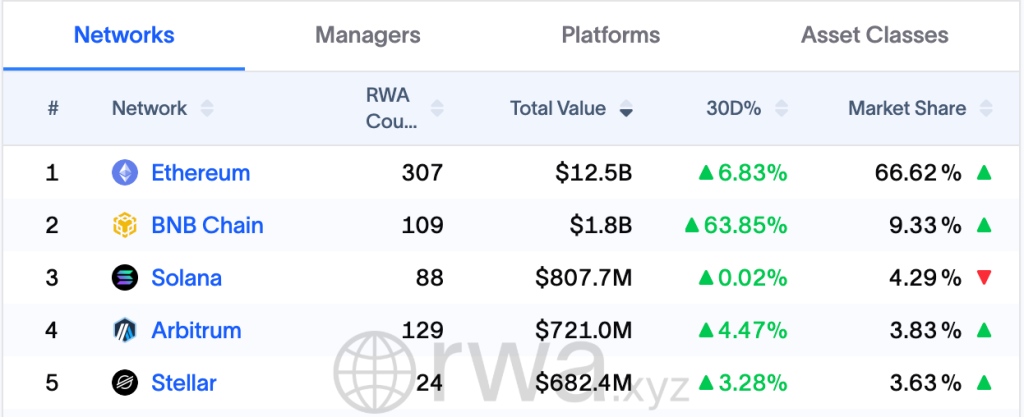

Ethereum currently hosts over 66% of all tokenized real-world assets according to RWA.xyz, with major financial firms including BlackRock, Securitize, and ONDO Finance deploying tokenized instruments.

JPMorgan Chase recently launched its first tokenized money-market fund on Ethereum, seeding the MONY fund with $100 million and opening it to qualified investors with minimum investments of $1 million through its Kinexys Digital Assets platform.

The bank’s asset management head, John Donohue, told the Wall Street Journal there is “a massive amount of interest from clients around tokenization,” adding that JPMorgan expects to lead the space with product offerings that match traditional money-market funds on the blockchain.

Simplicity Challenge Emerges as Critical Priority

A few days ago, Co-founder Vitalik Buterin identified protocol complexity as a fundamental threat to Ethereum’s trustlessness in a December 18 statement.

“An important and underrated FORM of trustlessness is increasing the number of people who can actually understand the whole protocol from top to bottom,” Buterin wrote, arguing the ecosystem should accept fewer features if necessary to improve understanding.

![]() @VitalikButerin says Ethereum’s trustlessness depends not just on decentralization, but on how many people can understand the protocol.#Ethereum #Buterinhttps://t.co/mIcGdixX8Z

@VitalikButerin says Ethereum’s trustlessness depends not just on decentralization, but on how many people can understand the protocol.#Ethereum #Buterinhttps://t.co/mIcGdixX8Z

The concern resulted from the growing tension between advanced functionality and accessibility as Ethereum’s technical abstractions multiply.

“If only five people can understand how your privacy protocol works, you haven’t achieved trustlessness, you’ve just changed who you trust,” privacy-focused layer-2 network INTMAX stated.

The foundation acknowledged these challenges in its roadmap, describing Ethereum as “” for most users while outlining plans for smart contract wallets that simplify gas fees and key management.

Meanwhile, the foundation temporarily paused open grant applications for its Ecosystem Support Program in August, citing plans to shift toward more targeted infrastructure funding after awarding nearly $3 million to 105 projects in 2024 alone.