Bitcoin Cycle Turns: CryptoQuant Warns Demand Exhaustion Signals Bear Market Shift

Bitcoin's bull run hits a wall. On-chain analytics firm CryptoQuant flags a critical shift in market dynamics, suggesting the digital gold's relentless demand surge is finally sputtering out.

The Demand Dilemma

Forget the hype. The data tells a colder story. The metrics that once screamed accumulation now whisper distribution. The relentless inflow of new capital that fueled previous rallies has tapered off, leaving price action vulnerable to a new, more cautious regime.

Cycle Mechanics in Play

Markets don't move in straight lines—they breathe in cycles of greed and fear. The current exhaustion signal isn't a prediction of doom but a recognition of phase change. It's the market digesting its gains, a necessary, if painful, recalibration before the next leg can begin. Every past cycle has weathered this transition.

Navigating the Turn

This isn't about calling a top; it's about adjusting strategy. Volatility is the price of admission in crypto, and smart money views pullbacks as a feature, not a bug. It separates the long-term builders from the short-term tourists chasing quick flips.

The bottom line? The music hasn't stopped, but the tempo has changed. While traditional finance pundits will likely use this as another 'I told you so' moment—as if their 0.5% yield bonds are the pinnacle of financial innovation—the real opportunity lies in understanding the rhythm, not fleeing the dance floor.

Demand Growth Falls Below Trend

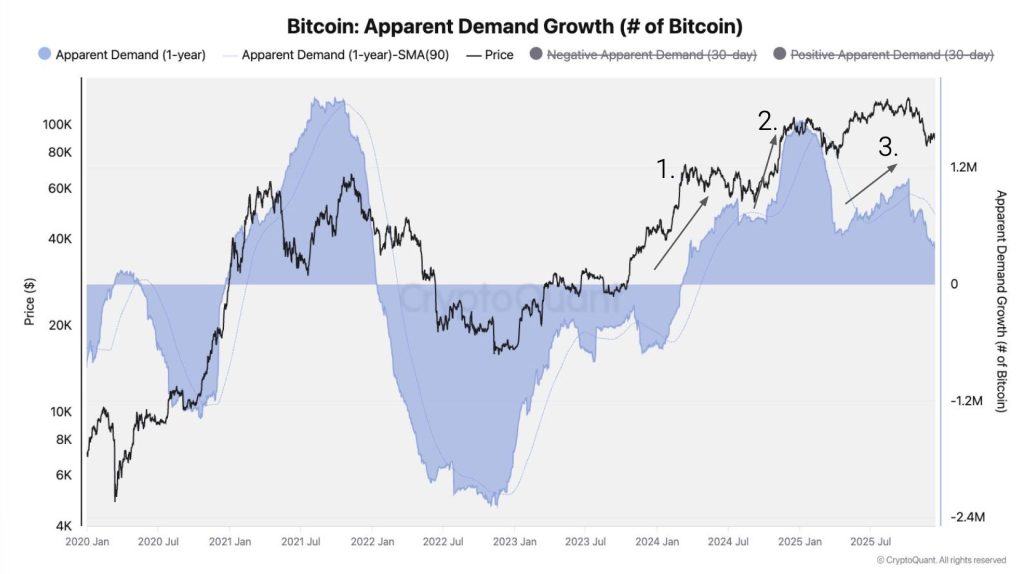

CryptoQuant’s analysis shows that Bitcoin demand growth has decisively slowed since early October 2025, falling below its long-term trend.

The current cycle featured three major spot demand waves: the launch of U.S. spot Bitcoin ETFs, Optimism surrounding the U.S. presidential election outcome, and a surge of interest from Bitcoin Treasury Companies.

With these catalysts largely priced in, incremental demand has diminished, removing a key source of price support that previously sustained upward momentum.

The firm notes that when demand growth rolls over in this manner, it has historically marked the end of bullish phases, regardless of broader narratives around supply shocks or halving events.

Institutional and Large-Holder Demand Reverses

Institutional behavior is now reinforcing the bearish signal. U.S. spot bitcoin ETFs have shifted from accumulation to distribution in the fourth quarter of 2025, with net holdings declining by approximately 24,000 BTC. This stands in stark contrast to Q4 2024, when ETFs were strong net buyers and a central driver of market strength.

At the same time, onchain data shows that addresses holding between 100 and 1,000 BTC—often associated with ETFs, funds, and corporate treasuries—are growing below historical trend.

CryptoQuant compares this pattern to late 2021, when similar demand deterioration preceded the 2022 bear market.

Derivatives Markets Signal Weakening Risk Appetite

Derivatives data adds further confirmation. Funding rates in perpetual futures, measured using a 365-day moving average, have declined to their lowest level since December 2023. Falling funding rates typically indicate reduced willingness among traders to maintain Leveraged long positions.

Historically, such conditions have been more consistent with bear market regimes than bull phases, reflecting declining risk appetite and lower conviction among market participants.

Price Structure and Downside Scenarios

From a technical perspective, Bitcoin has broken below its 365-day moving average, a key long-term indicator that has historically separated bull and bear market conditions.

CryptoQuant stresses that Bitcoin’s four-year cycle is driven primarily by demand expansions and contractions rather than the halving itself.

Despite the bearish shift, downside projections suggest a relatively shallow cycle. Past bear market bottoms have aligned with Bitcoin’s realized price, currently NEAR $56,000.

This WOULD imply a drawdown of roughly 55% from the recent all-time high—potentially the smallest bear market decline on record. Interim support is expected around the $70,000 level, offering a key zone to watch as the cycle continues to reset.