KindlyMD Bitcoin Treasury Plunges Below $1, Faces Nasdaq Delisting — Can It Survive Like MSTR?

Another Bitcoin treasury play hits the skids. KindlyMD, the healthcare firm that bet big on crypto, now watches its stock crater below the $1 mark—triggering a Nasdaq delisting warning. It's a brutal reminder that not every corporate Bitcoin strategy is MicroStrategy.

The Strategy That Wasn't

KindlyMD dove into Bitcoin, aiming to mirror the success of giants like Michael Saylor's MicroStrategy. The plan? Use the digital asset as a primary treasury reserve. But while MSTR's stock often trades as a leveraged Bitcoin ETF, KindlyMD's foray failed to ignite the same investor frenzy. The stock's relentless slide tells the story.

The $1 Rubicon

Breaching the $1 threshold isn't just a psychological blow—it's a regulatory tripwire. Nasdaq listing rules demand a minimum bid price. Falling below it for a sustained period forces the exchange's hand, issuing a compliance deficiency notice. The company now has a grace period to claw its way back up, or face removal from the big board. A delisting typically crushes liquidity and investor confidence—a death spiral for many small caps.

Survival Odds: Slim or None?

Can KindlyMD pull a MicroStrategy and rally? The paths are few and painful. A reverse stock split could technically boost the share price above $1, but it's financial cosmetics—a move often viewed as a sign of desperation by the market. Alternatively, a miraculous Bitcoin bull run could lift all boats, including its treasury's value. But betting the company's survival on crypto volatility is a strategy only a true degenerate—or a Wall Street hedge fund—could love.

The real lesson here isn't about Bitcoin's merit, but about execution and scale. MicroStrategy built a narrative, secured financing, and moved with conviction. KindlyMD, it seems, bought the dip but forgot to build the moat. In the end, the market has a cynical way of separating the visionary treasuries from the mere marketing gimmicks.

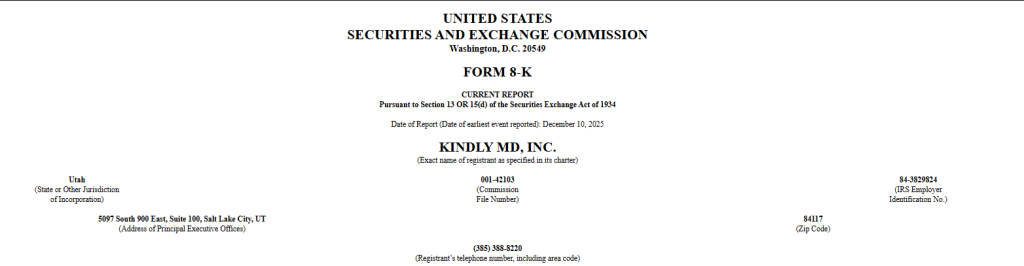

Source: SEC filing

Source: SEC filing

KindlyMD’s shares, which trade under the ticker NAKA, are currently priced at $0.38. The stock is down nearly 5% on the day, has fallen more than 30% over the past month, and is down over 73% year to date.

KindlyMD Faces June 2026 Deadline to Recover Stock Price

Under Nasdaq rules, KindlyMD has 180 calendar days, or until June 8, 2026, to regain compliance by maintaining a closing bid price of at least $1 for a minimum of 10 consecutive trading days.

KindlyMD’s current situation marks a steep reversal from earlier Optimism surrounding its Bitcoin strategy.

In May, the company merged with Nakamoto, a Bitcoin-focused public entity, in one of the first known cases of a healthcare firm formally adopting bitcoin as a core treasury asset.

![]() @KindlyMD merges with Bitcoin-native Nakamoto to launch the first-ever Bitcoin-backed healthcare company. #Bitcoin #treasury #Metaplanethttps://t.co/Gw5h56BP70

@KindlyMD merges with Bitcoin-native Nakamoto to launch the first-ever Bitcoin-backed healthcare company. #Bitcoin #treasury #Metaplanethttps://t.co/Gw5h56BP70

The combined entity retained the KindlyMD name, with Nakamoto operating as a wholly owned subsidiary, and raised more than $700 million through a mix of private placements and convertible debt to fund Bitcoin purchases.

That strategy accelerated in August, when KindlyMD acquired 5,764 Bitcoin in a single transaction, spending approximately $679 million at an average price above $118,000 per coin.

According to CoinGecko data, the company now holds Bitcoin valued at about $502.6 million, placing it around 32nd among public Bitcoin treasury holders, down from 26th three months earlier.

At current prices, the position carries an unrealized loss of roughly $176 million, or about 26%.

Bitcoin itself is trading near $87,000, up modestly on the week, but many publicly listed companies holding crypto on their balance sheets have seen their stocks fall faster than the underlying assets.

The Bitcoin Treasury Trade Isn’t One-Size-Fits-All: KindlyMD vs. Strategy

KindlyMD’s financial filings reflect the strain of its rapid transformation. In its third-quarter report, the company posted revenue of $0.4 million from its healthcare operations, while operating expenses climbed to $10.8 million, driven largely by costs tied to its Bitcoin strategy.

KindlyMD (NASDAQ: NAKA) today announced its Q3 2025 financial results.

Please review our press release for full financial details and forward-looking statements.

Press release available herehttps://t.co/QQHBZg0nGk

The company reported a net loss of $86 million for the quarter, including non-cash charges linked to the Nakamoto merger and unrealized digital asset losses.

Notably, the company said the Nasdaq’s notice has no immediate impact on its listing and that its shares will continue trading on the Nasdaq Global Market during the compliance period.

If it fails to recover, the company may seek to transfer to the Nasdaq Capital Market or pursue a reverse stock split, though it cautioned that there is no assurance either step WOULD be successful.

The situation differs from Strategy Inc., formerly MicroStrategy, which is facing uncertainty tied to index eligibility rather than exchange rules.

![]() Strategy’s spot @MicroStrategy in major indexes is now at risk, with JPMorgan warning that a removal from MSCI USA or the Nasdaq 100 could spark billions in outflows.#Strategy #CryptoStocks https://t.co/ozDjakVUm7

Strategy’s spot @MicroStrategy in major indexes is now at risk, with JPMorgan warning that a removal from MSCI USA or the Nasdaq 100 could spark billions in outflows.#Strategy #CryptoStocks https://t.co/ozDjakVUm7

MSCI began reviewing its index methodology in October 2025, triggering a sharp sell-off in MSTR shares.

The company has formally submitted its 12-page letter to MSCI opposing the proposal.

While the stock later stabilized after retaining its Nasdaq 100 position, the risk remains, with a delisting potentially triggering billions in forced passive fund sales.

MSCI is expected to issue a final decision in January 2026.

Notably, across the market, digital asset treasury stocks have broadly underperformed their underlying holdings in recent months.

Data shows that in November, inflows into DATS were only $1.32 billion in inflows, their lowest level of the year, showing a cooling of investor appetite as volatility and regulatory uncertainty persist.