Solana Price Prediction: Why Institutional ETF Flows Have Stalled – And the Single Catalyst That Could Reignite Them

Institutional money for Solana spot ETFs just hit a wall. The faucet's turned off, leaving traders asking one question: what's the missing spark?

The Waiting Game

Funds aren't flowing. The big players—the hedge funds and asset managers—are parked on the sidelines. They've got capital ready to deploy, but they're not pulling the trigger. It's a classic standoff between hype and hard conviction.

The Catalyst They're Watching

Forget minor protocol upgrades or partnership announcements. Institutions operate on a different signal. They're waiting for one thing: undeniable, network-level utility that translates directly to revenue and user growth metrics they can model in a spreadsheet. They need to see Solana not just as a faster blockchain, but as the unavoidable settlement layer for a new asset class. Until that narrative clicks from 'promising' to 'profitable,' the checkbooks stay closed. It's the same old finance dance—demanding a ten-page report to justify what retail figured out with a meme.

The next major move in SOL's price won't come from another influencer tweet. It hinges on a fundamental shift that makes the institutional risk-reward calculus impossible to ignore. The market's holding its breath.

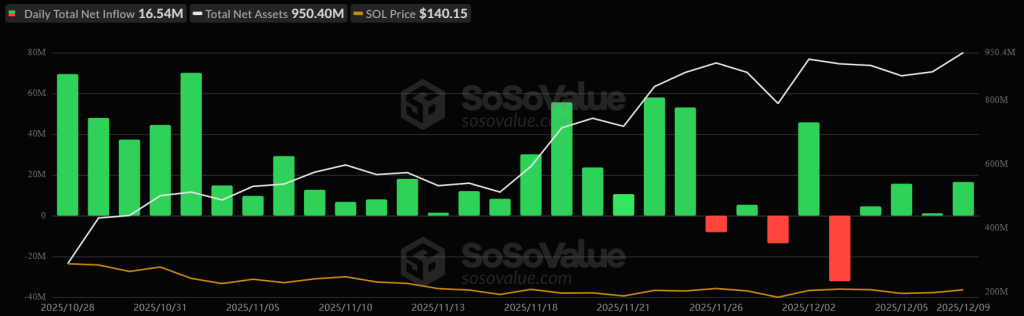

U.S. spot SOL ETF netflow. Source: SoSoValue.

U.S. spot SOL ETF netflow. Source: SoSoValue.

Market participants are pricing in a 50 basis point rate cut this month, with the potential to stimulate demand for risk assets like cryptocurrencies.

Macro data like better-than-expected inflation and 11 of the 12 FOMC members supporting a December ease have odds locked at 89%.

![]() BREAKING

BREAKING

FED MEMBERS ARE EXPECTED TO GO FOR A 50BPS RATE CUT TOMORROW AT FOMC MEETING.

ODDS ARE NOW 89.4%.

ALL EYES ON CRYPTO!![]() pic.twitter.com/n6RvAa5FR3

pic.twitter.com/n6RvAa5FR3

And solana is a standout beneficiary as the proven institutional play of choice after a 22-day inflow streak during crypto’s second-worst month of the year. TradFi markets bought the dip on SOL as most other ETF offerings bled.

Solana Price Prediction: Are Institutions About to Spark a Rally?

A 50 basis point rate cut could give Solana the fuel it needs to fully realise a double bottom pattern, now approaching its breakout threshold.

The $145 level is the last barrier to the strong reversal structure, and momentum indicators continue to reflect building buy pressure.

The RSI is building pressure towards a bullish shift with continued higher lows and rejections from the 50 neutral line. The MACD also continues to maintain a wide lead above the signal line, suggesting that an uptrend with real staying power has taken root.

The double bottom, setting up a retest of a year-long descending-triangle and a potential breakout scenario targeting levels near.

And with dovish speech from Fed Chair Jerome Powell, further interest rate cuts could be expected going into 2026. Solana could have the fuel for a much greater.

Still, a curveball interest rate hold could trigger a rejection at $145, putting the triangle and double bottom lower support at $120 back under pressure.

New Crypto Project is Bringing Solana’s Tech to Bitcoin

Bitcoin Hyper ($HYPER) merges Bitcoin’s unmatched security with Solana’s lightning-fast speed, creating a powerful new Layer 2 network that brings smart contracts, DeFi, and real utility to the Bitcoin ecosystem.

With over $30 million already raised in presale, the project is gaining serious momentum.

Once live, even a small slice of Bitcoin’s enormous trading activity flowing into Hyper’s ecosystem could drive massive upside for $HYPER.

The project is built around the Hyper Bridge, which lets BTC holders safely MOVE funds onto the Hyper L2.

Once transferred, users instantly receive a 1:1 amount on the L2 network with near-instant finality.

This opens the door to a fast-growing ecosystem where BTC users can finally access staking, payments, and high-yield opportunities.

To buy $HYPER before it lists on exchanges, visit the official HYPER website and connect a crypto wallet (such as Best Wallet).

You can swap existing crypto or use a bank card to make your purchase in seconds.

Visit the Official Website Here